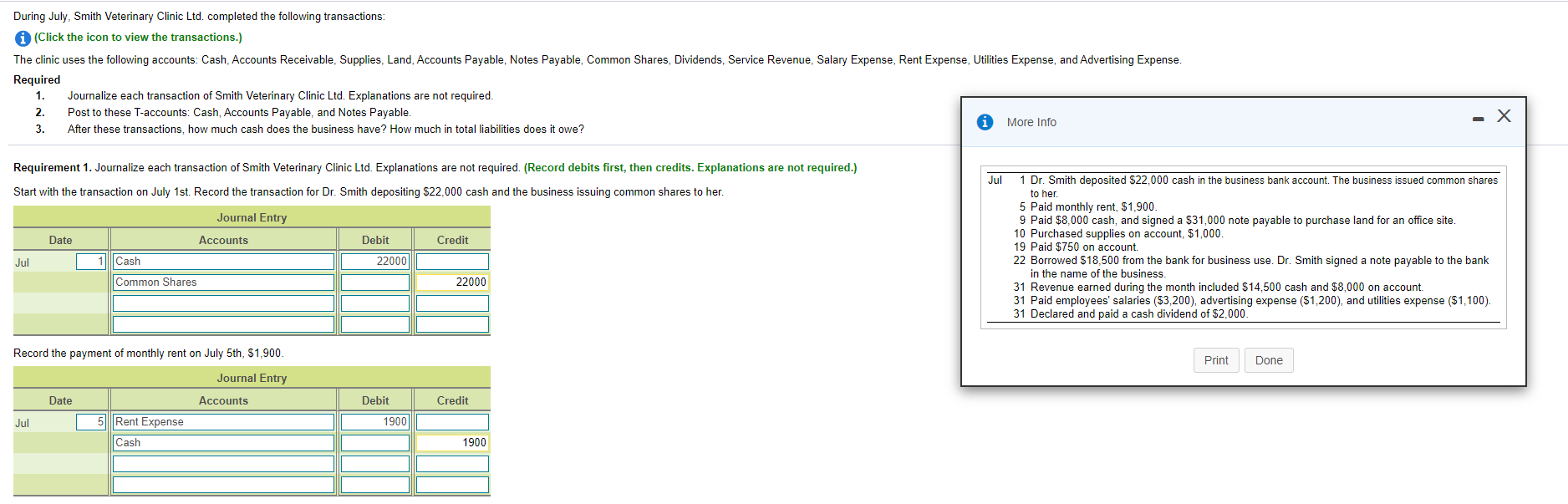

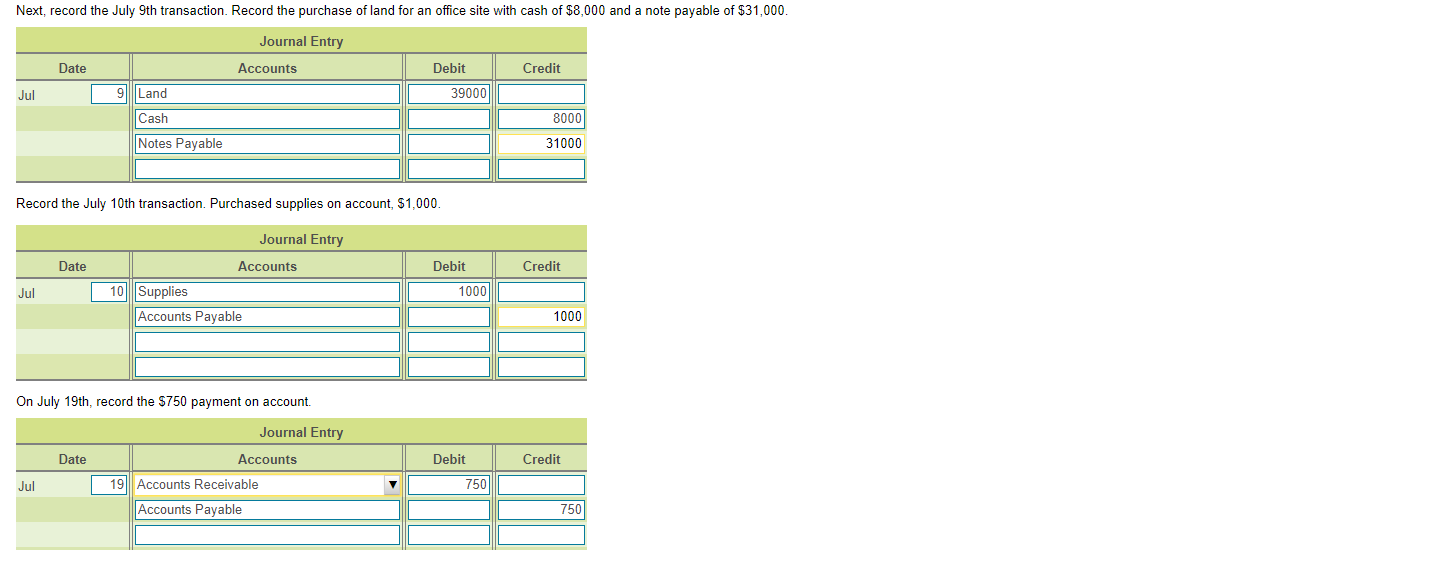

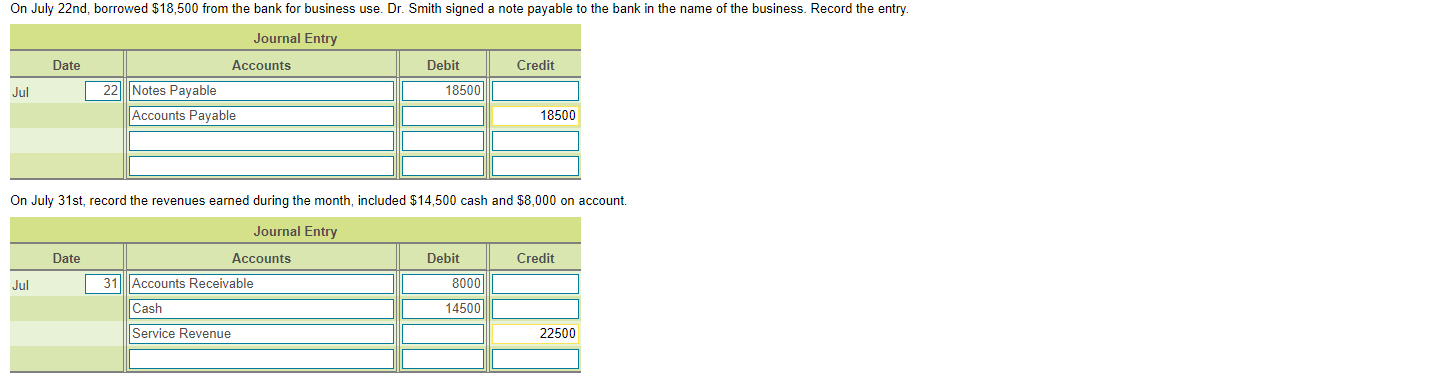

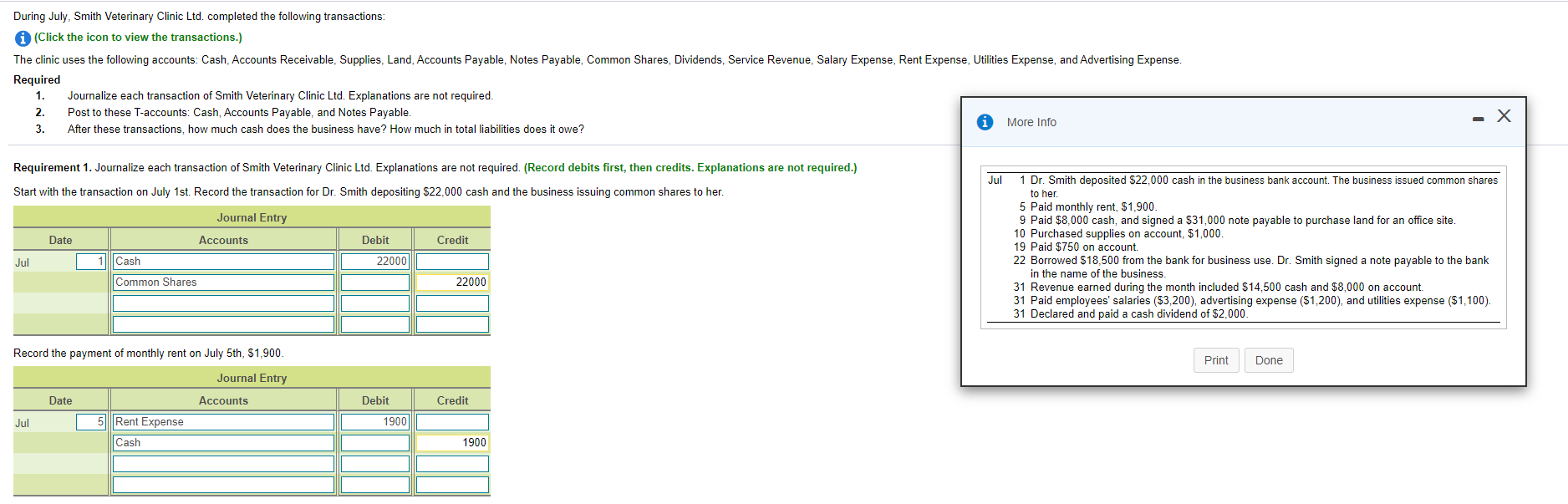

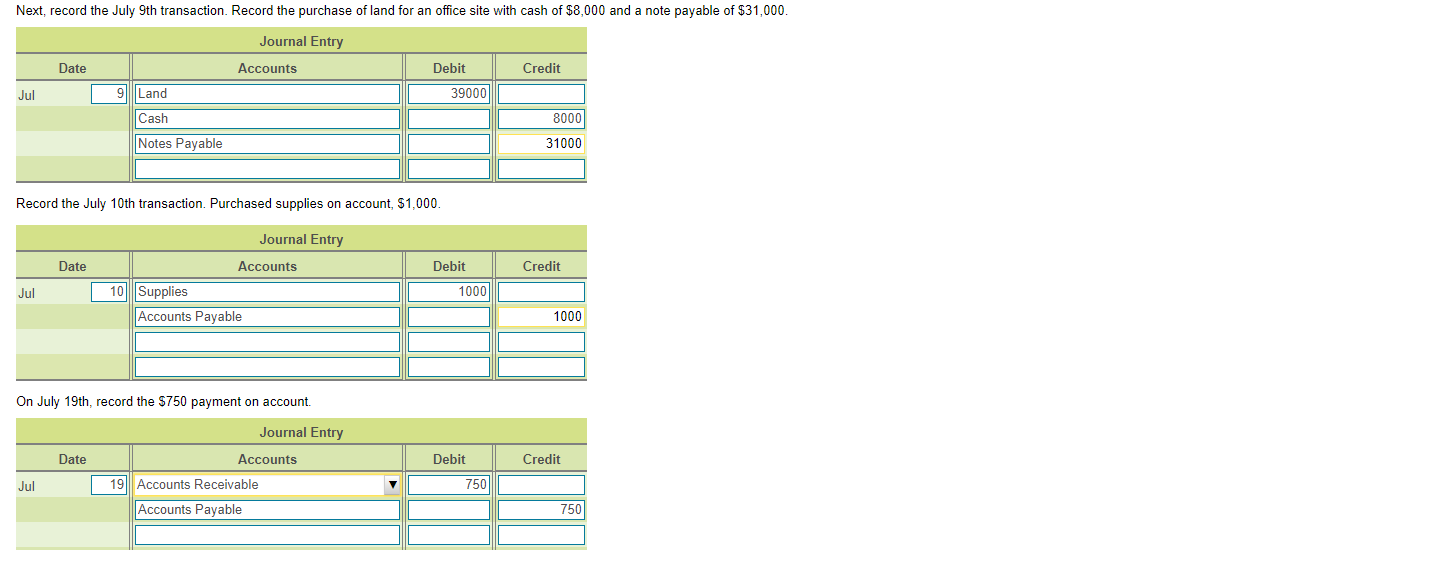

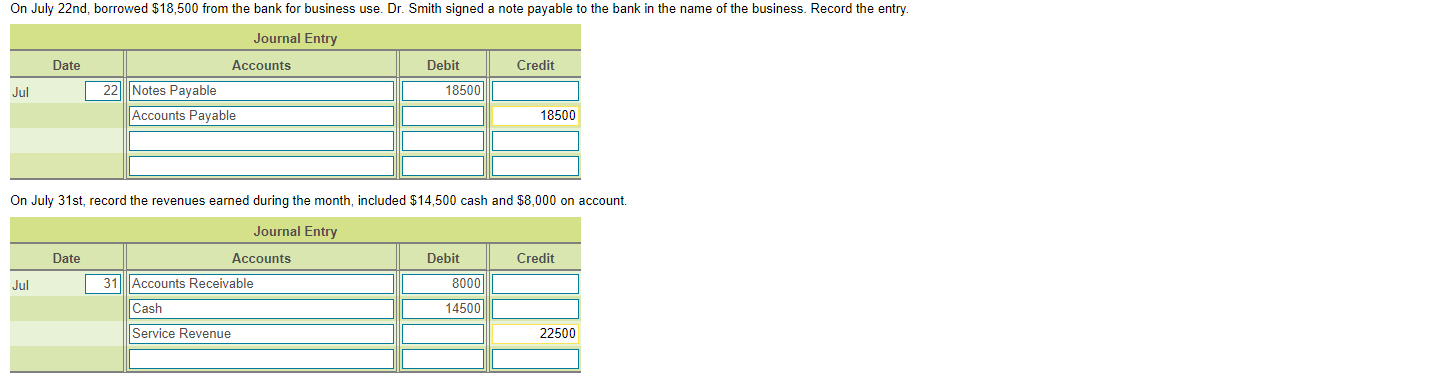

During July, Smith Veterinary Clinic Ltd. completed the following transactions: (Click the icon to view the transactions.) The clinic uses the following accounts: Cash, Accounts Receivable, Supplies, Land, Accounts Payable, Notes Payable, Common Shares, Dividends, Service Revenue, Salary Expense, Rent Expense, Utilities Expense, and Advertising Expense. Required 1. Journalize each transaction of Smith Veterinary Clinic Ltd. Explanations are not required. 2. Post to these T-accounts: Cash, Accounts Payable, and Notes Payable. More Info 3. After these transactions, how much cash does the business have? How much in total liabilities does it owe? - X Requirement 1. Journalize each transaction of Smith Veterinary Clinic Ltd. Explanations are not required. (Record debits first, then credits. Explanations are not required.) Start with the transaction on July 1st. Record the transaction for Dr. Smith depositing $22,000 cash and the business issuing common shares to her. Jul Journal Entry Date Debit Credit 1 Dr. Smith deposited $22,000 cash in the business bank account. The business issued common shares to her. 5 Paid monthly rent, S1,900 9 Paid $8,000 cash, and signed a $31,000 note payable to purchase land for an office site. 10 Purchased supplies on account, $1,000. 19 Paid $750 on account 22 Borrowed 518.500 from the bank for business use. Dr. Smith signed a note payable to the bank in the name of the business. 31 Revenue earned during the month included $14,500 cash and $8,000 on account. 31 Paid employees' salaries ($3,200), advertising expense (51,200), and utilities expense (51,100). 31 Declared and paid a cash dividend of $2,000 Jul Accounts Cash Common Shares 22000 22000 Record the payment of monthly rent on July 5th, $1,900. Print Done Journal Entry Date Accounts Debit Credit Jul 5 Rent Expense 1900 Cash 1900 Next, record the July 9th transaction. Record the purchase of land for an office site with cash of $8,000 and a note payable of $31,000. Journal Entry Date Accounts Debit Credit Jul 39000 9 Land Cash 8000 31000 Notes Payable Record the July 10th transaction. Purchased supplies on account, $1,000 Journal Entry Date Accounts Debit Credit Jul 1000 10|||Supplies Accounts Payable 1000 On July 19th, record the $750 payment on account. Journal Entry Date Accounts Debit Credit Jul 750 19 Accounts Receivable Accounts Payable 750 On July 22nd, borrowed $18,500 from the bank for business use. Dr. Smith signed a note payable to the bank in the name of the business. Record the entry. Journal Entry Date Accounts Debit Credit Jul 22 Notes Payable 18500 Accounts Payable 18500 On July 31st, record the revenues earned during the month, included $14,500 cash and $8,000 on account. Journal Entry Date Accounts Debit Credit Jul 31 || Accounts Receivable 8000 Cash 14500 Service Revenue 22500 On July 31st, paid the following expenses: employees' salaries ($3,200), advertising expense (S1,200), and utilities expense (S1,100). Record the entry. Date Debit Credit Jul 3200 Journal Entry Accounts 31 | Salary Expense Advertising Expense Utilities Expense Accounts Payable 1200 1100 5500 On July 31st, declared and paid a cash dividend of $2,000. Record the entry. Journal Entry Date Accounts Debit Credit Jul 31 Dividends 2000 Cash 2000 Requirement 2. Post to these T-accounts: Cash, Accounts Payable, and Notes Payable. We will begin by posting to the Cash T-account. Enter in the amounts in the same order that you prepared the journal entries. Be sure to enter the ending balance on the appropriate side of the T-account. Leave unused cells blank. (Make sure to use next available cell on the proper side of the T-account when entering the transactions. Leave unused cells blank.) Cash Next, post to the Accounts Payable and Notes Payable T-accounts. Remember to enter the amounts in the same order that you prepared the journal entries and enter the ending balance on the appropriate side of the T-account. Leave unused cells blank. (Make sure to use next available cell on the proper side of the T-account when entering the transactions. Leave unused cells blank.) Accounts Payable Notes Payable Requirement 3. After these transactions, how much cash does the business have? How much in total liabilities does it owe? The company has a cash balance of $ The company owes total liabilities of $