During 2023, Dr. Smith collected $100,000 from her patients. At December 31, 2022 Dr. Smith had accounts receivable of $20,000 and no liability for

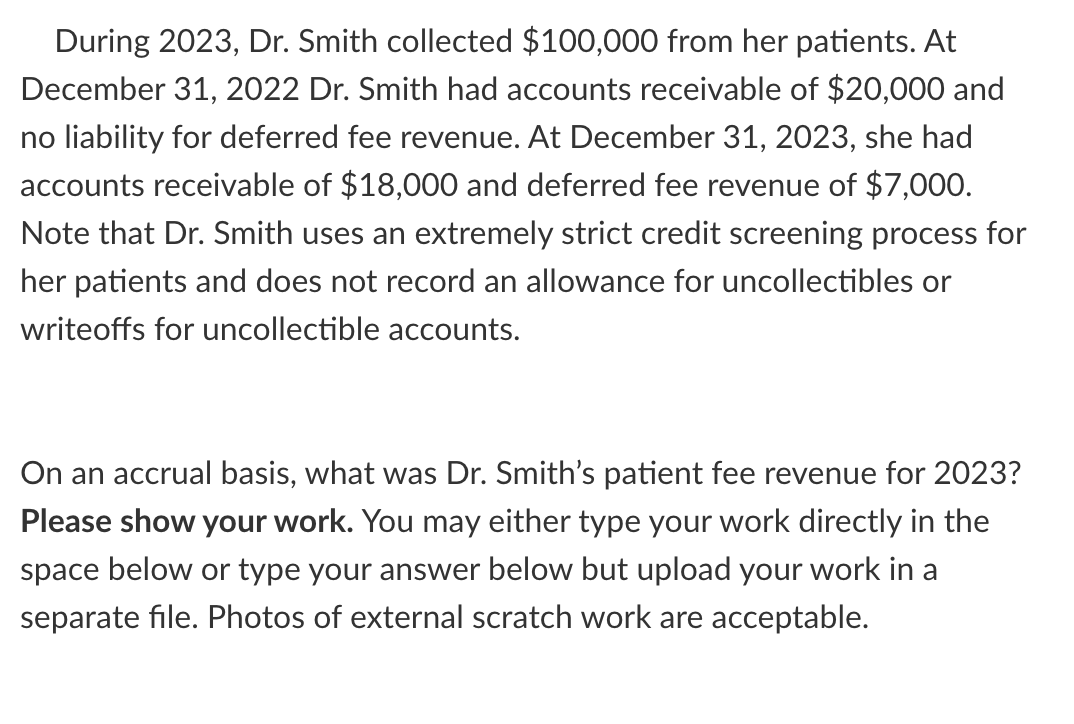

During 2023, Dr. Smith collected $100,000 from her patients. At December 31, 2022 Dr. Smith had accounts receivable of $20,000 and no liability for deferred fee revenue. At December 31, 2023, she had accounts receivable of $18,000 and deferred fee revenue of $7,000. Note that Dr. Smith uses an extremely strict credit screening process for her patients and does not record an allowance for uncollectibles or writeoffs for uncollectible accounts. On an accrual basis, what was Dr. Smith's patient fee revenue for 2023? Please show your work. You may either type your work directly in the space below or type your answer below but upload your work in a separate file. Photos of external scratch work are acceptable.

Step by Step Solution

3.50 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Dr Smiths patient fee revenue for 2023 on an accrual basis we need to consider both the cash received during the year and the change in a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started