Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During January, Mary Dolan, a contractor, provided pet care services to Angel's Kuno for three Fridays in January, totaling 24 hours @ $20 per

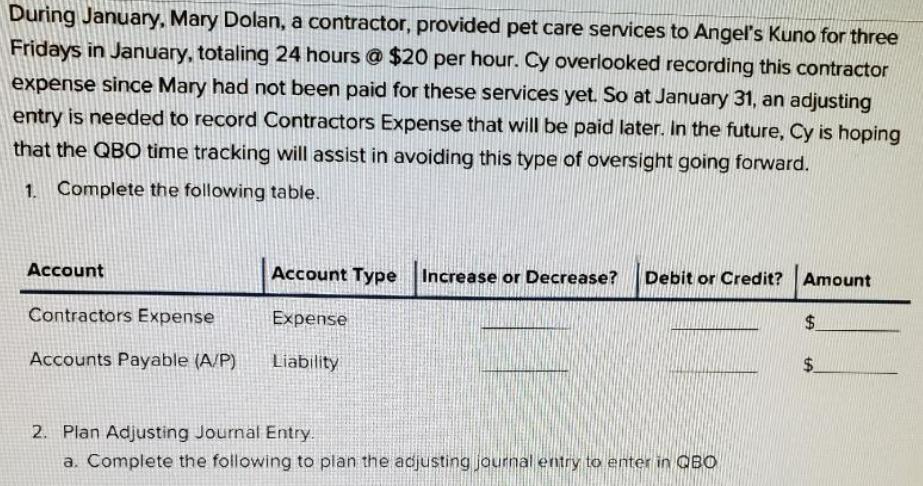

During January, Mary Dolan, a contractor, provided pet care services to Angel's Kuno for three Fridays in January, totaling 24 hours @ $20 per hour. Cy overlooked recording this contractor expense since Mary had not been paid for these services yet. So at January 31, an adjusting entry is needed to record Contractors Expense that will be paid later. In the future, Cy is hoping that the QBO time tracking will assist in avoiding this type of oversight going forward. 1. Complete the following table. Account Account Type Increase or Decrease? Debit or Credit? Amount Contractors Expense Expense $ Accounts Payable (A/P) Liability 2. Plan Adjusting Journal Entry. a. Complete the following to plan the adjusting journal entry to enter in QBO $ LA

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Contractors Expense is an Expense account Since expense is be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started