Answered step by step

Verified Expert Solution

Question

1 Approved Answer

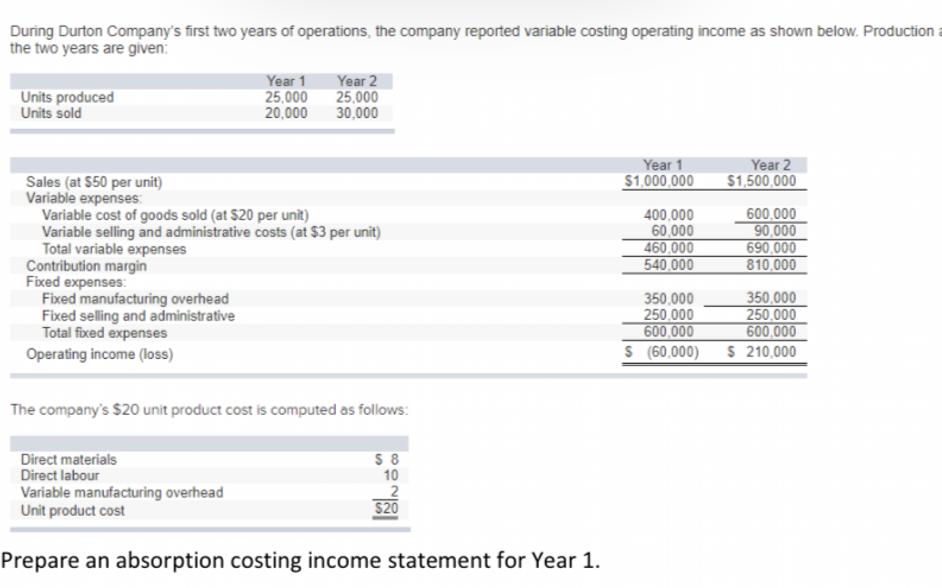

During Durton Company's first two years of operations, the company reported variable costing operating income as shown below. Production a the two years are

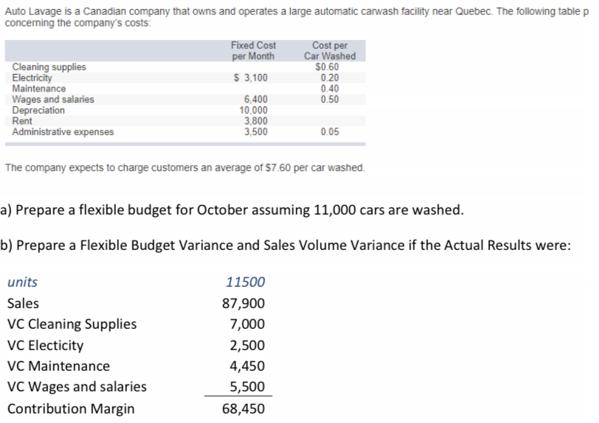

During Durton Company's first two years of operations, the company reported variable costing operating income as shown below. Production a the two years are given: Year 2 25,000 30,000 Year 1 Units produced Units sold 25,000 20,000 Year 2 $1.,500.000 Year 1 $1.000.000 Sales (at $50 per unit) Variable expenses: Variable cost of goods sold (at $20 per unit) Variable selling and administrative costs (at $3 per unit) Total variable expenses Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Operating income (loss) 400,000 60,000 460.000 540.000 600,000 90,000 690.000 810.000 350,000 250.000 600,000 S (60,000) 350,000 250.000 600,000 S 210,000 The company's $20 unit product cost is computed as follows: Direct materials Direct labour Variable manufacturing overhead Unit product cost $ 8 10 $20 Prepare an absorption costing income statement for Year 1. Auto Lavage is a Canadian company that owns and operates a large automatic carwash facility near Quebec. The following table p concerning the company's costs Fixed Cost Cost per Car Washed $0.60 0.20 0.40 0.50 per Month Cleaning supplies Electricity Maintenance Wages and salaries Depreciation Rent Administrative expenses $ 3,100 6,400 10,000 3,800 3.500 0. 05 The company expects to charge customers an average of 57.60 per car washed. a) Prepare a flexible budget for October assuming 11,000 cars are washed. b) Prepare a Flexible Budget Variance and Sales Volume Variance if the Actual Results were: units 11500 Sales 87,900 VC Cleaning Supplies VC Electicity VC Maintenance vC Wages and salaries 7,000 2,500 4,450 5,500 Contribution Margin 68,450

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

WORKING NOTES Sales Units sold Selling price Year 1 20000 501000000 Year 2 30000 501500000 In variab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started