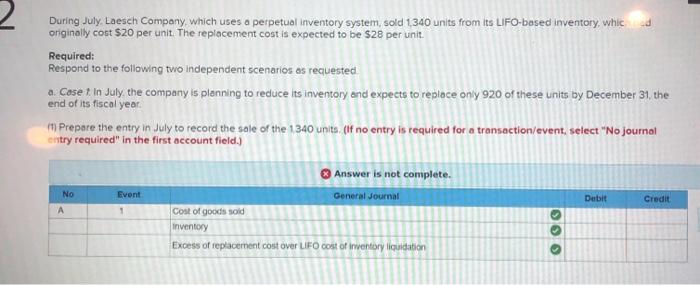

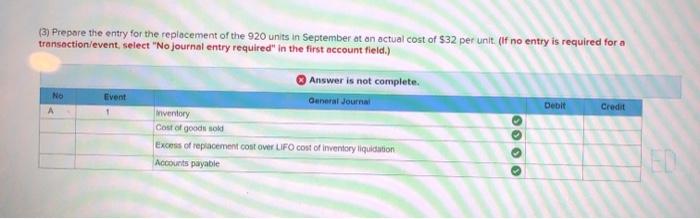

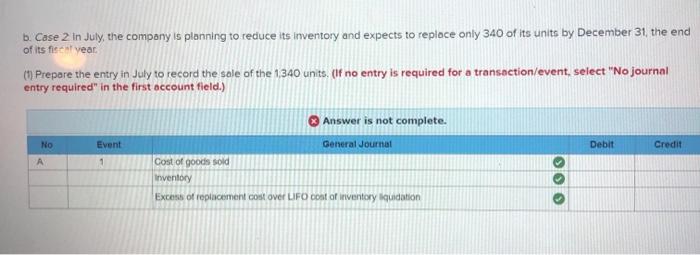

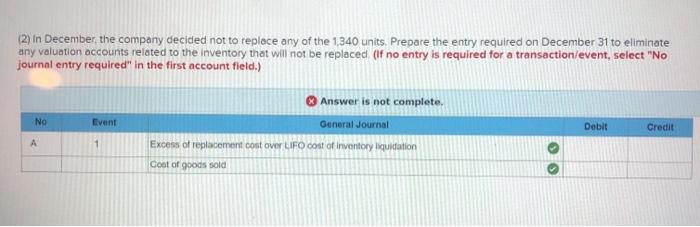

During July. Laesch Company which uses a perpetual inventory system, sold 1340 units from its LIFO-based Inventory, whic originally cost $20 per unit. The replacement cost is expected to be $28 per unit. Required: Respond to the following two independent scenarios as requested a Caset in July, the company is planning to reduce its inventory and expects to replace only 920 of these units by December 31, the end of its fiscal year. Prepare the entry in July to record the sale of the 1340 units. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) NO Debit Event 1 Credit A 3 Answer is not complete. General Journal Cost of goods sold Inventory Excess of replacement cost over LIFO Cost of inventory liquidation OOO (3) Prepare the entry for the replacement of the 920 units in September at an actual cost of $32 per unit. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Event NO Debit Credit + Answer is not complete General Journal ventory Cost of goods sold Excess of replacement cost over LIFO cost of inventory liquidation Accounts payable OOOO b. Case 2 in July, the company is planning to reduce its inventory and expects to replace only 340 of its units by December 31. the end of its fent year (1) Prepare the entry in July to record the sale of the 1340 units. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No General Journal Debit Credit Event 1 A Cost of goods sold Inventory OOO Excess of replacement cost over LIFO Coat of inventory liquidation (2) In December the company decided not to replace any of the 1.340 units. Prepare the entry required on December 31 to eliminate any valuation accounts related to the inventory that will not be replaced (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No Event General Journal Debit Credit A 1 Excess of replacement cost over LIFO cost of inventory quidation Coot of goods sold