Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2023, Wildhorse Corporation started a construction job with a contract price of $3.08 million. Wildhorse ran into severe echnical difficulties during construction but

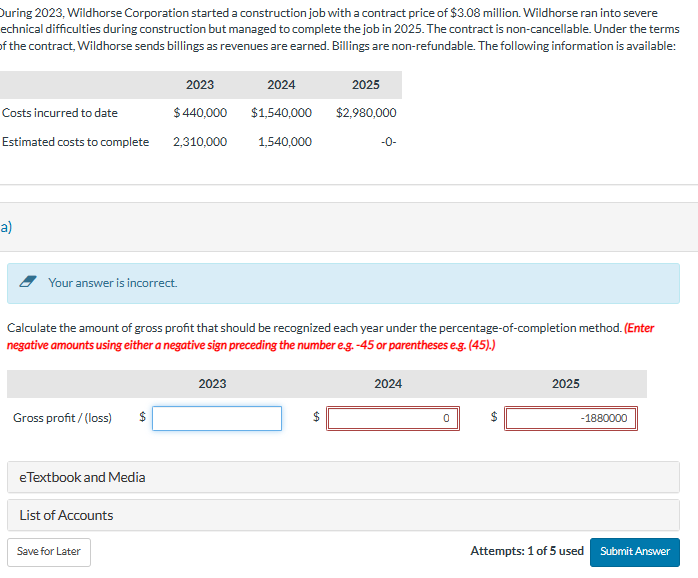

During 2023, Wildhorse Corporation started a construction job with a contract price of $3.08 million. Wildhorse ran into severe echnical difficulties during construction but managed to complete the job in 2025. The contract is non-cancellable. Under the terms of the contract, Wildhorse sends billings as revenues are earned. Billings are non-refundable. The following information is available: 2023 2024 2025 Costs incurred to date $440,000 $1,540,000 $2,980,000 Estimated costs to complete 2,310,000 1,540,000 -0- a) Your answer is incorrect. Calculate the amount of gross profit that should be recognized each year under the percentage-of-completion method. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Gross profit/(loss) $ eTextbook and Media List of Accounts Save for Later 2023 2024 0 2025 -1880000 Attempts: 1 of 5 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount of gross profit that should be recognized each year under the percentageofco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started