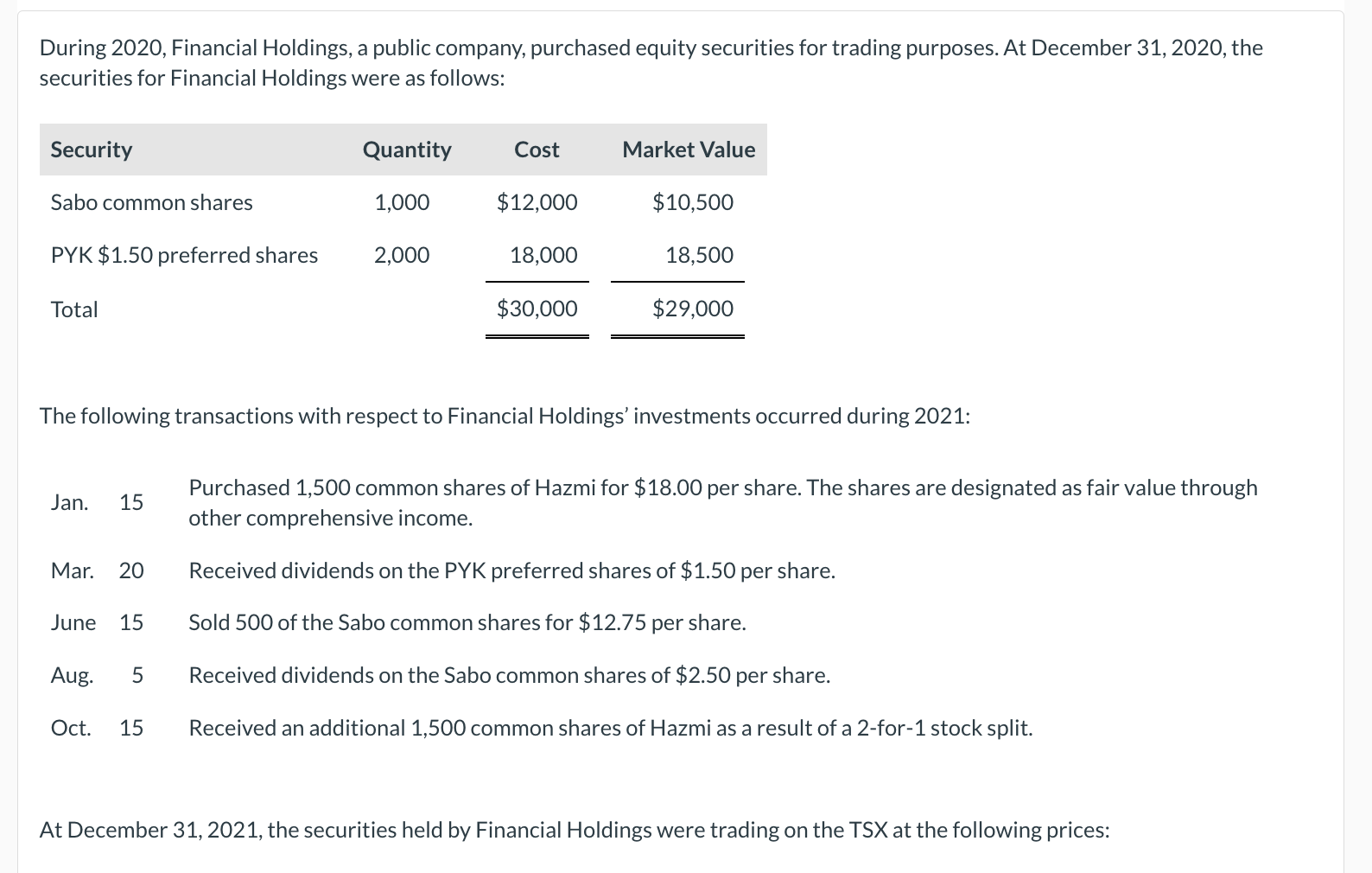

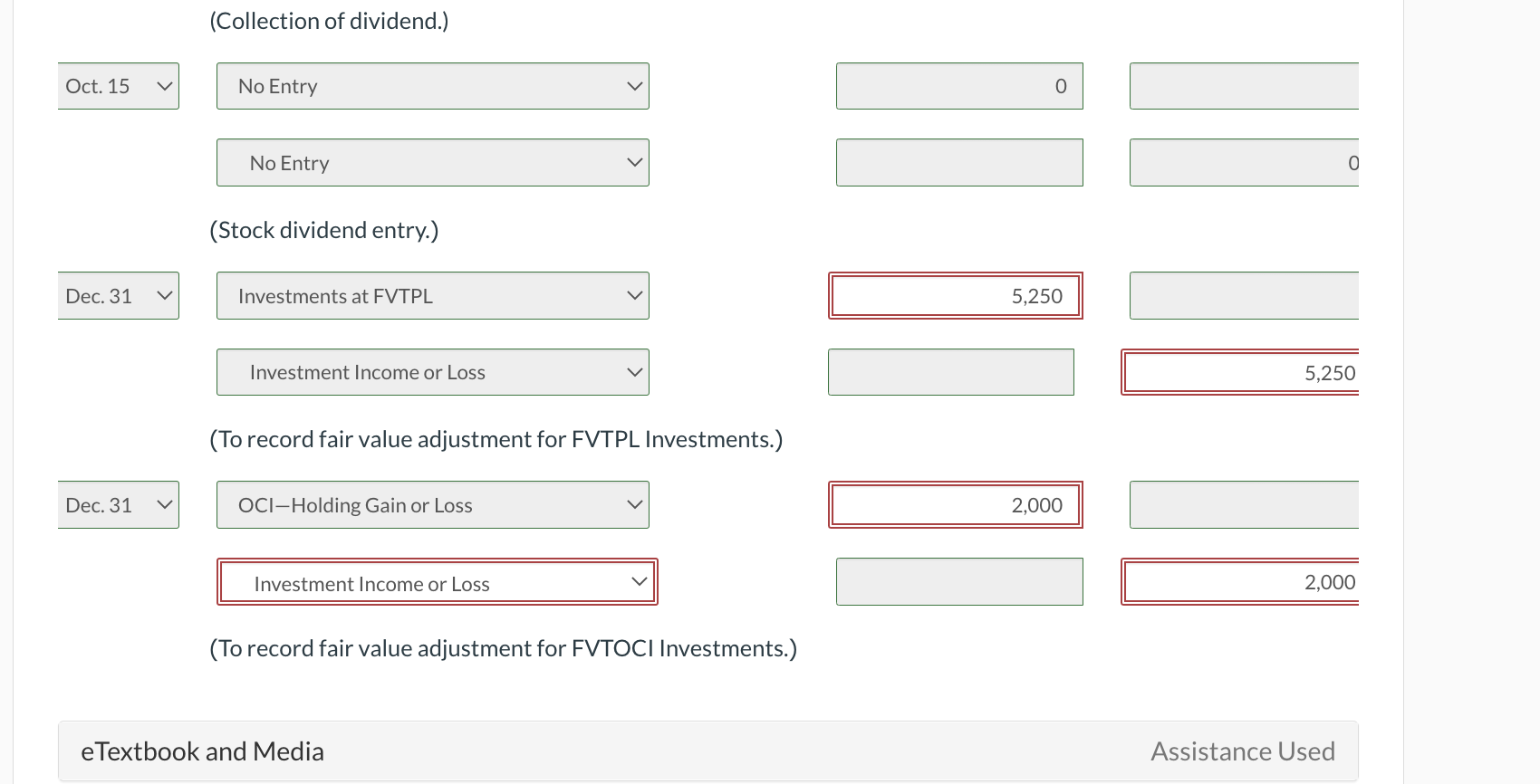

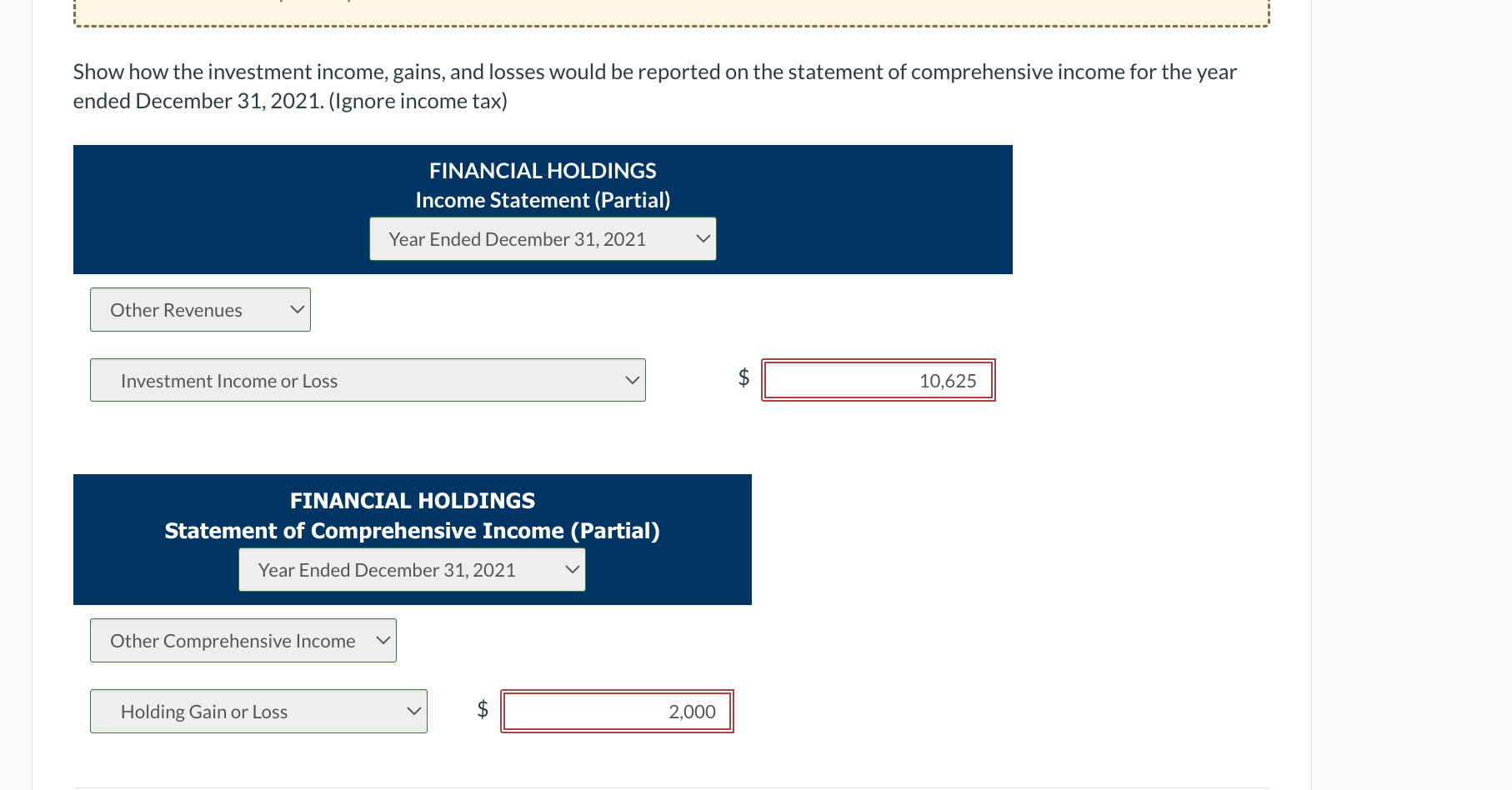

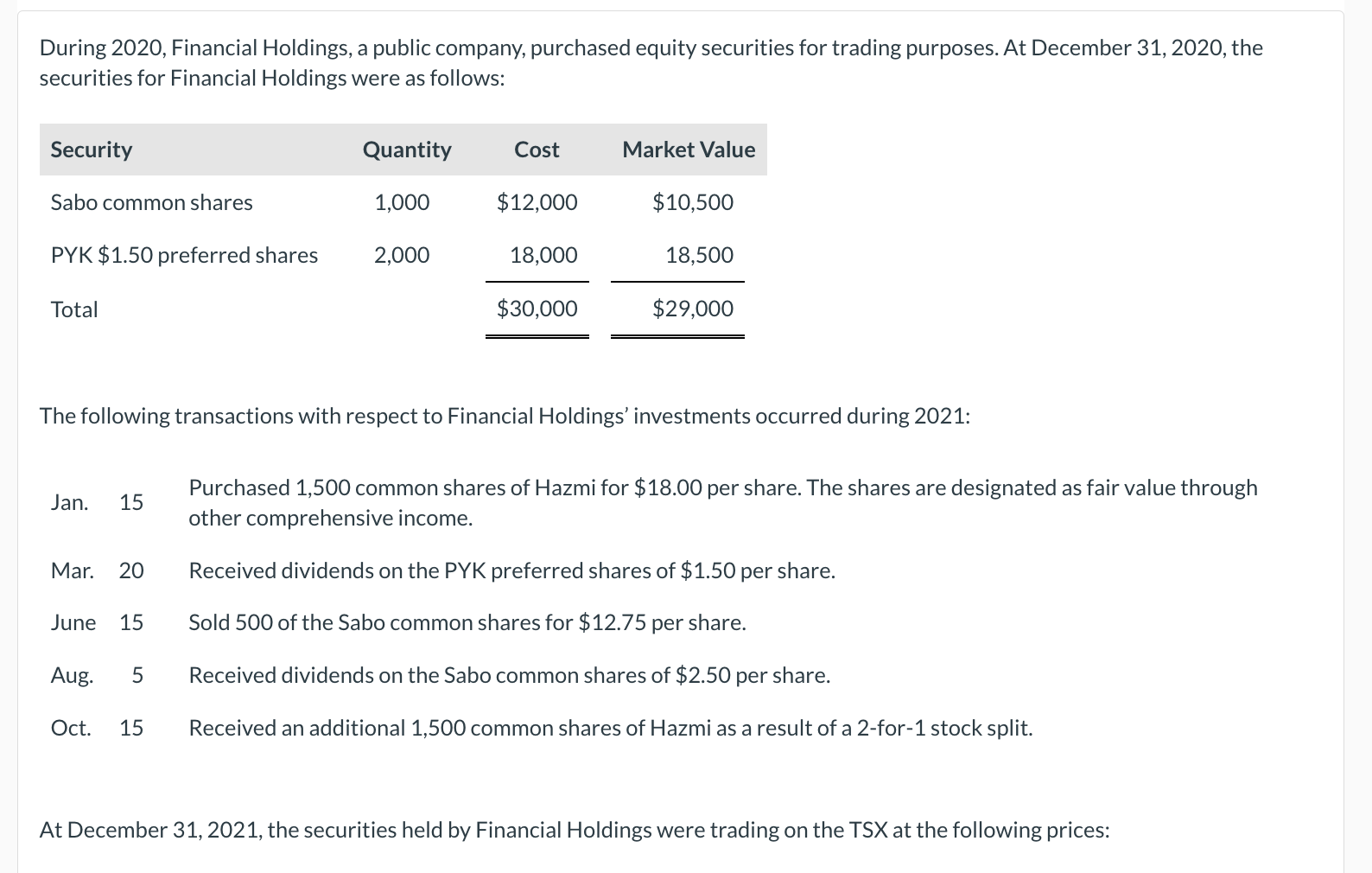

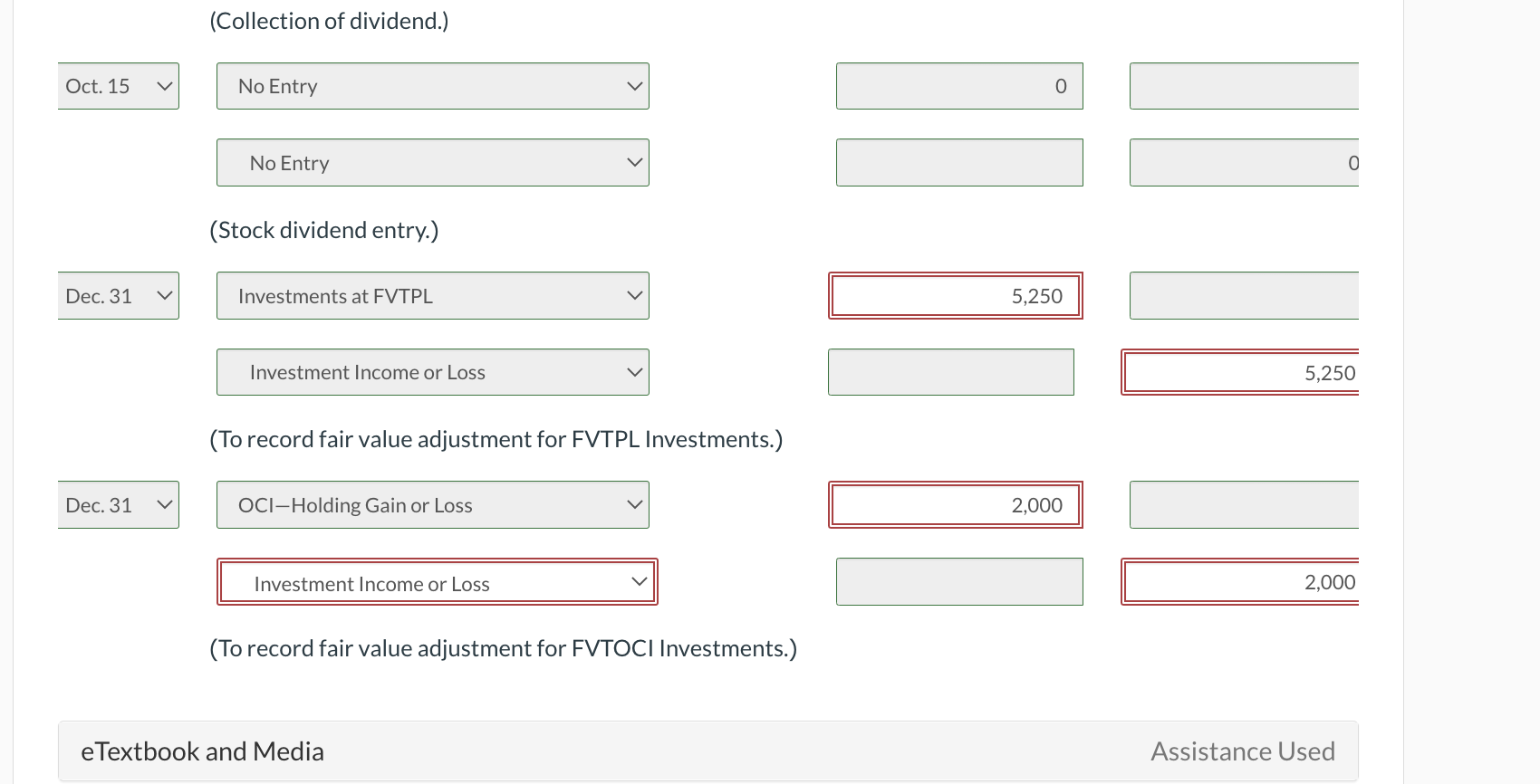

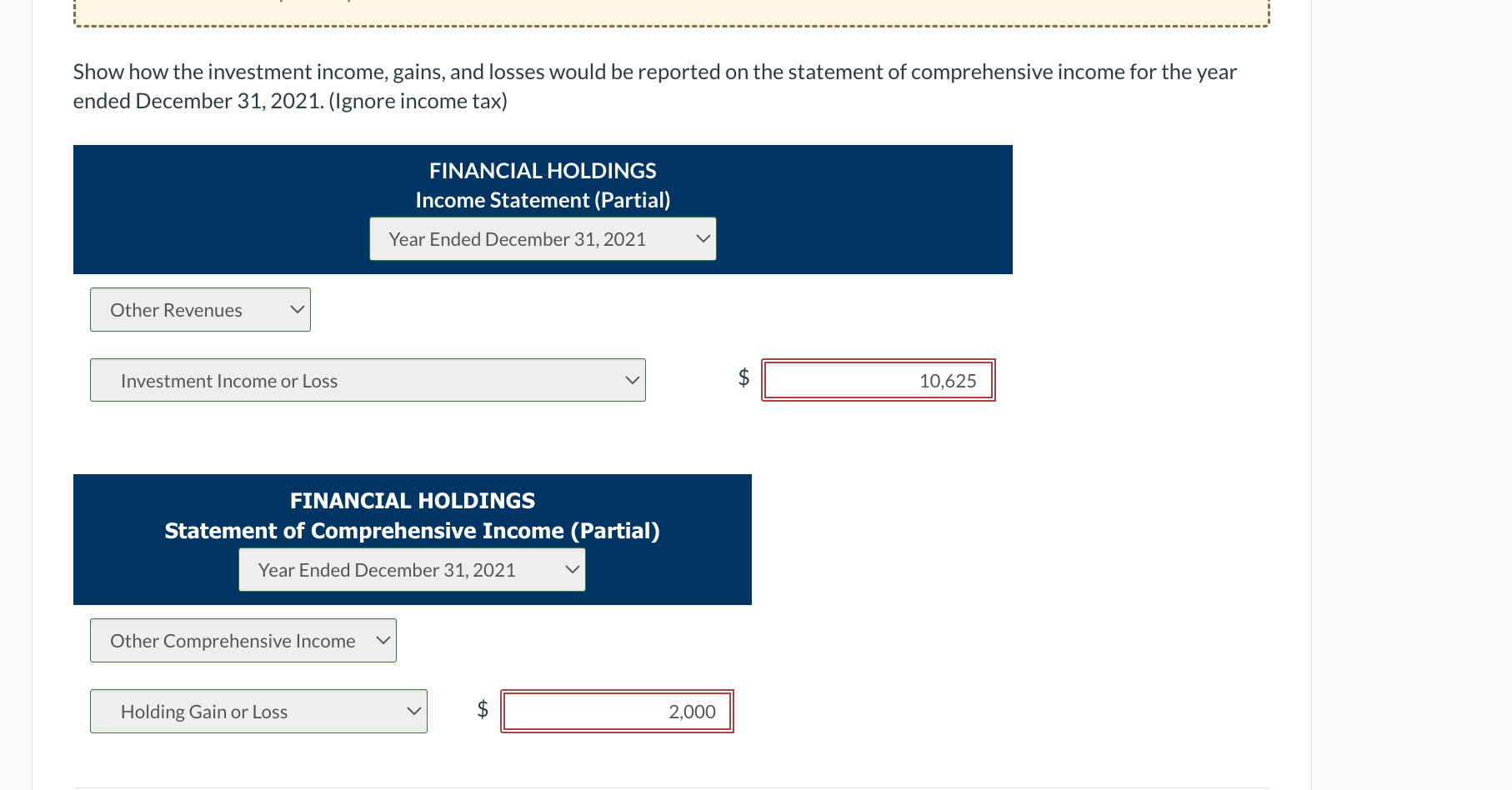

During 2020, Financial Holdings, a public company, purchased equity securities for trading purposes. At December 31, 2020, the securities for Financial Holdings were as follows: Security Quantity Cost Market Value Sabo common shares 1,000 $12,000 $10,500 PYK $1.50 preferred shares 2,000 18,000 18,500 Total $30,000 $29,000 The following transactions with respect to Financial Holdings' investments occurred during 2021: Jan. 15 Purchased 1,500 common shares of Hazmi for $18.00 per share. The shares are designated as fair value through other comprehensive income. Mar. 20 Received dividends on the PYK preferred shares of $1.50 per share. June 15 Sold 500 of the Sabo common shares for $12.75 per share. Aug. 5 Received dividends on the Sabo common shares of $2.50 per share. Oct. 15 Received an additional 1,500 common shares of Hazmi as a result of a 2-for-1 stock split. At December 31, 2021, the securities held by Financial Holdings were trading on the TSX at the following prices: (Collection of dividend.) Oct. 15 No Entry 0 No Entry 0 (Stock dividend entry.) Dec. 31 V Investments at FVTPL 5,250 Investment Income or Loss 5,250 (To record fair value adjustment for FVTPL Investments.) Dec. 31 OCI-Holding Gain or Loss 2,000 Investment Income or Loss 2,000 (To record fair value adjustment for FVTOCI Investments.) e Textbook and Media Assistance Used Show how the investment income, gains, and losses would be reported on the statement of comprehensive income for the year ended December 31, 2021. (Ignore income tax) FINANCIAL HOLDINGS Income Statement (Partial) Year Ended December 31, 2021 Other Revenues Investment Income or Loss 10,625 FINANCIAL HOLDINGS Statement of Comprehensive Income (Partial) Year Ended December 31, 2021 Other Comprehensive Income Holding Gain or Loss $ 2,000 During 2020, Financial Holdings, a public company, purchased equity securities for trading purposes. At December 31, 2020, the securities for Financial Holdings were as follows: Security Quantity Cost Market Value Sabo common shares 1,000 $12,000 $10,500 PYK $1.50 preferred shares 2,000 18,000 18,500 Total $30,000 $29,000 The following transactions with respect to Financial Holdings' investments occurred during 2021: Jan. 15 Purchased 1,500 common shares of Hazmi for $18.00 per share. The shares are designated as fair value through other comprehensive income. Mar. 20 Received dividends on the PYK preferred shares of $1.50 per share. June 15 Sold 500 of the Sabo common shares for $12.75 per share. Aug. 5 Received dividends on the Sabo common shares of $2.50 per share. Oct. 15 Received an additional 1,500 common shares of Hazmi as a result of a 2-for-1 stock split. At December 31, 2021, the securities held by Financial Holdings were trading on the TSX at the following prices: (Collection of dividend.) Oct. 15 No Entry 0 No Entry 0 (Stock dividend entry.) Dec. 31 V Investments at FVTPL 5,250 Investment Income or Loss 5,250 (To record fair value adjustment for FVTPL Investments.) Dec. 31 OCI-Holding Gain or Loss 2,000 Investment Income or Loss 2,000 (To record fair value adjustment for FVTOCI Investments.) e Textbook and Media Assistance Used Show how the investment income, gains, and losses would be reported on the statement of comprehensive income for the year ended December 31, 2021. (Ignore income tax) FINANCIAL HOLDINGS Income Statement (Partial) Year Ended December 31, 2021 Other Revenues Investment Income or Loss 10,625 FINANCIAL HOLDINGS Statement of Comprehensive Income (Partial) Year Ended December 31, 2021 Other Comprehensive Income Holding Gain or Loss $ 2,000