Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During its first month of operations, Ava Corporation provided $62,079 of services to their customers. Ava's costs included rent of $11,112 and salaries and

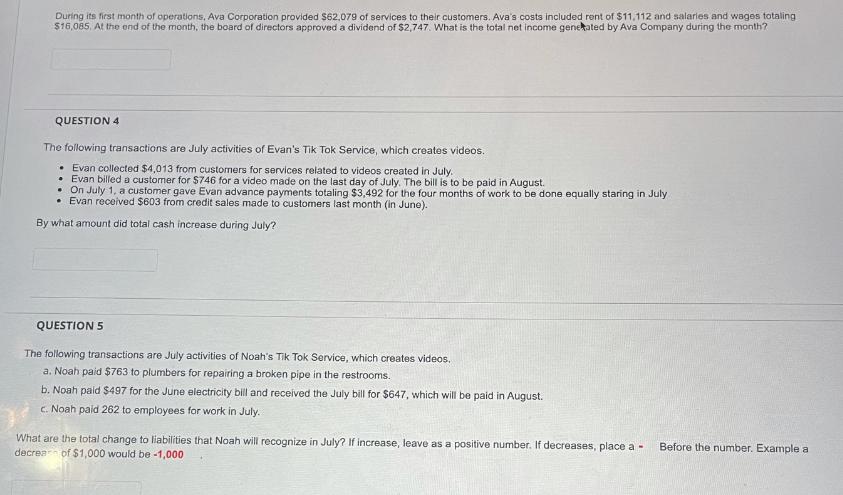

During its first month of operations, Ava Corporation provided $62,079 of services to their customers. Ava's costs included rent of $11,112 and salaries and wages totaling $16,085. At the end of the month, the board of directors approved a dividend of $2,747. What is the total net income generated by Ava Company during the month? QUESTION 4 The following transactions are July activities of Evan's Tik Tok Service, which creates videos. Evan collected $4,013 from customers for services related to videos created in July. Evan billed a customer for $746 for a video made on the last day of July. The bill is to be paid in August. On July 1, a customer gave Evan advance payments totaling $3,492 for the four months of work to be done equally staring in July Evan received $603 from credit sales made to customers last month (in June). By what amount did total cash increase during July? QUESTION 5 The following transactions are July activities of Noah's Tik Tok Service, which creates videos. a. Noah paid $763 to plumbers for repairing a broken pipe in the restrooms. b. Noah paid $497 for the June electricity bill and received the July bill for $647, which will be paid in August. c. Noah paid 262 to employees for work in July. What are the total change to liabilities that Noah will recognize in July? If increase, leave as a positive number. If decreases, place a - decrea of $1,000 would be -1,000 Before the number. Example a

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

For Question 1 To calculate the total net income generated by Ava Corporation during the month we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started