During the 1990s, many large companies began to realize that lack of integration among their information systems was leading to serious operational inefficiencies. Furthermore, these

During the 1990s, many large companies began to realize that lack of integration among their information systems was leading to serious operational inefficiencies. Furthermore, these inefficiencies were beginning to cause many companies to lose ground to other, better-organized firms. At the same time, enterprise resource planning (ERP) software, especially SAP R/3 (http://www.sap.com/), was reaching a high state of maturity as its penetration rate among the Fortune 1000 rose. The decision whether to convert to SAP (or a competing product) was a strategic one for many companies at this time, both because of the high costs and risks of cost overruns (many SAP implementations had failed or been far more costly than expected) and because of the high risks of not implementingintegrated software. This case will allow you to explore the analysis done by one typical company for this decision.

What is ERP software? An ERP system is companywide software that links all operations to a central database. ERP software is organized by module, one for each functional area such as Finance, Accounting, Manufacturing, Payroll, Human Resources, and so on. Each of these modules has a common software design, and it shares information as needed with the central database. While converting old systems to ERP is a massive undertaking, once it is accomplished the firm has one common database, one common definition of business concepts, one central warehouse in which all information resides, and individual modules for each functional area that are compatible but can be upgraded independently. The Situation at Mega Corporation Mega Corporation has for many years been a dominant manufacturer in its industry. As a worldwide firm, it has four main manufacturing sites and sales offices spread across the world. Since most of the growth in the firm occurred in the 1970s and 1980s, before integrated firmwide software was available, few of the company’s information systems can communicate with each other. This lack of information integration is becoming an increasing burden on the firm. Each of the manufacturing sites has its own hardware and software, and none are linked electronically. As a consequence, much of the sharing of information that goes on among the manufacturing sites is done by telephone, fax, or memo. Each of the main sales offices has purchased and developed its own information systems, and these do not communicate with each other or with manufacturing. Again, this forces the sales offices to use telephone and faxes to share data. The accounting department is centralized at headquarters, but its software system does not interface with the others. Much of theirtime is spent manually transferring accounting data from the field into their central system. Purchasing is done by each of the manufacturing sites independently, and since their systems do not communicate, the firm cannot keep track of its purchases from single vendors and thus missesout on many discounts. This is just a sample of the problems that Mega suffers due to a lack of information integration.

As these problems deepened, and the need for some centralized solution became more and more apparent, a conflict arose between the chief information officer (CIO) and the chief financial officer (CFO). The CIO wanted to install an integrated system immediately despite the costs and risks; the CFO wanted to kill any attempt to install this software. Here is a summary of the pros and cons of this decision, as expressed by the two executives.

The Case for ERP

The CIO argued that partial fixes to the company’s current information systems were becoming more expensive and less effective every year. The conversion to ERP was inevitable, so why not do it now? Once the system was up and running, the firm could expect to see lower inventories both of finished goods and raw materials. Finished goods inventories would be lower because Marketing and Manufacturing would be able to share common forecasts; raw materials inventories would be lower because Manufacturing would communicate its needs better to Purchasing, which would not have to maintain large stocks of raw materials to cover unexpected orders. In addition, Purchasing would be able to obtain quantity discounts from more vendors by pooling its orders from the various manufacturing sites. Sales would increase because, with better communication between Marketing and Manufacturing, there would be fewer canceled orders, fewer late shipments, and more satisfied customers. Software maintenance costs would go down because the company would not have to maintain the old, nonintegrated software, much of which existed simply to allow one system to communicate with another. Decision making would also improve with the ERP system, because such basic information as current production costs at the product level would be available for the first time. Finally, once the basic ERP system was in place it would become possible to install more sophisticated software such as a customer-relationship management or CRM system. A CRM system sits on top of the ERP system, using its database to help answer questions such as “Are we making money selling products to our customers in the Northeast?” and “Is our sales force in East Asia fully productive?”

The Case against ERP

The case against ERP was made forcefully by the CFO. ERP hardware and software costs are high and must be paid in full before any benefits come in. ERP systems change almost everyone’s job, so the retraining costs are enormous. Some people will even leave the company rather than retrain on the new systems. No one within the company has any experiencewithERP, so an expensive group of consultants must be hired over many years. Even after the consultants are gone, the company will have to hire a substantial number of highly trained and highly paid systems people to maintain the ERP system. Improved decision making sounds valuable, but it is hard to quantify, and besides, if the company has as much difficulty as some firms have had implementingERP, the “benefits” may well be negative!

The only rational way to develop an understanding of the likely costs and benefits of implementing ERP, and perhaps to settle this argument, is to develop a model. Youhave been asked by the Board to do just that. Your model should be complete in that it accounts for all the possible costs and benefits from both an ERP system and from installing aCRM system on top of the ERP system. The model should be flexible, so that alternative assumptions can easily be tested. It should be robust, in that nonsensical inputs should be rejected. It should also provide insights, so that the Board can use it effectively to decide under what circumstances the ERP/CRM project would make sense. Some of the initial assumptions on which the Board would like the model to be built are described next.

Assumptions

First, the model should cover 20 years, from 2005 – 2024. Second, it should account for changes in sales (and revenues) from the ERP and CRM systems, as well as changes in inventories. Finally, it should include the costs of hardware, software, consultants, permanent employees, training of nonprogramming staff, and maintenance of old systems.

Specific numerical assumptions follow: Without ERP, sales are expected to hold steady at about $100 million per year over the next 20 years. Sales can be expected to grow about 1 percent/year once an ERP system is fully operational, which will take two years. If a CRM system is installed, sales growth will become 2 percent/year. (The CRM system would be installed in year 4 and become operational beginning in year 5.) The company currently spends $5 million per year maintaining its old systems, and this cost will grow by $100,000 per year. All of this maintenance cost will be avoided if an ERP system is installed. ERP hardware will cost $5 million in the first year of installation and $1 million in the second. ERP software will cost $10 million in the first year ofinstallation and $1 million in the second. CRM hardware and software will each cost $1 million in the year of installation (year 4). The CRM installation cannot occur before three years after the ERP installation is begun.

Consultants work 225 days per year.

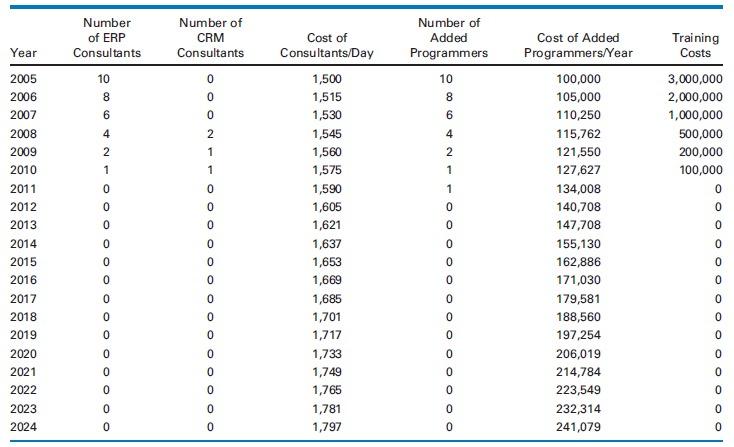

The accompanying table gives: the number of ERP and CRM consultants required, along with their daily rate the number of additional programmers required, as well as their yearly salary the costs of training non programming staff Without ERP, inventory turns over 11 times per year. Thus, the average level of inventory (in dollars) is annual sales divided by 11. With the ERP system, turns are expected to increase to 13. To hold a dollar of finished goods inventory for one year costs $0.50. Variable costs (excluding the costs of inventory) are 75percent of sales revenues. The hurdle rates normally used in the company to evaluate capital investments range from 10 to 15 percent. However, an argument has been made that a significantly higher rate should be used given the risks of this project.

Efficiency gains from ERP systems have varied widely from firm to firm. Some managers within this firm are optimistic and would estimate these gains at $7 million per year. Others are pessimistic and would see a loss of $5 million per year due to cost overruns and unexpectedretraining expenses. Finally, there is a neutral camp that would prefer to assume no efficiency gains or losses fromERP.

Analysis

Using the assumptions already given and whatever additional assumptions you feel are warranted, build a model to project the Net Present Value of the gains from the ERP and CRM decisions. Remember that your model should be complete, flexible, robust, and capable of providing insight.

Establish a base case. Perform what-if analysis. Over what ranges for critical parameters does the project look attractive? Which assumptions appear to be especially critical in determining the gains from ERP? Where are the breakeven values for critical parameters at which the project changes from attractive to unattractive?

Synthesize what you have learned from this analysis into a short PowerPoint presentation to the Board. Your presentation should use graphical means wherever possible to convey your insights. Do not repeat anything the Board already knows—get right to the point.

Refer to the ERP Decision case. From the corresponding exercise in Chapter 3, review the design of a spreadsheet that will assist the Board in understanding the likely costs and benefits of implementing ERP.

a. Develop a base case. You may create any data you need for this purpose.Why is this base case appropriate for this situation?

b. How sensitive are the benefits of ERP in the base case to the efficiency gains?

c. Break the total benefits down into the contribution from efficiency gains, inventory turns, and CRM.

Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Number of ERP Consultants 10 8 6 42 1 0 0 0 0 0 0 0 0 0 0 0 0 0 Number of CRM Consultants 0 NOO 0 2 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 Cost of Consultants/Day 1,500 1,515 1,530 1,545 1,560 1,575 1,590 1,605 1,621 1,637 1,653 1,669 1,685 1,701 1,717 1,733 1,749 1,765 1,781 1,797 Number of Added Programmers 10 0 0 0 0 0 0 0 0 0 0 - - NAD 00 8 4 0 Cost of Added Programmers/Year 100,000 105,000 110,250 115,762 121,550 127,627 134,008 140,708 147,708 155,130 162,886 171,030 179,581 188,560 197,254 206,019 214,784 223,549 232,314 241,079 Training Costs 3,000,000 2,000,000 1,000,000 500,000 200,000 100,000 0 0 0 0 0 0 0 0 0 0 0 0 0

Step by Step Solution

3.41 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

a Develop a base case You may create any data you need for this purposeWhy is this base case appropr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started