Question

During February, Alexander Inc. worked on two jobs with the following data: Units in each order Units sold Materials requisitioned Direct labor hours Direct

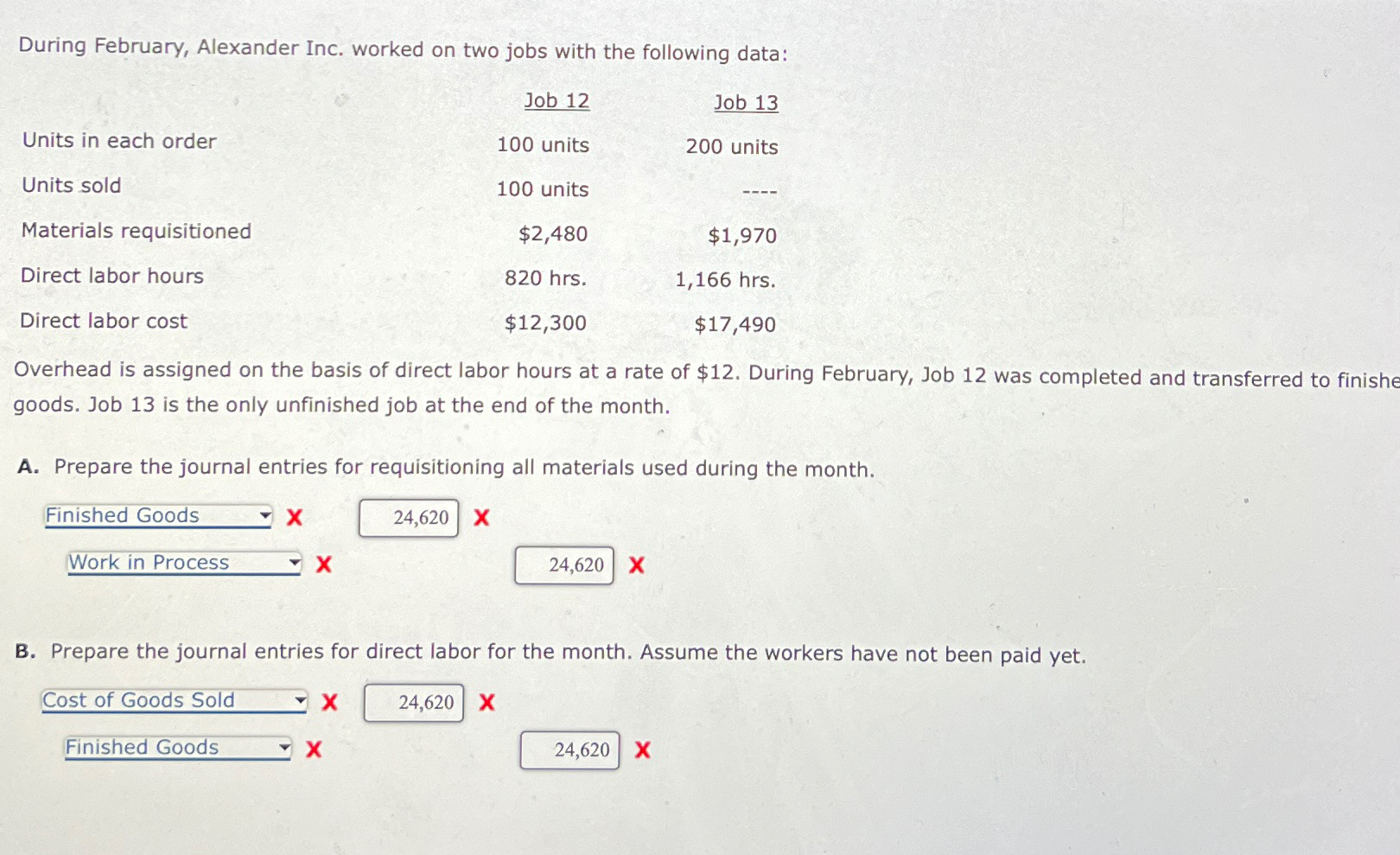

During February, Alexander Inc. worked on two jobs with the following data: Units in each order Units sold Materials requisitioned Direct labor hours Direct labor cost Job 12 Job 13 100 units 200 units 100 units $2,480 $1,970 820 hrs. 1,166 hrs. $12,300 $17,490 Overhead is assigned on the basis of direct labor hours at a rate of $12. During February, Job 12 was completed and transferred to finishe goods. Job 13 is the only unfinished job at the end of the month. A. Prepare the journal entries for requisitioning all materials used during the month. Finished Goods Work in Process X 24,620 X X 24,620 X B. Prepare the journal entries for direct labor for the month. Assume the workers have not been paid yet. Cost of Goods Sold Finished Goods X 24,620 X X 24,620 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones Of Cost Management

Authors: Don R. Hansen, Maryanne M. Mowen

3rd Edition

9781305147102, 1285751787, 1305147103, 978-1285751788

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App