Answered step by step

Verified Expert Solution

Question

1 Approved Answer

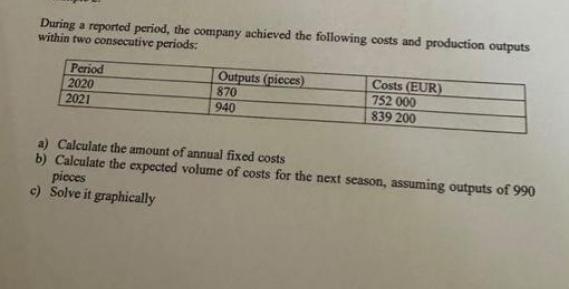

During a reported period, the company achieved the following costs and production outputs within two consecutive periods: Period 2020 2021 Outputs (pieces) 870 940

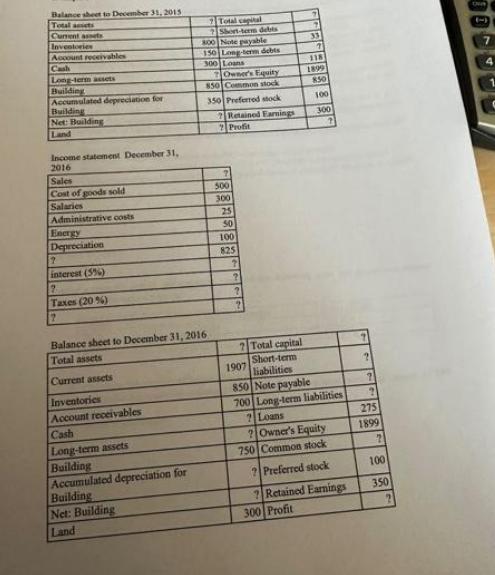

During a reported period, the company achieved the following costs and production outputs within two consecutive periods: Period 2020 2021 Outputs (pieces) 870 940 pieces c) Solve it graphically Costs (EUR) 752 000 839 200 a) Calculate the amount of annual fixed costs b) Calculate the expected volume of costs for the next season, assuming outputs of 990 Balance sheet to December 31, 2015 Total assets Current assets Inventories Account receivables Cash Long-term assets Building Accumulated depreciation for Building Net: Building Land Income statement December 31, 2016 Sales Cost of goods sold Salaries Administrative costs Energy Depreciation ? interest (5%) 7 Taxes (20 %) 7 Accumulated depreciation for Building Balance sheet to December 31, 2016 Total assets Current assets Inventories Account receivables Cash Long-term assets Building Net: Building Land Total capital Short-term debts 800 Note payable 150 Long-term debts 300 Loans Owner's Equity 850 Common stock 350 Preferred stock ? Retained Earnings Profit 500 300 25 50 100 825 7 ? ? 7 33 1 118 1899 850 100 300 Total capital Short-term liabilities 1907 850 Note payable 700 Long-term liabilities ? Loans ? Owner's Equity 750 Common stock ? Preferred stock 7 Retained Earnings 300 Profit ? ? 2 275 1899 2 100 350 2 Ov 7 4 a) Fill question marks if you know that the requirement of investors is 10% of the return on capital. b) Assess the cash flow development of the examined company (by indirect methodology). Where did we spent most of our money? c) Did the examined company create the economic value added for their investors? Could you explain how the minimum EBIT should look like to get a positive EVA? d) Evaluate the cost of capital of examined company (in currency and in percentage also) Suggest if it is worth (from WACC position) to accept another CZK 300 loan with the interest of 12% or reinvest profit in the same amount (CZK 300) if the owners' expected return is 10% e) f) Your competitor has a cost function such as TC-475+0,6 -Q. Please decide which company (you or the competitor) has more effective technology (comparing the cost function) and explain why. g) Could you assess what kind of financial strategy the company is using and if it is healthy? (Compare financial strategy with liquidity). What would be your suggestions if you would like to propose a neutral strategy? h) Would shareholders be satisfied with the amount of dividends which will be received lately? Why? How much would sales decline to make the leverage effect neutral? i) j) Please calculate and comment on the CCC cycle? Does that mean negative CCC? k) Could you explain and calculate DFL (degree of financial leverage)? What can the result tell you?

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the amount of annual fixed costs we need to find the portion of costs that remains constant regardless of the level of production In 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started