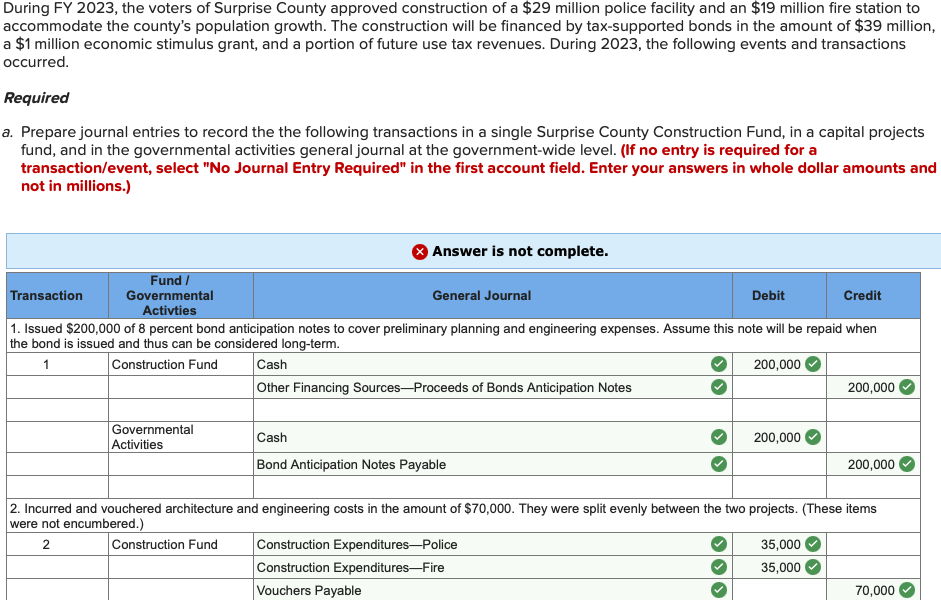

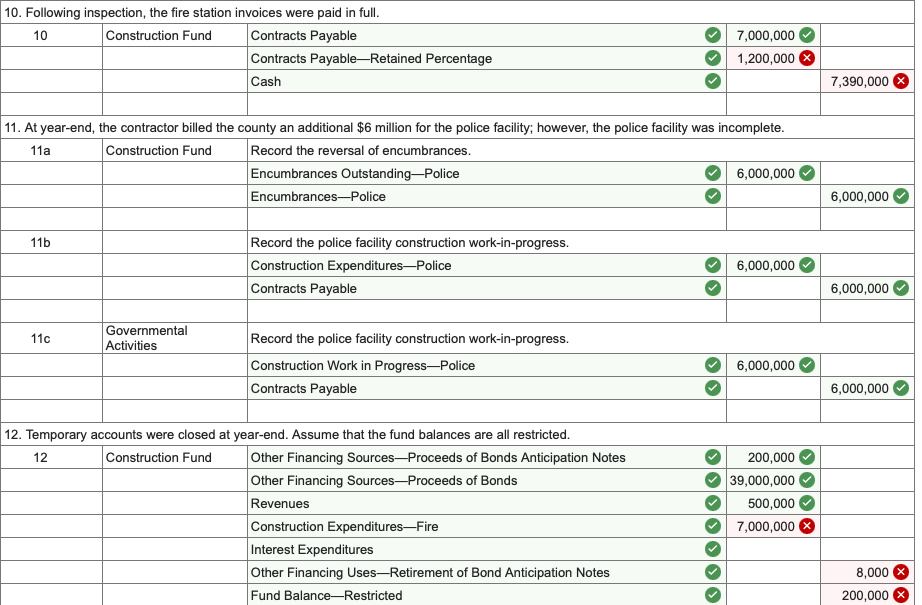

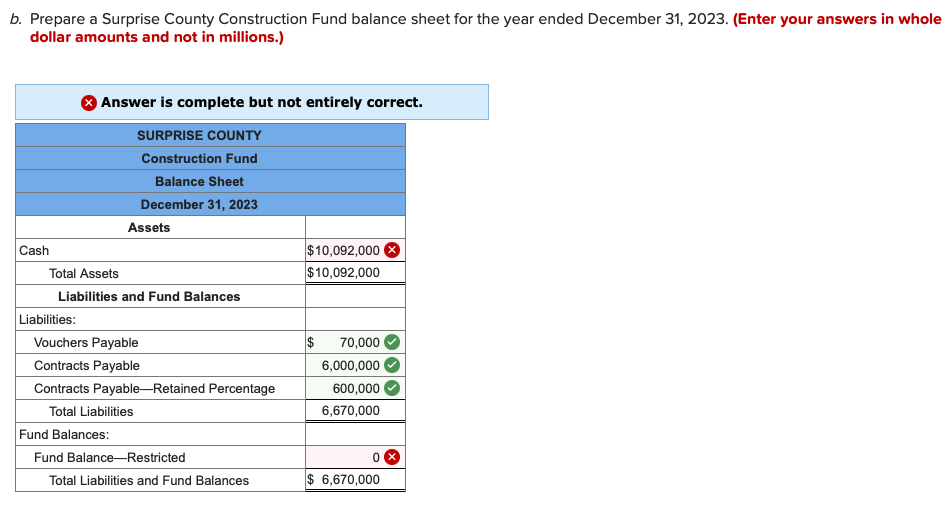

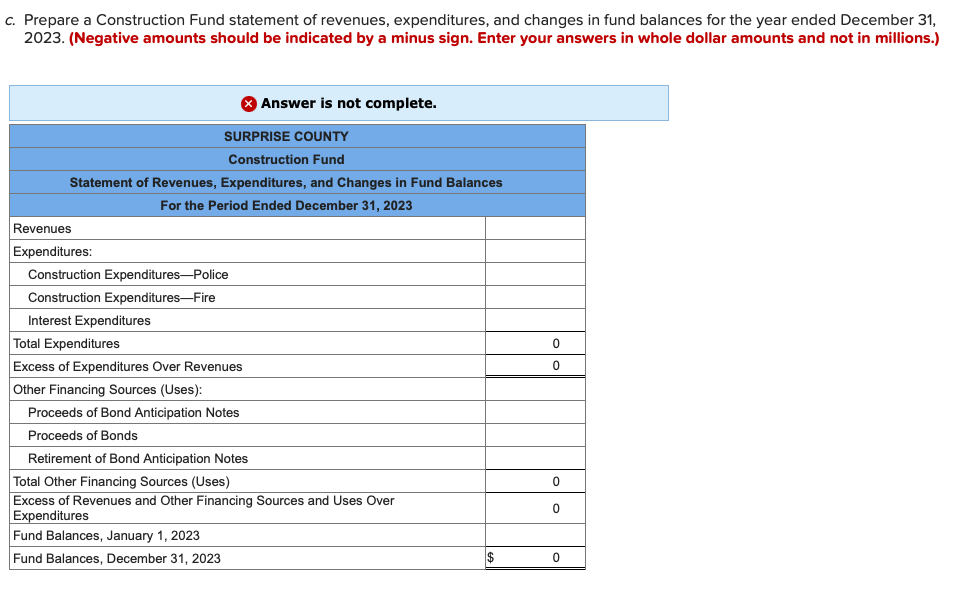

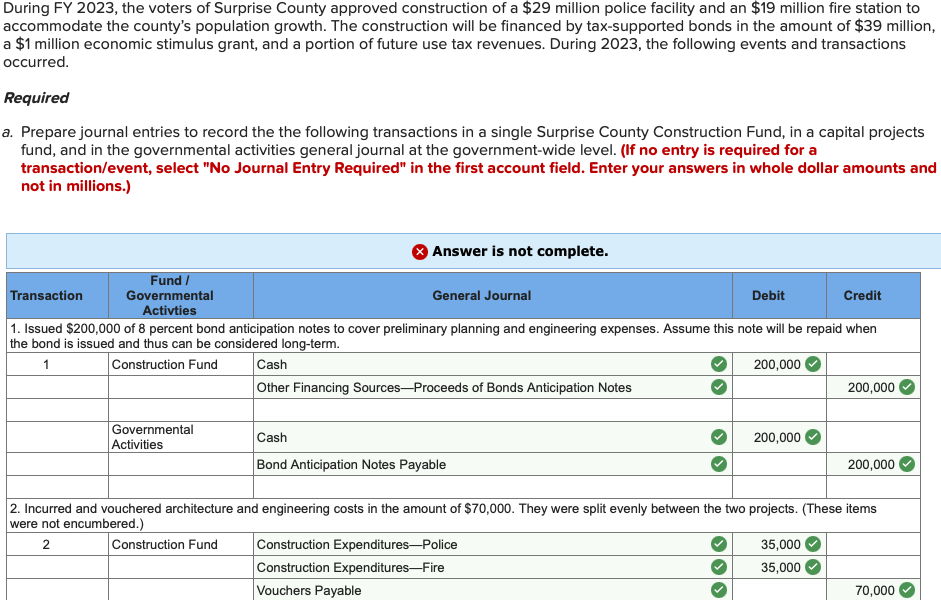

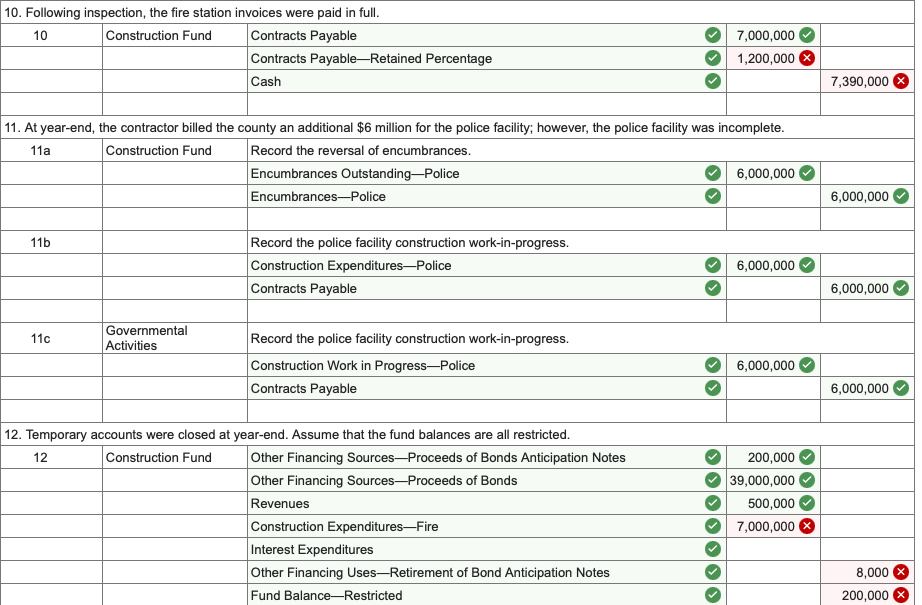

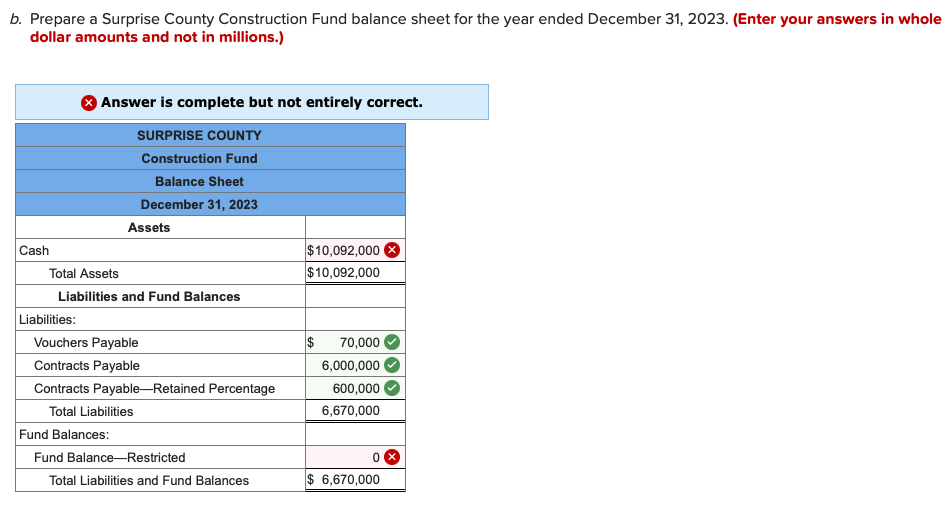

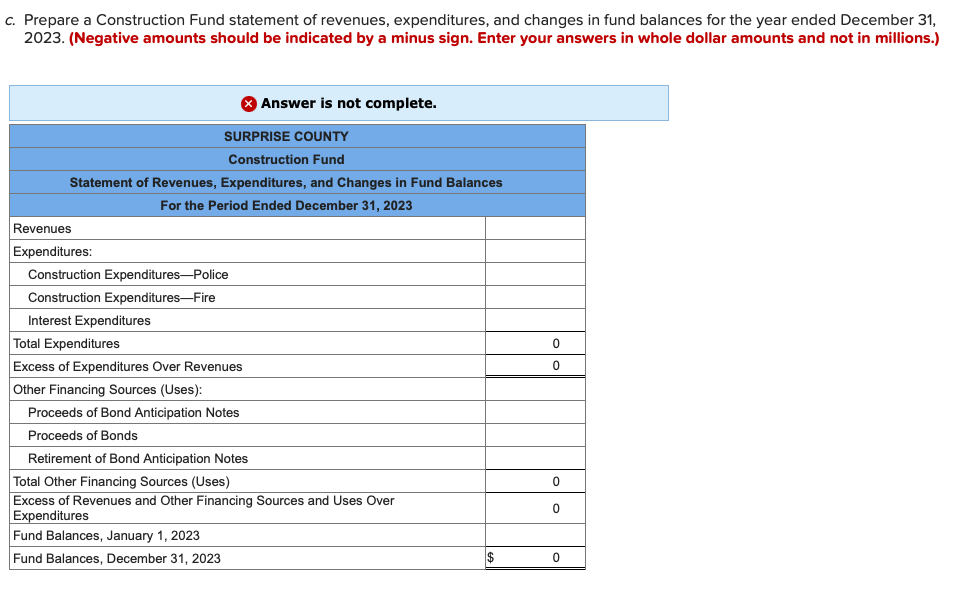

During FY 2023 , the voters of Surprise County approved construction of a $29 million police facility and an $19 million fire station to accommodate the county's population growth. The construction will be financed by tax-supported bonds in the amount of $39 million, a $1 million economic stimulus grant, and a portion of future use tax revenues. During 2023 , the following events and transactions occurred. Required Prepare journal entries to record the the following transactions in a single Surprise County Construction Fund, in a capital projects fund, and in the governmental activities general journal at the government-wide level. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollar amounts and not in millions.) 10. Following inspection, the fire station invoices were paid in full. 11. At year-end, the contractor billed the county an additional $6 million for the police facility; however, the police facility was incomplete. \begin{tabular}{|c|l|l|l|l|l|} \hline 11a & Construction Fund & Record the reversal of encumbrances. \\ \hline & & Encumbrances Outstanding-Police \\ \hline 11b & & Encumbrances-Police \\ \hline & & Record the police facility construction work-in-progress. \\ \hline & & Construction Expenditures-Police \\ \hline 11c & & Contracts Payable \\ \hline & GovernmentalActivities & Record the police facility construction work-in-progress. \\ \hline & & Construction Work in Progress-Police \\ \hline & & Contracts Payable \\ \hline \end{tabular} 12. Temporary accounts were closed at year-end. Assume that the fund balances are all restricted. \begin{tabular}{|l|l|l|l|} \hline 12 & Construction Fund & Other Financing Sources-Proceeds of Bonds Anticipation Notes \\ \hline & & Other Financing Sources-Proceeds of Bonds \\ \hline & & Revenues \\ \hline & Construction Expenditures-Fire \\ \hline & & Interest Expenditures \\ \hline & Other Financing Uses-Retirement of Bond Anticipation Notes \\ \hline & Fund Balance-Restricted \\ \hline \end{tabular} b. Prepare a Surprise County Construction Fund balance sheet for the year ended December 31, 2023. (Enter your answers in whole dollar amounts and not in millions.) Answer is complete but not entirely correct. c. Prepare a Construction Fund statement of revenues, expenditures, and changes in fund balances for the year ended December 31 , 2023. (Negative amounts should be indicated by a minus sign. Enter your answers in whole dollar amounts and not in millions.)