Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During class we discussed various non-profit transactions and the corresponding journal entries. This required us to differentiate between exchange and non-exchange transactions as well as

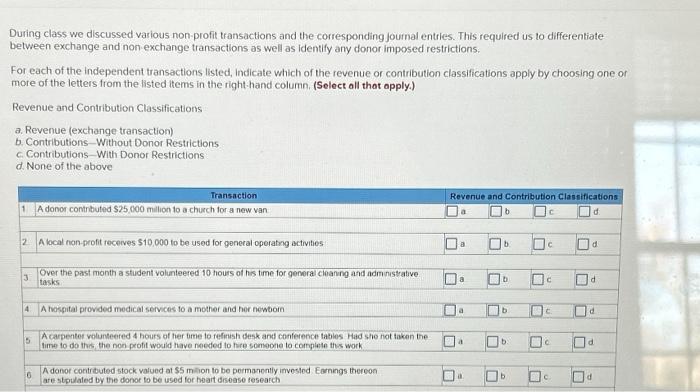

During class we discussed various non-profit transactions and the corresponding journal entries. This required us to differentiate between exchange and non-exchange transactions as well as identify any donor imposed restrictions. For each of the independent transactions listed, indicate which of the revenue or contribution classifications apply by choosing one or more of the letters from the listed items in the right-hand column. (Select all that apply.) Revenue and Contribution Classifications a. Revenue (exchange transaction) b. Contributions-Without Donor Restrictions C. Contributions-With Donor Restrictions d. None of the above Transaction 1 A donor contributed $25,000 million to a church for a new van 2 A local non-profit receives $10,000 to be used for general operating activities 3 Over the past month a student volunteered 10 hours of his time for general cleaning and administrative tasks. 4 A hospital provided medical services to a mother and her newborn 5 A carpenter volunteered 4 hours of her time to refinish desk and conference tables Had she not taken the time to do this, the non-profit would have needed to hire someone to complete this work 6 A donor contributed stock valued at $5 million to be permanently invested Earnings thereon are stipulated by the donor to be used for heart disease research. Revenue and Contribution Classifications d a a a a a b b b b b b C C C C d d d d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started