Question

You believe that stocks are overvalued so you elect to add bonds to your retirement plan to reduce future potential downside price risk. With

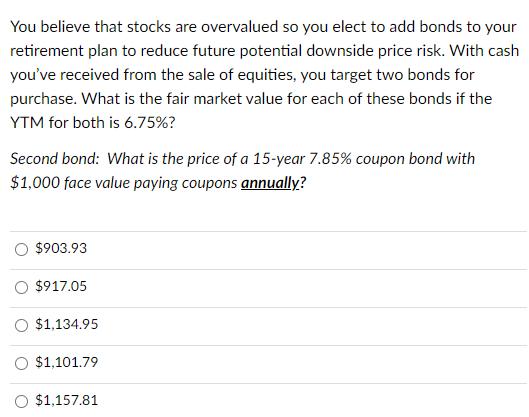

You believe that stocks are overvalued so you elect to add bonds to your retirement plan to reduce future potential downside price risk. With cash you've received from the sale of equities, you target two bonds for purchase. What is the fair market value for each of these bonds if the YTM for both is 6.75%? Second bond: What is the price of a 15-year 7.85% coupon bond with $1,000 face value paying coupons annually? $903.93 $917.05 $1,134.95 O $1,101.79 $1,157.81

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

fair value i6752 What is Price is Price of 15 ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App