Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During a training seminar, Harry raises a question about the computation of E&P. Which of the following statements is not considered a timing difference

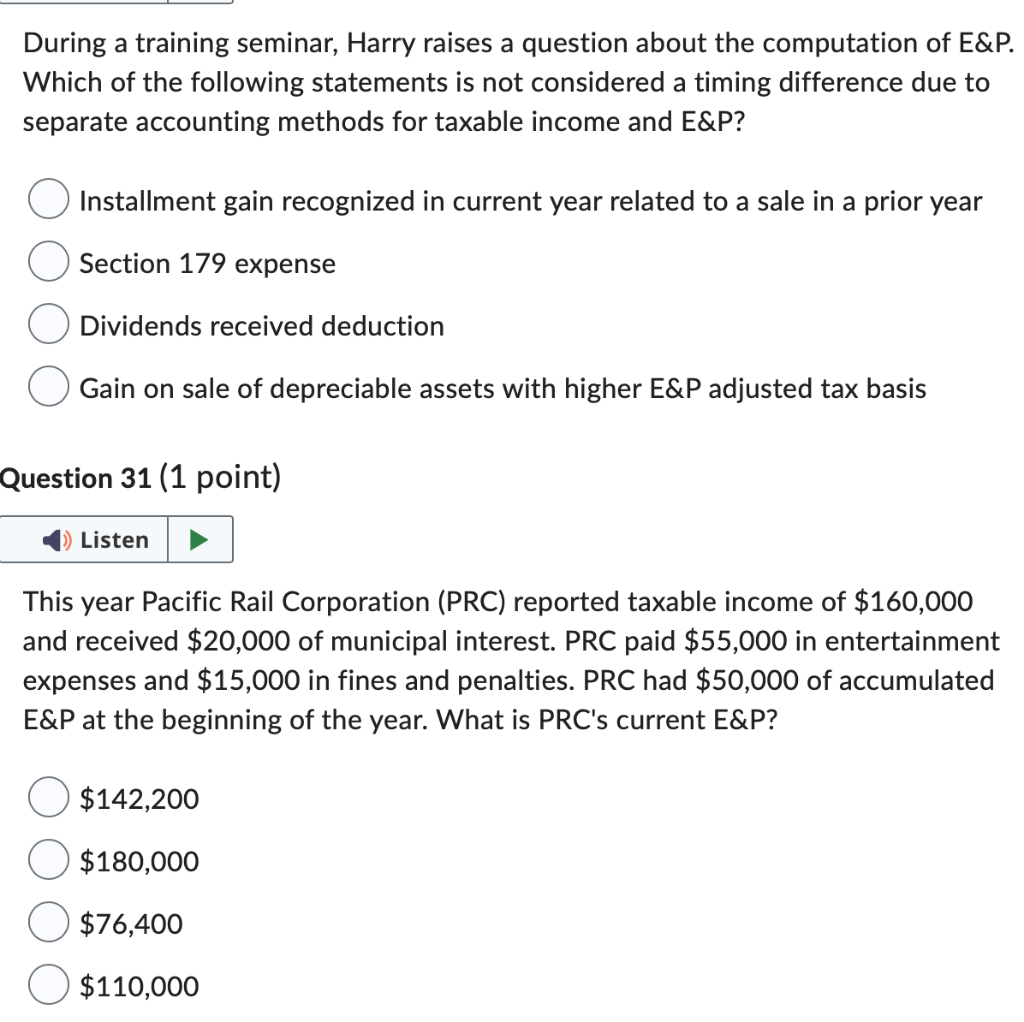

During a training seminar, Harry raises a question about the computation of E&P. Which of the following statements is not considered a timing difference due to separate accounting methods for taxable income and E&P? Installment gain recognized in current year related to a sale in a prior year Section 179 expense Dividends received deduction Gain on sale of depreciable assets with higher E&P adjusted tax basis Question 31 (1 point) Listen This year Pacific Rail Corporation (PRC) reported taxable income of $160,000 and received $20,000 of municipal interest. PRC paid $55,000 in entertainment expenses and $15,000 in fines and penalties. PRC had $50,000 of accumulated E&P at the beginning of the year. What is PRC's current E&P? $142,200 $180,000 $76,400 $110,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started