Question

During FY 2023, the voters of Surprise County approved construction of a $21 million police facility and an $11 million fire station to accommodate the

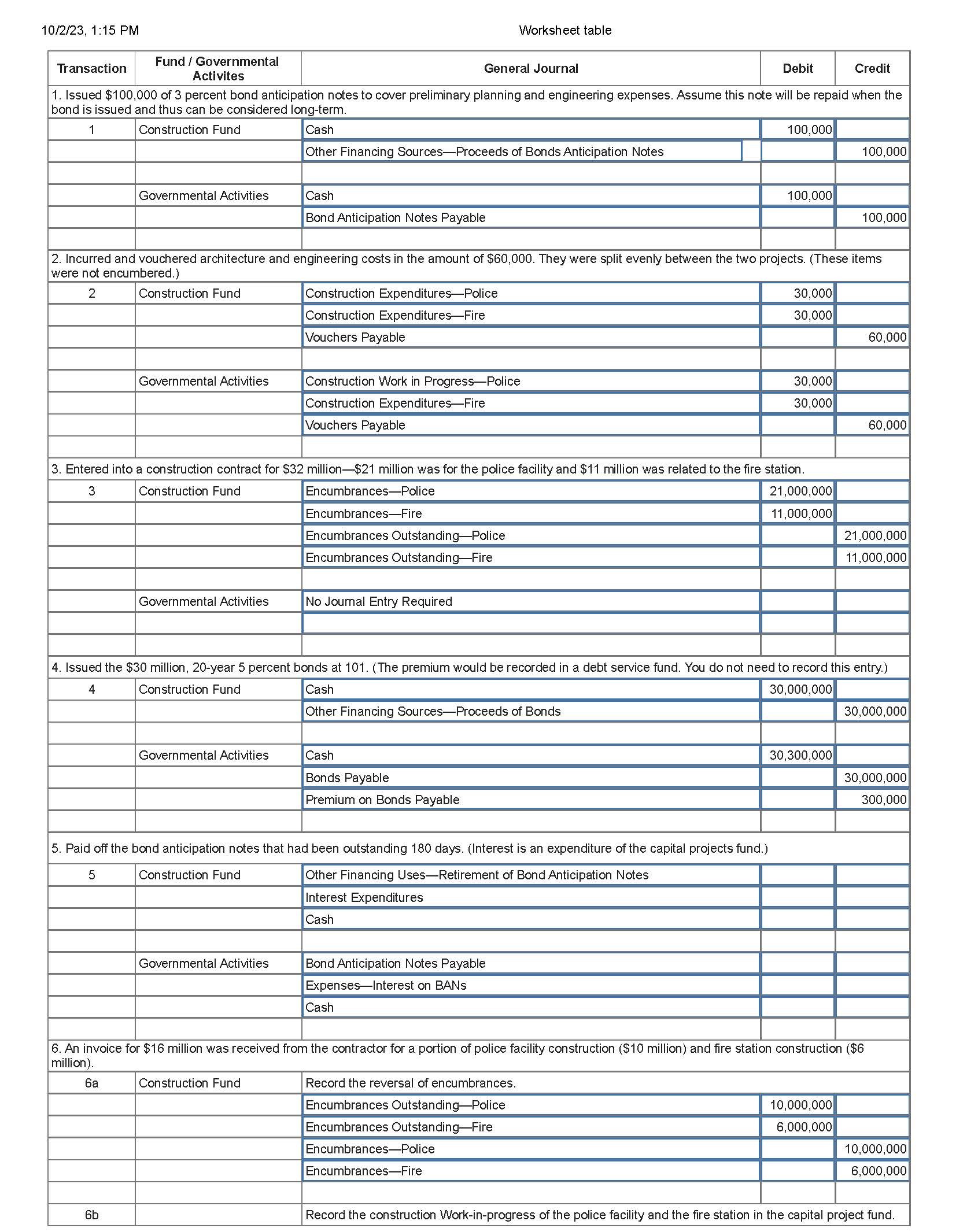

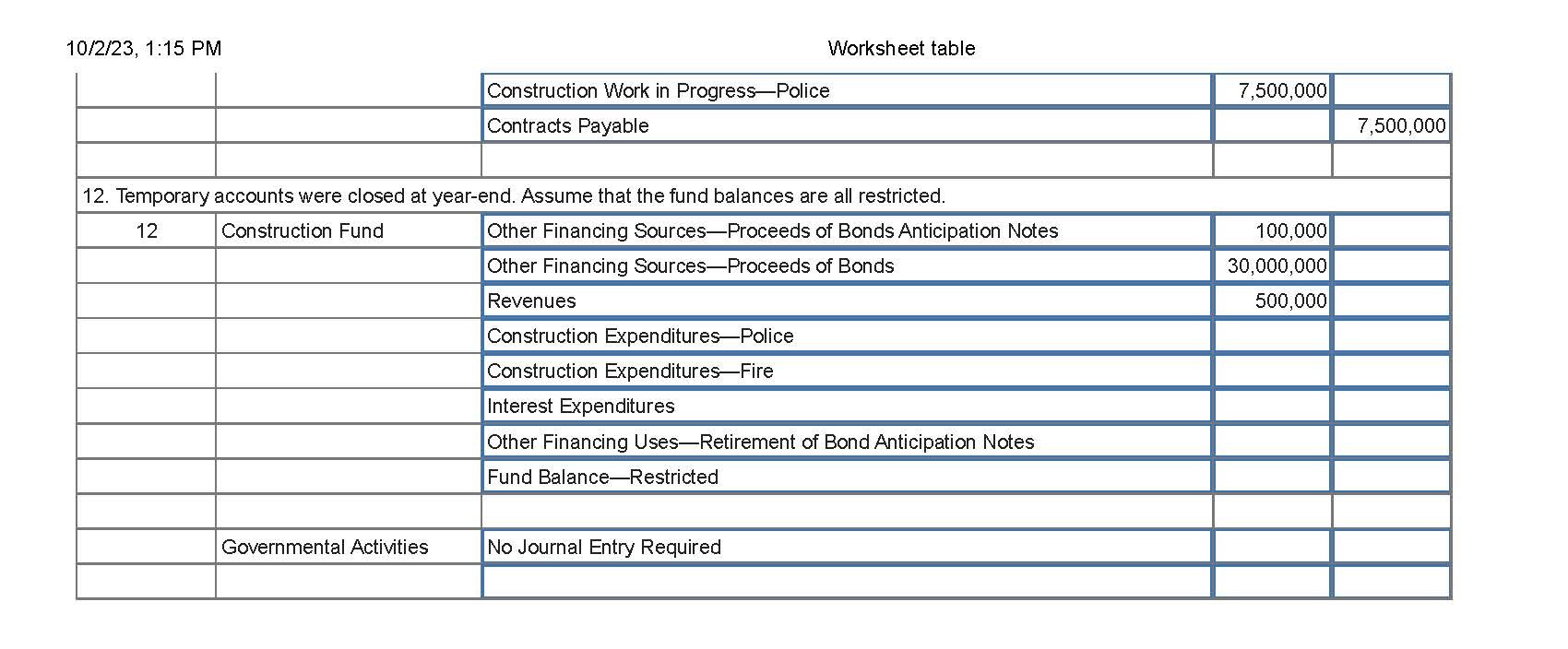

During FY 2023, the voters of Surprise County approved construction of a $21 million police facility and an $11 million fire station to accommodate the countys population growth. The construction will be financed by tax-supported bonds in the amount of $30 million, a $1 million economic stimulus grant, and a portion of future use tax revenues. During 2023, the following events and transactions occurred. Required Prepare journal entries to record the the following transactions in a single Surprise County Construction Fund, in a capital projects fund, and in the governmental activities general journal at the government-wide level. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in whole dollar amounts and not in millions.)

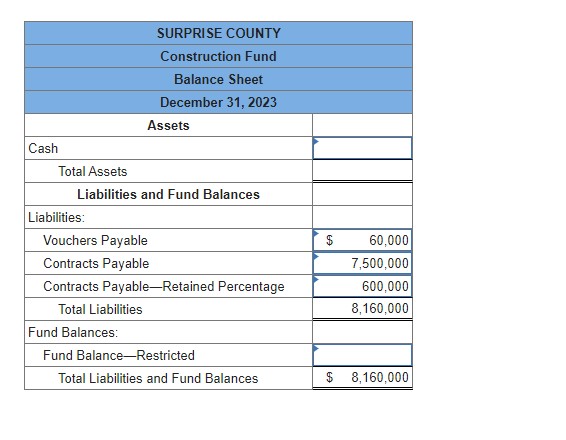

- Prepare a Surprise County Construction Fund balance sheet for the year ended December 31, 2023. (Enter your answers in whole dollar amounts and not in millions.)

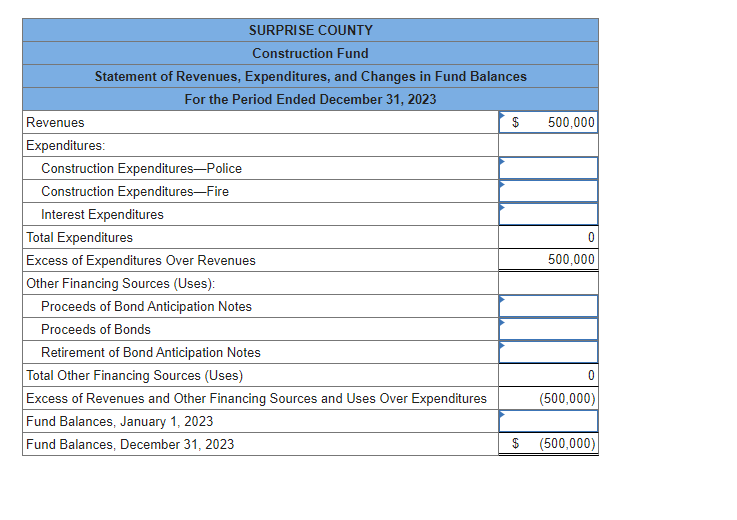

- Prepare a Construction Fund statement of revenues, expenditures, and changes in fund balances for the year ended December 31, 2023. (Negative amounts should be indicated by a minus sign. Enter your answers in whole dollar amounts and not in millions.)

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ SURPRISE COUNTY } \\ \hline \multicolumn{3}{|l|}{ Construction Fund } \\ \hline \multicolumn{3}{|l|}{ Balance Sheet } \\ \hline \multicolumn{3}{|l|}{ December 31, 2023} \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Cash } \\ \hline \multicolumn{3}{|l|}{ Total Assets } \\ \hline \multicolumn{3}{|l|}{ Liabilities and Fund Balances } \\ \hline \multicolumn{3}{|l|}{ Liabilities: } \\ \hline Vouchers Payable & $ & 60,000 \\ \hline Contracts Payable & & 7,500,000 \\ \hline Contracts Payable-Retained Percentage & & 600,000 \\ \hline Total Liabilities & & 8,160,000 \\ \hline \multicolumn{3}{|l|}{ Fund Balances: } \\ \hline \multicolumn{3}{|l|}{ Fund Balance-Restricted } \\ \hline Total Liabilities and Fund Balances & $ & 8,160,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{SURPRISECOUNTYConstructionFund} \\ \hline \multicolumn{1}{|c|}{ Statement of Revenues, Expenditures, and Changes in Fund Balances } \\ \hline \multicolumn{1}{|c|}{ For the Period Ended December 31, 2023 } \\ \hline Revenues & \\ \hline Expenditures: & \\ \hline Construction Expenditures-Police & \\ \hline Construction Expenditures-Fire & \\ \hline Interest Expenditures & \\ \hline Total Expenditures & \\ \hline Excess of Expenditures Over Revenues & \\ \hline Other Financing Sources (Uses): & \\ \hline Proceeds of Bond Anticipation Notes & \\ \hline Proceeds of Bonds & \\ \hline Retirement of Bond Anticipation Notes & \\ \hline Total Other Financing Sources (Uses) & (500,000) \\ \hline Excess of Revenues and Other Financing Sources and Uses Over Expenditures & \\ \hline Fund Balances, January 1, 2023 & (500,000) \\ \hline Fund Balances, December 31, 2023 & \\ \hline \end{tabular} 10/2/23, 1:15 PM Worksheet table \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ 10/2/23, 1:15 PM } & \multicolumn{2}{|l|}{ Worksheet table } & \\ \hline & & Construction Work in Progress_-Police & 7,500,000 & \\ \hline & & Contracts Payable & & 7,500,000 \\ \hline 12. Tempc & accounts were closed at y & end. Assume that the fund balances are all restricted. & & \\ \hline 12 & Construction Fund & Other Financing Sources-Proceeds of Bonds Anticipation Notes & 100,000 & \\ \hline & & Other Financing Sources-Proceeds of Bonds & 30,000,000 & \\ \hline & & Revenues & 500,000 & \\ \hline & & Construction Expenditures_-Police & & \\ \hline & & Construction Expenditures_-Fire & & \\ \hline & & Interest Expenditures & & \\ \hline & & Other Financing Uses-Retirement of Bond Anticipation Notes & & \\ \hline & & Fund Balance-Restricted & & \\ \hline & Governmental Activities & No Journal Entry Required & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ SURPRISE COUNTY } \\ \hline \multicolumn{3}{|l|}{ Construction Fund } \\ \hline \multicolumn{3}{|l|}{ Balance Sheet } \\ \hline \multicolumn{3}{|l|}{ December 31, 2023} \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Cash } \\ \hline \multicolumn{3}{|l|}{ Total Assets } \\ \hline \multicolumn{3}{|l|}{ Liabilities and Fund Balances } \\ \hline \multicolumn{3}{|l|}{ Liabilities: } \\ \hline Vouchers Payable & $ & 60,000 \\ \hline Contracts Payable & & 7,500,000 \\ \hline Contracts Payable-Retained Percentage & & 600,000 \\ \hline Total Liabilities & & 8,160,000 \\ \hline \multicolumn{3}{|l|}{ Fund Balances: } \\ \hline \multicolumn{3}{|l|}{ Fund Balance-Restricted } \\ \hline Total Liabilities and Fund Balances & $ & 8,160,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{SURPRISECOUNTYConstructionFund} \\ \hline \multicolumn{1}{|c|}{ Statement of Revenues, Expenditures, and Changes in Fund Balances } \\ \hline \multicolumn{1}{|c|}{ For the Period Ended December 31, 2023 } \\ \hline Revenues & \\ \hline Expenditures: & \\ \hline Construction Expenditures-Police & \\ \hline Construction Expenditures-Fire & \\ \hline Interest Expenditures & \\ \hline Total Expenditures & \\ \hline Excess of Expenditures Over Revenues & \\ \hline Other Financing Sources (Uses): & \\ \hline Proceeds of Bond Anticipation Notes & \\ \hline Proceeds of Bonds & \\ \hline Retirement of Bond Anticipation Notes & \\ \hline Total Other Financing Sources (Uses) & (500,000) \\ \hline Excess of Revenues and Other Financing Sources and Uses Over Expenditures & \\ \hline Fund Balances, January 1, 2023 & (500,000) \\ \hline Fund Balances, December 31, 2023 & \\ \hline \end{tabular} 10/2/23, 1:15 PM Worksheet table \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ 10/2/23, 1:15 PM } & \multicolumn{2}{|l|}{ Worksheet table } & \\ \hline & & Construction Work in Progress_-Police & 7,500,000 & \\ \hline & & Contracts Payable & & 7,500,000 \\ \hline 12. Tempc & accounts were closed at y & end. Assume that the fund balances are all restricted. & & \\ \hline 12 & Construction Fund & Other Financing Sources-Proceeds of Bonds Anticipation Notes & 100,000 & \\ \hline & & Other Financing Sources-Proceeds of Bonds & 30,000,000 & \\ \hline & & Revenues & 500,000 & \\ \hline & & Construction Expenditures_-Police & & \\ \hline & & Construction Expenditures_-Fire & & \\ \hline & & Interest Expenditures & & \\ \hline & & Other Financing Uses-Retirement of Bond Anticipation Notes & & \\ \hline & & Fund Balance-Restricted & & \\ \hline & Governmental Activities & No Journal Entry Required & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started