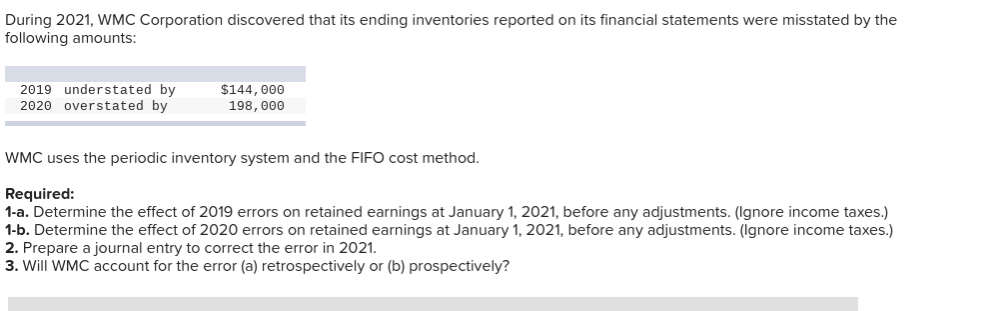

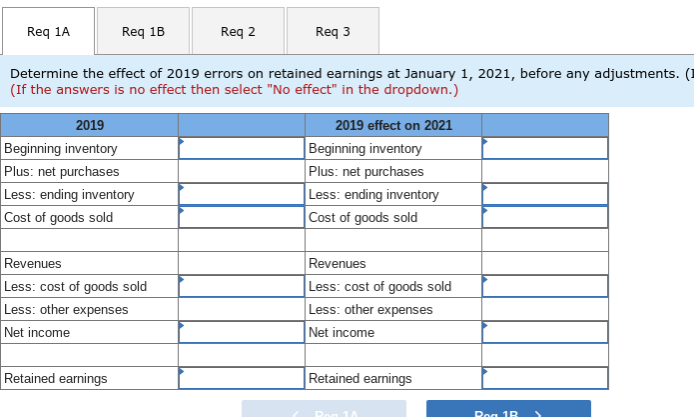

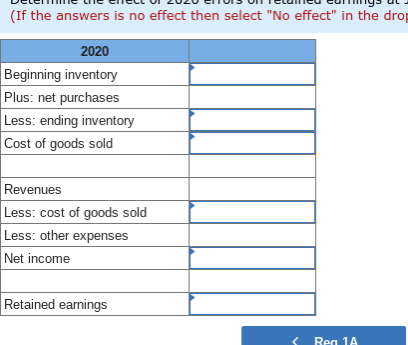

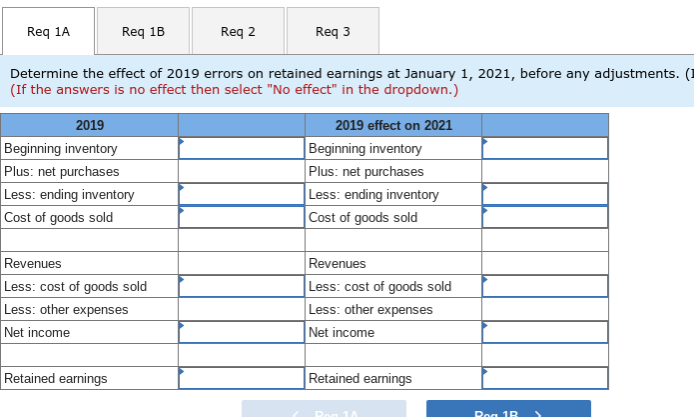

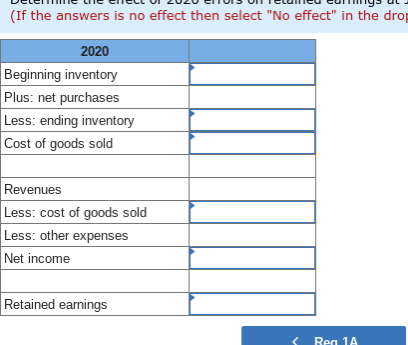

During 2021, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: 2019 understated by 2020 overstated by $144,000 198,000 WMC uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2019 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2020 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2021. 3. Will WMC account for the error (a) retrospectively or (b) prospectively? Req 1A Req 1B Reg 2 Req3 Determine the effect of 2019 errors on retained earnings at January 1, 2021, before any adjustments. (1 (If the answers is no effect then select "No effect" in the dropdown.) 2019 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold 2019 effect on 2021 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income Revenues Less: cost of goods sold Less: other expenses Net income Retained earnings Retained earnings VELCIEC CIRCU VE 020 CIUIS UNIeluneu currys UL. (If the answers is no effect then select "No effect" in the drop 2020 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income Retained earnings During 2021, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: 2019 understated by 2020 overstated by $144,000 198,000 WMC uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2019 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2020 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2021. 3. Will WMC account for the error (a) retrospectively or (b) prospectively? Req 1A Req 1B Reg 2 Req3 Determine the effect of 2019 errors on retained earnings at January 1, 2021, before any adjustments. (1 (If the answers is no effect then select "No effect" in the dropdown.) 2019 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold 2019 effect on 2021 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income Revenues Less: cost of goods sold Less: other expenses Net income Retained earnings Retained earnings VELCIEC CIRCU VE 020 CIUIS UNIeluneu currys UL. (If the answers is no effect then select "No effect" in the drop 2020 Beginning inventory Plus: net purchases Less: ending inventory Cost of goods sold Revenues Less: cost of goods sold Less: other expenses Net income Retained earnings