Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During March, the first month of operations, ACME Inc. worked on several different jobs. ACME Inc. applies overhead to jobs using a predetermined overhead

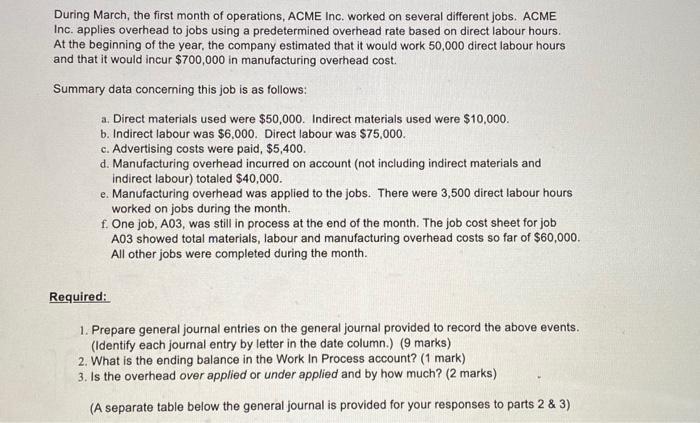

During March, the first month of operations, ACME Inc. worked on several different jobs. ACME Inc. applies overhead to jobs using a predetermined overhead rate based on direct labour hours. At the beginning of the year, the company estimated that it would work 50,000 direct labour hours and that it would incur $700,000 in manufacturing overhead cost. Summary data concerning this job is as follows: a. Direct materials used were $50,000. Indirect materials used were $10,000. b. Indirect labour was $6,000. Direct labour was $75,000. c. Advertising costs were paid, $5,400. d. Manufacturing overhead incurred on account (not including indirect materials and indirect labour) totaled $40,000. e. Manufacturing overhead was applied to the jobs. There were 3,500 direct labour hours worked on jobs during the month. f. One job, A03, was still in process at the end of the month. The job cost sheet for job A03 showed total materials, labour and manufacturing overhead costs so far of $60,000. All other jobs were completed during the month. Required: 1. Prepare general journal entries on the general journal provided to record the above events. (Identify each journal entry by letter in the date column.) (9 marks) 2. What is the ending balance in the Work In Process account? (1 mark). 3. Is the overhead over applied or under applied and by how much? (2 marks) (A separate table below the general journal is provided for your responses to parts 2 & 3)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the general journal entries to record the above events Date Account Title and Explanation D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started