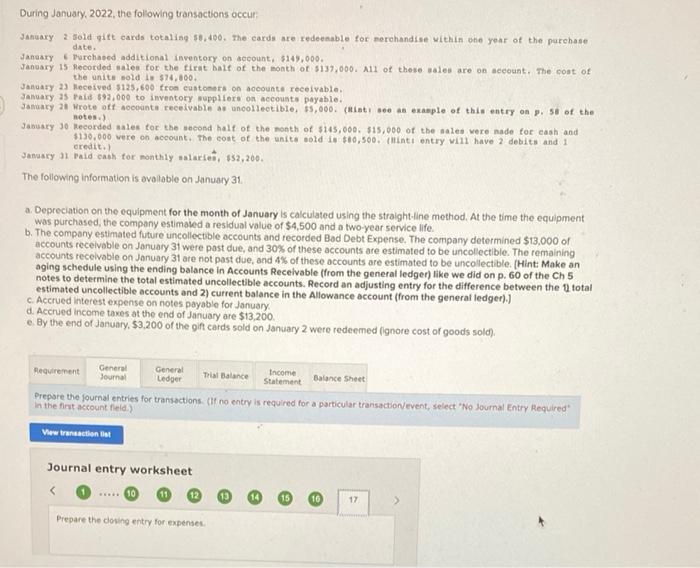

During January, 2022, the following transactions occur January 2 Sold gift cards totaling 50,400. The cards are redeemable for merchandise within one year of the purchase date. January Purchased additional inventory on account. $149,000. January 15 Recorded sales for the first half of the month of $137,000. All of those sales are on account. The cost of the units sold i 574.800. January 23 Received 5125,600 from customers on accounts receivable January 35 P 592,000 to inventory suppliers on accounts payable. January 21 Wrote oft accounts receivable as uncollectible, 35,000. (Hintas example of this entry on p. 58 of the notes.) January 30 Recorded sales for the second half of the month of $145,000. 315,000 of the sales were made for cash and $130.000 were on account. The cost of the units sold is $10,500. (litt entry will have 2 debits and 1 credit.) January on bald each for monthly alates 152,200. The following information is ovalable on January 31 a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased the company estimated a residual value of $4,500 and a two-year service life. b. The company estimated future uncollectible accounts and recorded Bad Debt Expense. The company determined $13,000 of accounts receivable on January 31 were post due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 4% of these accounts are estimated to be uncollectible (Hint: Make an aging schedule using the ending balance in Accounts Receivable (from the general ledger) like we did on p. 60 of the Ch 5 notes to determine the total estimated uncollectible accounts. Record an adjusting entry for the difference between the 1 total estimated uncollectible accounts and 2) current balance in the Allowance account (from the general ledger).] c. Accrued interest expense on notes payable for January d. Accrued income taxes at the end of January are $13.200. e. By the end of January, 53.200 of the gift cards sold on January 2 were redeemed ignore cost of goods sold) Requirement General General Journal Income Ledger Trial Balance Statement Balance Sheet Prepare the journal entries for transactions. (It no entry is required for a particular transaction/event, select "No Journal Entry Required In the first account feld) Vow transactions Journal entry worksheet 16 17 Prepare the closing entry for expenses During January, 2022, the following transactions occur January 2 Sold gift cards totaling 50,400. The cards are redeemable for merchandise within one year of the purchase date. January Purchased additional inventory on account. $149,000. January 15 Recorded sales for the first half of the month of $137,000. All of those sales are on account. The cost of the units sold i 574.800. January 23 Received 5125,600 from customers on accounts receivable January 35 P 592,000 to inventory suppliers on accounts payable. January 21 Wrote oft accounts receivable as uncollectible, 35,000. (Hintas example of this entry on p. 58 of the notes.) January 30 Recorded sales for the second half of the month of $145,000. 315,000 of the sales were made for cash and $130.000 were on account. The cost of the units sold is $10,500. (litt entry will have 2 debits and 1 credit.) January on bald each for monthly alates 152,200. The following information is ovalable on January 31 a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased the company estimated a residual value of $4,500 and a two-year service life. b. The company estimated future uncollectible accounts and recorded Bad Debt Expense. The company determined $13,000 of accounts receivable on January 31 were post due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 4% of these accounts are estimated to be uncollectible (Hint: Make an aging schedule using the ending balance in Accounts Receivable (from the general ledger) like we did on p. 60 of the Ch 5 notes to determine the total estimated uncollectible accounts. Record an adjusting entry for the difference between the 1 total estimated uncollectible accounts and 2) current balance in the Allowance account (from the general ledger).] c. Accrued interest expense on notes payable for January d. Accrued income taxes at the end of January are $13.200. e. By the end of January, 53.200 of the gift cards sold on January 2 were redeemed ignore cost of goods sold) Requirement General General Journal Income Ledger Trial Balance Statement Balance Sheet Prepare the journal entries for transactions. (It no entry is required for a particular transaction/event, select "No Journal Entry Required In the first account feld) Vow transactions Journal entry worksheet 16 17 Prepare the closing entry for expenses