Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2023, Paul Crawford, a 40-year-old single taxpayer, who is a professor at BMCC, reports the following items to his tax preparer: Salary 150,000

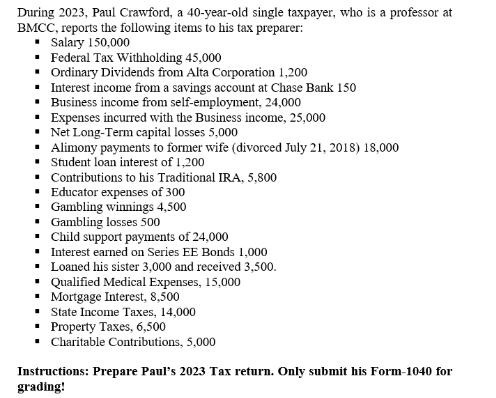

During 2023, Paul Crawford, a 40-year-old single taxpayer, who is a professor at BMCC, reports the following items to his tax preparer: Salary 150,000 Federal Tax Withholding 45,000 Ordinary Dividends from Alta Corporation 1,200 Interest income from a savings account at Chase Bank 150 Business income from self-employment, 24,000 Expenses incurred with the Business income, 25,000 Net Long-Term capital losses 5,000 Alimony payments to former wife (divorced July 21, 2018) 18,000 Student loan interest of 1,200 Contributions to his Traditional IRA, 5,800 Educator expenses of 300 Gambling winnings 4,500 Gambling losses 500 Child support payments of 24,000 Interest earned on Series EE Bonds 1,000 Loaned his sister 3,000 and received 3,500. Qualified Medical Expenses, 15,000 Mortgage Interest, 8,500 State Income Taxes, 14,000 Property Taxes, 6,500 Charitable Contributions, 5,000 Instructions: Prepare Paul's 2023 Tax return. Only submit his Form-1040 for grading!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Form 1040 US Individual Income Tax Return Filing Status Single Taxpayer Information First Name Paul ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started