Answered step by step

Verified Expert Solution

Question

1 Approved Answer

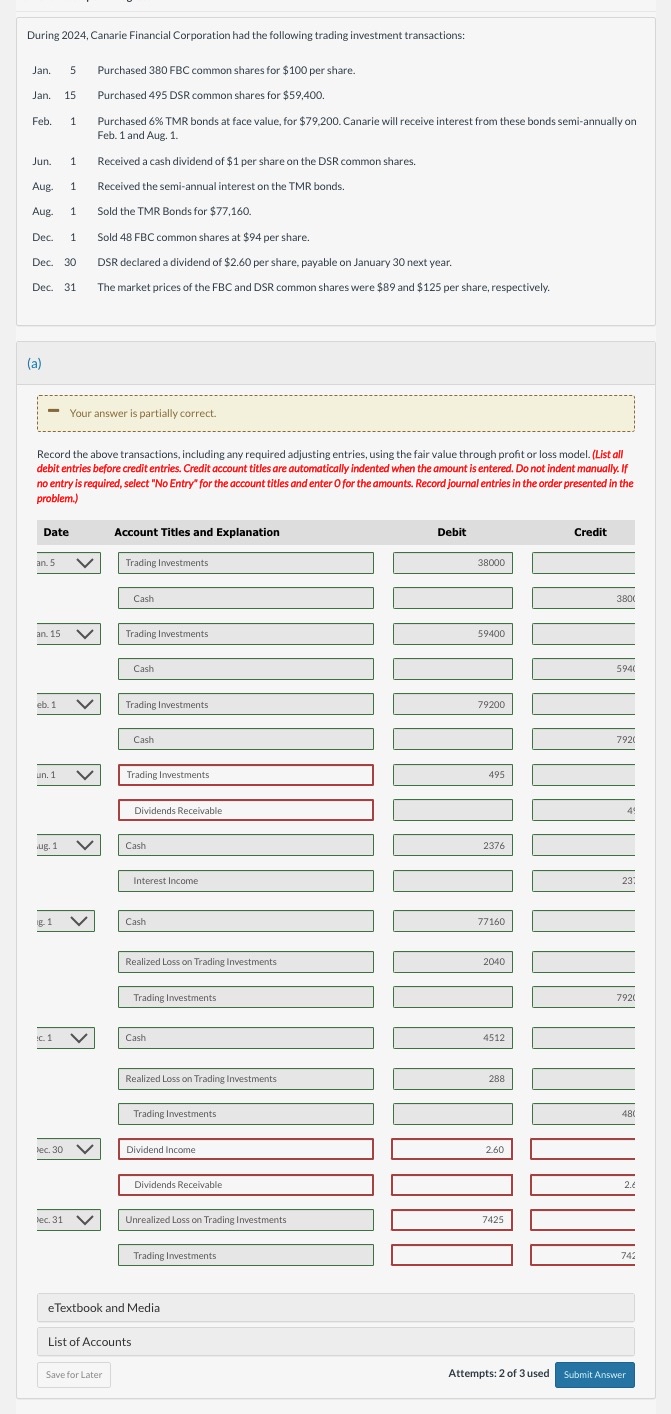

During 2024, Canarie Financial Corporation had the following trading investment transactions: Jan. 5 Purchased 380 FBC common shares for $100 per share. Jan. 15

During 2024, Canarie Financial Corporation had the following trading investment transactions: Jan. 5 Purchased 380 FBC common shares for $100 per share. Jan. 15 Purchased 495 DSR common shares for $59,400. Feb. 1 Jun. 1 Aug. 1 Aug. 1 Purchased 6% TMR bonds at face value, for $79,200. Canarie will receive interest from these bonds semi-annually on Feb. 1 and Aug. 1. Received a cash dividend of $1 per share on the DSR common shares. Received the semi-annual interest on the TMR bonds. Sold the TMR Bonds for $77,160. Dec. 1 Sold 48 FBC common shares at $94 per share. Dec. 30 DSR declared a dividend of $2.60 per share, payable on January 30 next year. Dec. 31 The market prices of the FBC and DSR common shares were $89 and $125 per share, respectively. Your answer is partially correct. Record the above transactions, including any required adjusting entries, using the fair value through profit or loss model. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation an. 5 Trading Investments Cash an. 15 Trading Investments Cash Debit 38000 59400 eb. 1 Trading Investments 79200 Cash un. 1 Trading Investments Dividends Receivable ug. 1 Cash Interest Income Cash 495 2376 77160 Realized Loss on Trading Investments 2040 Trading Investments Cash 4512 Realized Loss on Trading Investments 288 Trading Investments lec. 30 Dividend Income Dividends Receivable 260 lec. 31 Unrealized Loss on Trading Investments 7425 Trading Investments eTextbook and Media List of Accounts Save for Later Credit 3800 5940 7920 23: 7920 480 2. 742 Attempts: 2 of 3 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information here are the journal entries for the transactions using the fair valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started