Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During November, Robotics Manufacturing completed the following manufacturing transactions: 1. Purchased raw materials costing $60,000 and manufacturing supplies costing $3,000 on account. (Single Transaction) 2.

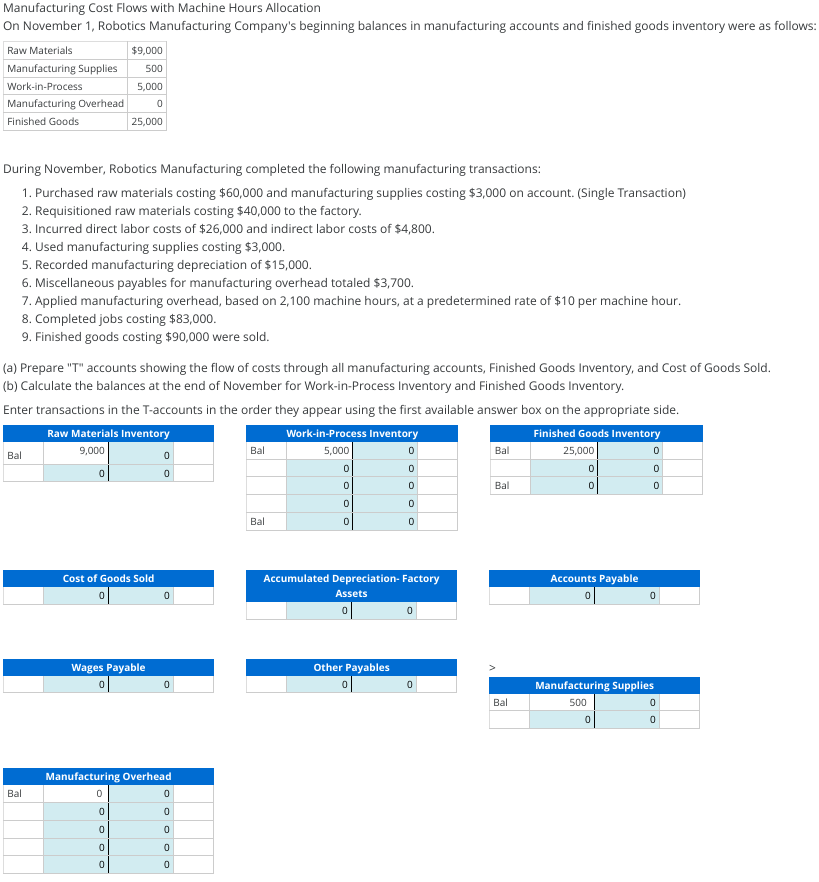

During November, Robotics Manufacturing completed the following manufacturing transactions: 1. Purchased raw materials costing $60,000 and manufacturing supplies costing $3,000 on account. (Single Transaction) 2. Requisitioned raw materials costing $40,000 to the factory. 3. Incurred direct labor costs of $26,000 and indirect labor costs of $4,800. 4. Used manufacturing supplies costing $3,000. 5. Recorded manufacturing depreciation of $15,000. 6. Miscellaneous payables for manufacturing overhead totaled $3,700. 7. Applied manufacturing overhead, based on 2,100 machine hours, at a predetermined rate of $10 per machine hour. 8. Completed jobs costing $83,000. 9. Finished goods costing $90,000 were sold. (a) Prepare "T" accounts showing the flow of costs through all manufacturing accounts, Finished Goods Inventory, and Cost of Goods S (b) Calculate the balances at the end of November for Work-in-Process Inventory and Finished Goods Inventory. Enter transactions in the T-accounts in the order they appear using the first available answer box on the appropriate side

During November, Robotics Manufacturing completed the following manufacturing transactions: 1. Purchased raw materials costing $60,000 and manufacturing supplies costing $3,000 on account. (Single Transaction) 2. Requisitioned raw materials costing $40,000 to the factory. 3. Incurred direct labor costs of $26,000 and indirect labor costs of $4,800. 4. Used manufacturing supplies costing $3,000. 5. Recorded manufacturing depreciation of $15,000. 6. Miscellaneous payables for manufacturing overhead totaled $3,700. 7. Applied manufacturing overhead, based on 2,100 machine hours, at a predetermined rate of $10 per machine hour. 8. Completed jobs costing $83,000. 9. Finished goods costing $90,000 were sold. (a) Prepare "T" accounts showing the flow of costs through all manufacturing accounts, Finished Goods Inventory, and Cost of Goods S (b) Calculate the balances at the end of November for Work-in-Process Inventory and Finished Goods Inventory. Enter transactions in the T-accounts in the order they appear using the first available answer box on the appropriate side Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started