Question

During 20x6, a catering company served spoiled food to a wedding reception. As a result of this, several people became violently ill. These have

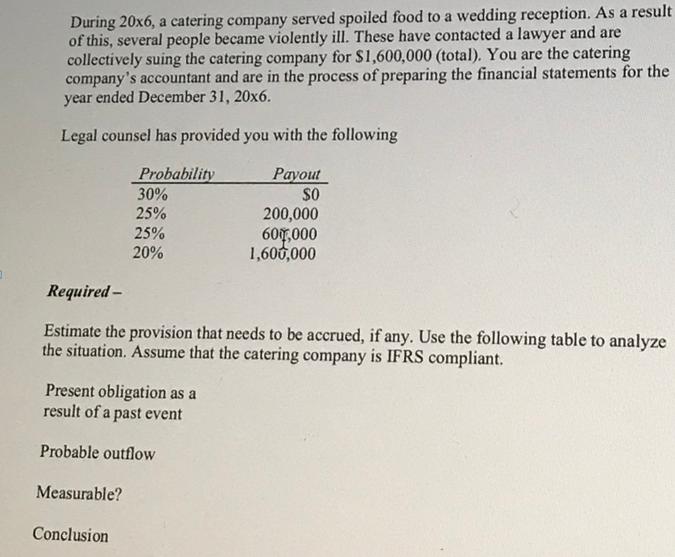

During 20x6, a catering company served spoiled food to a wedding reception. As a result of this, several people became violently ill. These have contacted a lawyer and are collectively suing the catering company for S1,600,000 (total). You are the catering company's accountant and are in the process of preparing the financial statements for the ended December 31, 20x6. year Legal counsel has provided you with the following Probability 30% Payout SO 200,000 25% 60,000 1,600,000 25% 20% Required- Estimate the provision that needs to be accrued, if any. Use the following table to analyze the situation. Assume that the catering company is IFRS compliant. Present obligation as a result of a past event Probable outflow Measurable? Conclusion

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

3rd edition

132890542, 978-0132890540

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App