Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2020, Rafael Corp. produced 30,000 units and sold 30,000 for $16 per unit. Suppose the accountant for Rafael Corp. uses normal costing and uses

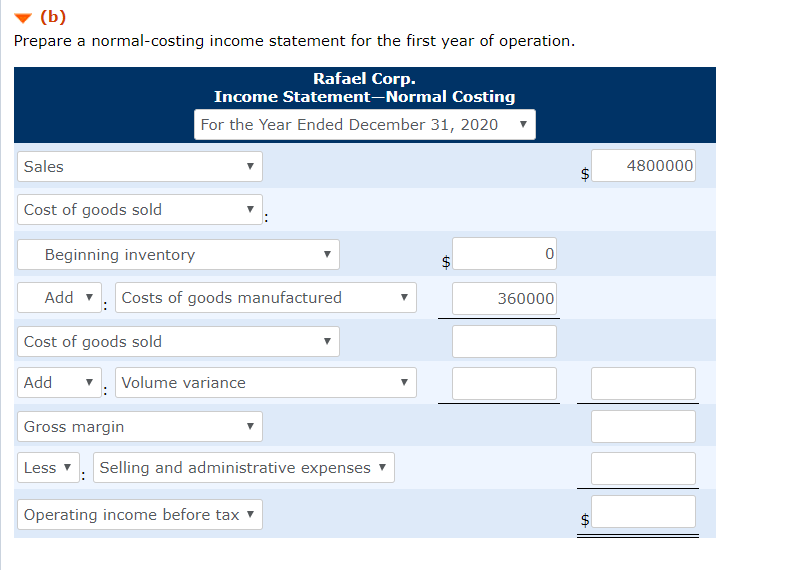

During 2020, Rafael Corp. produced 30,000 units and sold 30,000 for $16 per unit. Suppose the accountant for Rafael Corp. uses normal costing and uses the budgeted volume of 50,000 units. Variable manufacturing costs were $7 per unit. Annual fixed manufacturing overhead was $60,000 ($3 per unit). Variable selling and administrative costs were $2 per unit sold, and fixed selling and administrative expenses were $40,000. The company expenses production volume variance to cost of goods sold in the accounting period in which it occurs.

(b) Prepare a normal-costing income statement for the first year of operation. Rafael Corp. Income Statement-Normal Costing For the Year Ended December 31, 2020 Sales $ 4800000 Cost of goods sold Beginning inventory 0 $ Add Costs of goods manufactured 360000 Cost of goods sold Add Volume variance Gross margin Less Selling and administrative expenses Operating income before tax $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started