Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2021, Ellen Evans, made cash contributions, as listed below. Cash contribution to her church Cash contribution to the government of the of Virginia

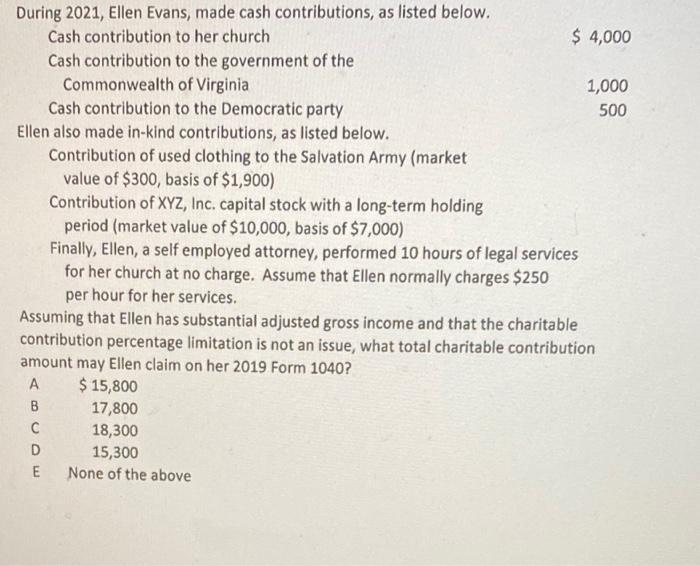

During 2021, Ellen Evans, made cash contributions, as listed below. Cash contribution to her church Cash contribution to the government of the of Virginia Commonwealth Cash contribution to the Democratic party Ellen also made in-kind contributions, as listed below. $ 4,000 Contribution of used clothing to the Salvation Army (market value of $300, basis of $1,900) Contribution of XYZ, Inc. capital stock with a long-term holding period (market value of $10,000, basis of $7,000) Finally, Ellen, a self employed attorney, performed 10 hours of legal services for her church at no charge. Assume that Ellen normally charges $250 per hour for her services. 18,300 15,300 None of the above 1,000 500 Assuming that Ellen has substantial adjusted gross income and that the charitable contribution percentage limitation is not an issue, what total charitable contribution amount may Ellen claim on her 2019 Form 1040? A $ 15,800 B 17,800 C D E

Step by Step Solution

★★★★★

3.61 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer B 17800 Ellen may claim a total charitable contribution amount of 17800 on her 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started