Answered step by step

Verified Expert Solution

Question

1 Approved Answer

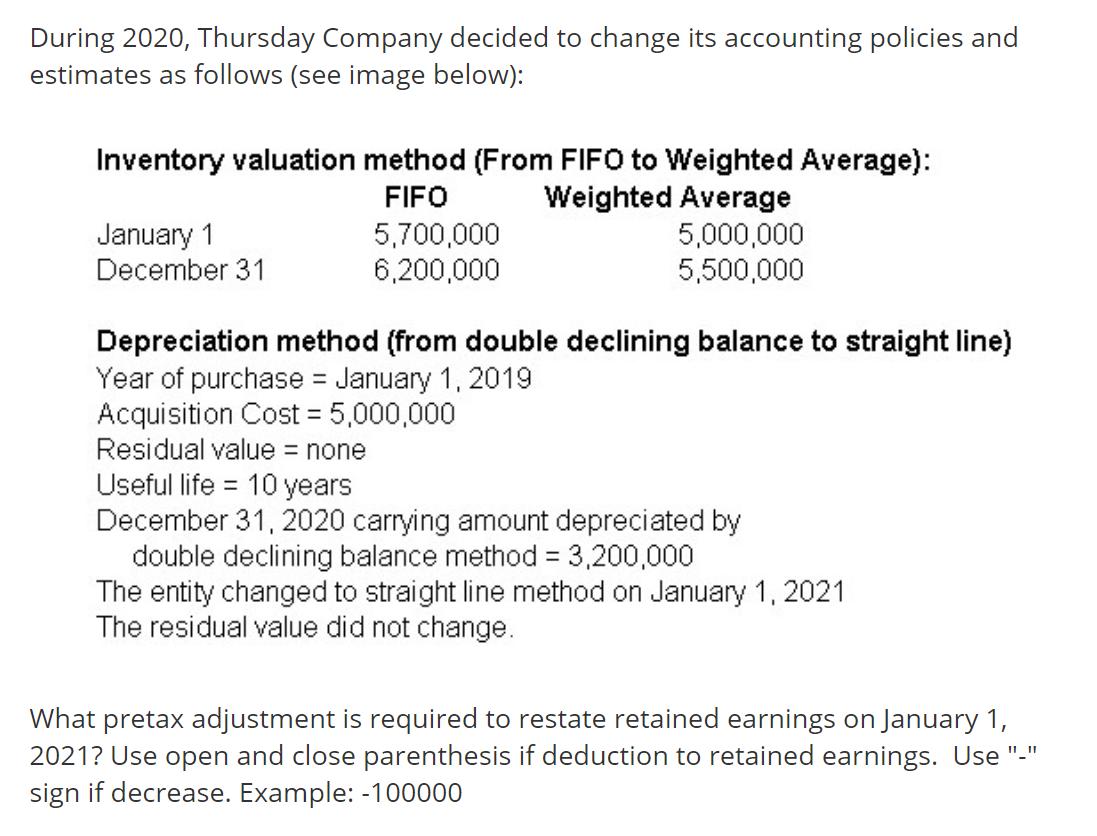

During 2020, Thursday Company decided to change its accounting policies and estimates as follows (see image below): Inventory valuation method (From FIFO to Weighted

During 2020, Thursday Company decided to change its accounting policies and estimates as follows (see image below): Inventory valuation method (From FIFO to Weighted Average): January 1 December 31 FIFO 5,700,000 6,200,000 Weighted Average 5,000,000 5,500,000 Depreciation method (from double declining balance to straight line) Year of purchase = January 1, 2019 Acquisition Cost = 5,000,000 Residual value = none Useful life 10 years = December 31, 2020 carrying amount depreciated by double declining balance method = 3,200,000 The entity changed to straight line method on January 1, 2021 The residual value did not change. What pretax adjustment is required to restate retained earnings on January 1, 2021? Use open and close parenthesis if deduction to retained earnings. Use "-" sign if decrease. Example: -100000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the pretax adjustment required to restate retained earnings on January 1 2021 we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started