Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During May of 2014, the employees of Pollich Inc earned $740,000 of salary for work performed that month. Pollich Inc withheld $127,000 for income

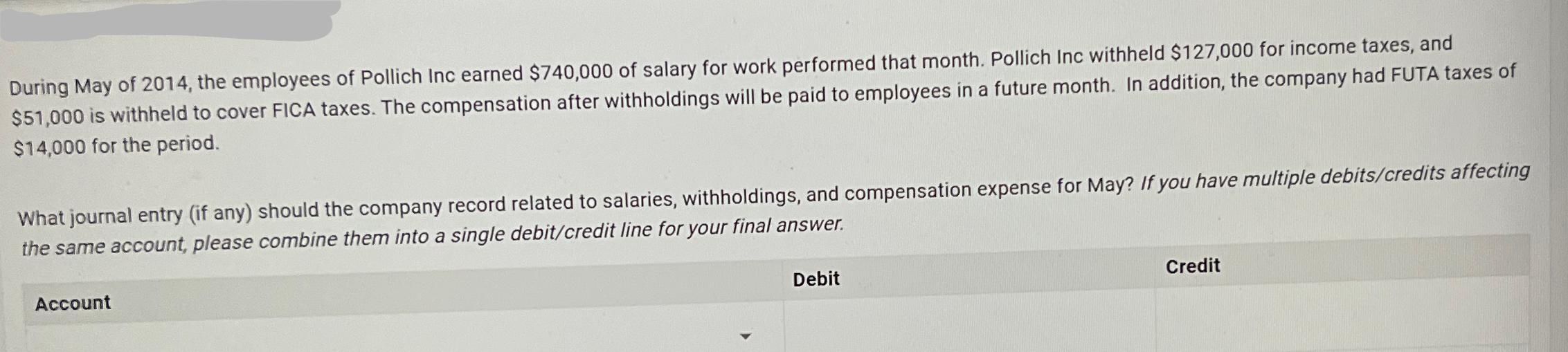

During May of 2014, the employees of Pollich Inc earned $740,000 of salary for work performed that month. Pollich Inc withheld $127,000 for income taxes, and $51,000 is withheld to cover FICA taxes. The compensation after withholdings will be paid to employees in a future month. In addition, the company had FUTA taxes of $14,000 for the period. What journal entry (if any) should the company record related to salaries, withholdings, and compensation expense for May? If you have multiple debits/credits affecting the same account, please combine them into a single debit/credit line for your final answer. Account Debit Credit

Step by Step Solution

★★★★★

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer The journal entry to record the salaries withholdings compensation expense and FUTA taxes fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started