Question

During Inc. is evaluating a new capital budgeting project and conducting some basic risk analysis. First, it calculated the project's NPV at various levels for

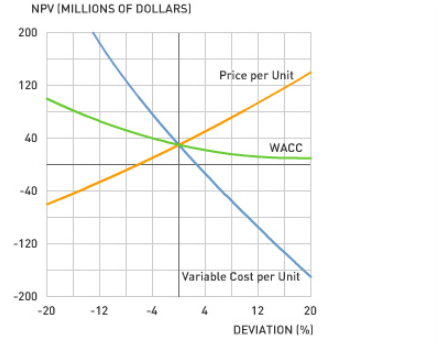

During Inc. is evaluating a new capital budgeting project and conducting some basic risk analysis. First, it calculated the project's NPV at various levels for the project's key inputs: price per unit, variable cost per unit, and the project's WACC. This process is a sensitivity analysis whose results are graphed below:

1) According to this analysis, which variable is the key value drive for the project?

- WACC - Variable cost per unit - Price per unit

2) At the current input value estimates, does this project have a positive or negative NPV?

3) Which type of firm is more likely to base its decisions on stand-alone risk? - A large, widely held firm whose owners are well diversified and do not have very much of their wealth tied up in the firm

- A small, closely held firm whose owners have much of their wealth tied up in the firm (The answer I chose, is that correct?)

THANKS!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started