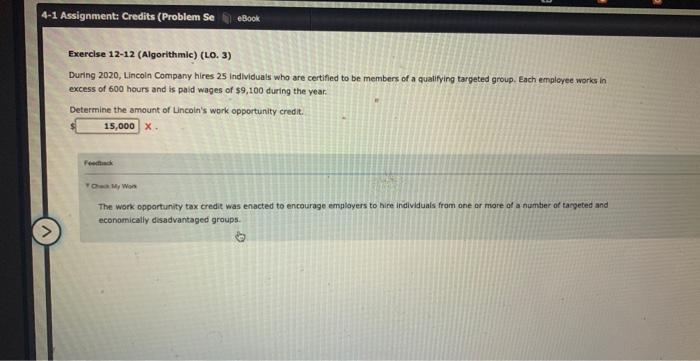

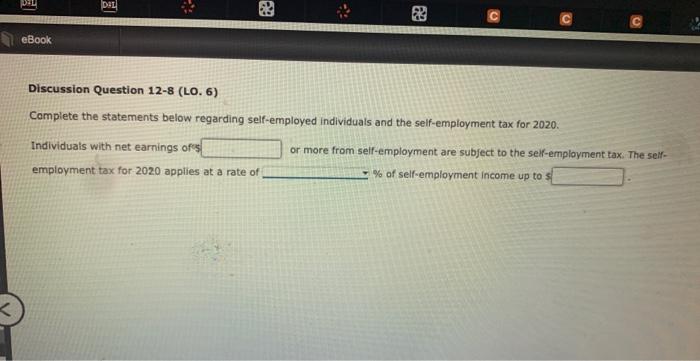

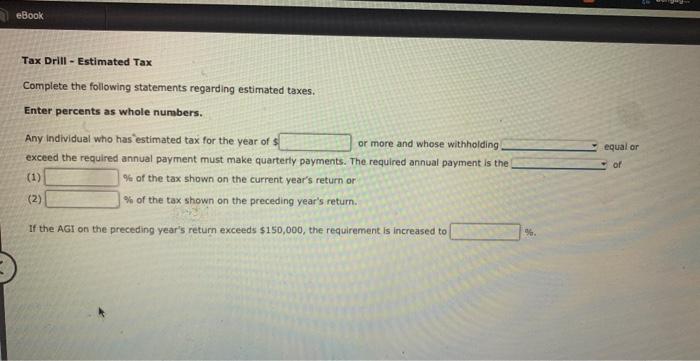

During 2020, Lincoln Company hires 25 individuals who are certified to be members of a qualifying targeted group, Each empleyee works in excess of 600 hours and is paid wages of $9,100 during the year. Determine the amount of Lincoin's wark opportunity credit. x Towar wos The work opportunity tax credit was enacted to encourage employers to hire inilividuals from one or more af a number of targeted and economically disadvantaged groups. Paola and Isadora Shaw are married, file a joint tax return, and have one dependent child, Dante. The Shaws report modifled AGi of $138,155. The couple paid $8,760 of tultion and $5,970 for room and board for Dante, a full-time first-year student at Serene Callege and claimed as a dependent by Paola and Isidora. Determine the amount of the Shaws' American Opportunity credit for the year. Santiago and Amy are mamied and file a joint tax return. They have three children, ages 7, 14, and 18. All parties are U.S. citizens. Their AGI is $252,800. Santiago and Amy's child tax credit for 2020 is \$ and dependent tax credit is 1 Tax Drill - Credit for Child and Dependent Care Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care expenses. Click here to access the percentage chart to us for this problem. Ivanna and Sergio's credit for child and dependent care expenses is $ Discussion Question 12-8 (LO. 6) Complete the statements below regarding self-employed individuals and the self-employment tax for 2020. Individuals with net earnings ofos or more from self-employment are subject to the self-employment tax. The selfemployment tax for 2020 applies at a rate of % of self-employment income up to s Tax Drill - Estimated Tax Complete the following statements regarding estimated taxes. Enter percents as whole numbers. Any individual who has iestimated tax for the year of $ or more and whose withholding equal or exceed the required annual payment must make quarterly payments. The required annual payment is the (1) \% of the tax shown on the current year's return or (2) \% of the tax shown on the preceding year's return. If the AGI on the preceding year's return exceeds $150,000, the requirement is increased to