Question

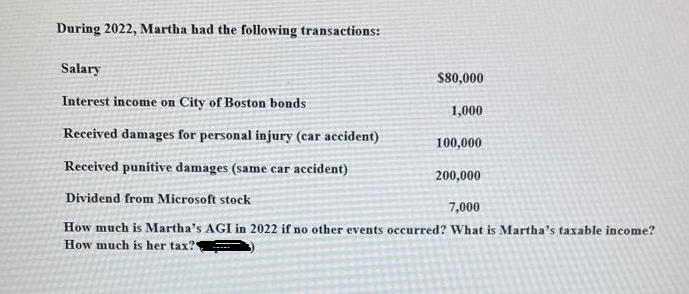

During 2022, Martha had the following transactions: Salary Interest income on City of Boston bonds Received damages for personal injury (car accident) Received punitive

During 2022, Martha had the following transactions: Salary Interest income on City of Boston bonds Received damages for personal injury (car accident) Received punitive damages (same car accident) Dividend from Microsoft stock 7,000 How much is Martha's AGI in 2022 if no other events occurred? What is Martha's taxable income? How much is her tax? $80,000 1,000 100,000 200,000

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Marthas AGI Adjusted Gross Income for 2022 can be calculated by summing up her salary interest incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App