During 20X9, Song produced inventory for $20,000 and sold it to Polka for $30,000. Polka resold 60 percent of the inventory in 20X9. Also in

During 20X9, Song produced inventory for $20,000 and sold it to Polka for $30,000. Polka resold 60 percent of the inventory in 20X9. Also in 20X9, Polka sold inventory purchased from Song 20X8. It had cost Song $60,000 to produce the inventory, and Polka purchased it for $75,000. Assume Polka uses the fully adjusted equity method.

Required:

a. What amount of cost of goods sold will be reported in the 20X9 consolidated income statement?

b. What inventory balance will be reported in the December 31, 20X9, consolidated balance sheet?

c. What amount of income will be assigned to noncontrolling shareholders in the 20X9 consolidated income statement?

d. What amount will be assigned to noncontrolling interest in the consolidated balance sheet prepared on December 31, 20X9?

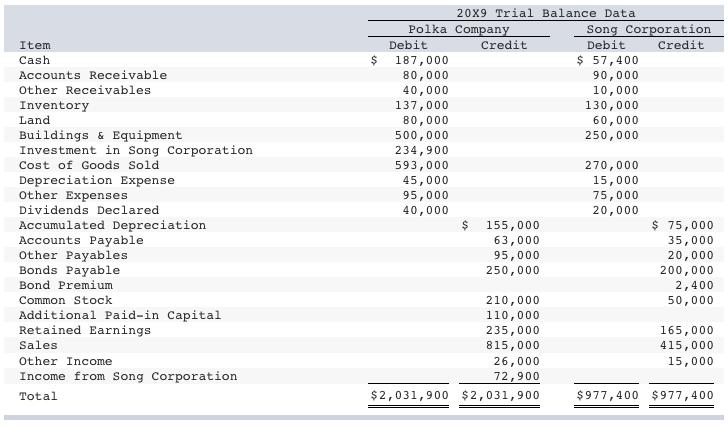

Item Cash. Accounts Receivable Other Receivables Inventory Land Buildings & Equipment Investment in Song Corporation Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Other Payables Bonds Payable Bond Premium Common Stock Additional Paid-in Capital Retained Earnings Sales: Other Income Income from Song Corporation Total Polka Company Debit 20x9 Trial Balance Data 187,000 80,000 40,000 137,000 80,000 500,000 234,900 593,000 45,000 95,000 40,000 $ Credit 155,000 63,000 95,000 250,000 210,000 110,000 235,000 815,000 26,000 72,900 $2,031,900 $2,031,900 Song Corporation Debit Credit $ 57,400 90,000 10,000 130,000 60,000 250,000 270,000 15,000 75,000 20,000 $ 75,000 35,000 20,000 200,000 2,400 50,000 165,000 415,000 15,000 $977,400 $977,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a b Consolidated cost of goods sold for 20X9 Amount reported by ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started