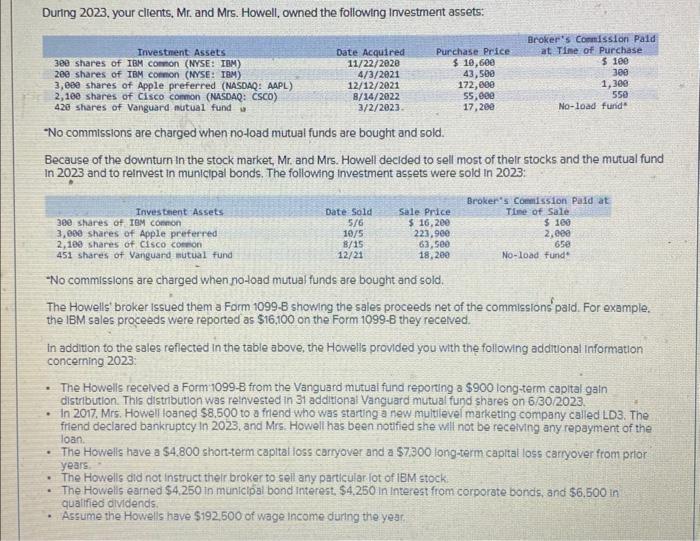

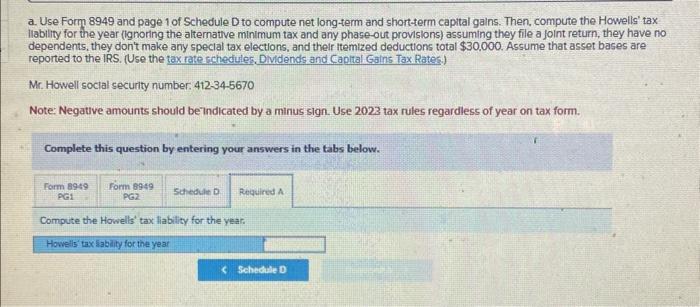

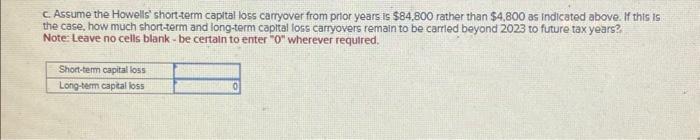

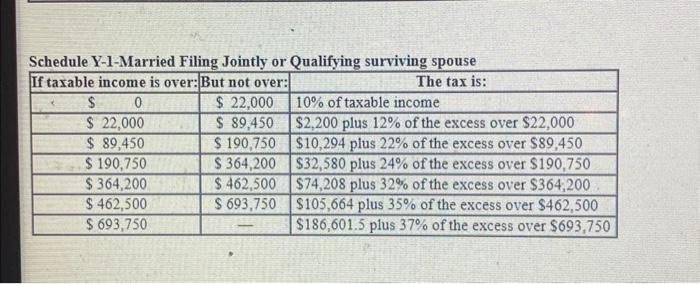

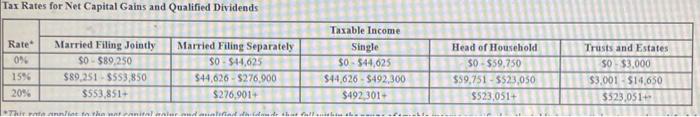

During 2023, your clients, Mr. and Mrs. Howell, owned the following investment assets: *No commissions are charged when notoad mutual funds are bought and sold. Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2023 and to reinvest in municipal bonds. The following investment assets were sold in 2023: No commissions are charged when notoad mutual funds are bought and sold. The Howell' broker issued them a Form 1099 -B showng the sales proceeds net of the commissions' paid. For example, the IBM sales proceeds were reported as $16,100 on the Form 1099-8 they receved. In addition to the sales reflected in the table above, the Howells provided you with the following additional information concerning 2023: - The Howells recelved a Form 10998 from the Vanguard mutual fund reporting a $900 iong-term capital gain distribution. This distribution was relnvested in 31 additionai Vanguard mutual fund shares on 6/30/2023. - In 2017. Mrs. Howell loaned $8,500 to a frend who was starting a new multievel marketing company called LD3. The fftend declared bankruptcy in 2023, and Mrs. Howell has been notified she will not be recelvng any repayment of the loan. - The Howells have a $4,800 short-term capltal loss carnyover and a $7,300 iong-term capital loss carryover from prior years. - The Howells did not instruct their broker to sell any particular fot of IBM stock - The Howells eamed $4,250 in municlpal bond interest, $4,250 in interest from corporate bonds, and $6,500 in qualified dividends. - Assume the Howells have $192,500 of wage income duitng the year. a. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital galns. Then, compute the Howellg' tax liability for the year (lgnoring the alternative minimum tax and any phase-out provislons) assuming they file a joint return, they have no dependents, they don't make any speclal tax elections, and their itemized deductions total $30,000. Assume that asset bases are reported to the IRS. (Use the tax rate scheculer. Dividends and Capltal Gains Tax Rates) Mr. Howell soctal security number. 412,345670 Note: Negative amounts should be Tndicated by a minus sign. Use 2023 tax rules regardless of year on tax form. Complete this question by entering your answers in the tabs below. Compute the Howells' tax liability for the year. c. Assume the Howells' shortterm capital loss carryover from prior years is $84,800 rather than $4,800 as indicated above. If this is the case, how much short-erm and long-term capltal loss carryovers remain to be carred beyond 2023 to future tax years? Note: Leave no cells blank - be certain to enter " 0 " wherever required. Schadula V-1-Married Filino. Iointlv or Onalifving surviving snouse Tax Rates for Net Capital Gains and Qualified Dividends