Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the annual budget preparation TechnoBrix Industries created a cash budget for the winter months (January, February, March). The company has a line of

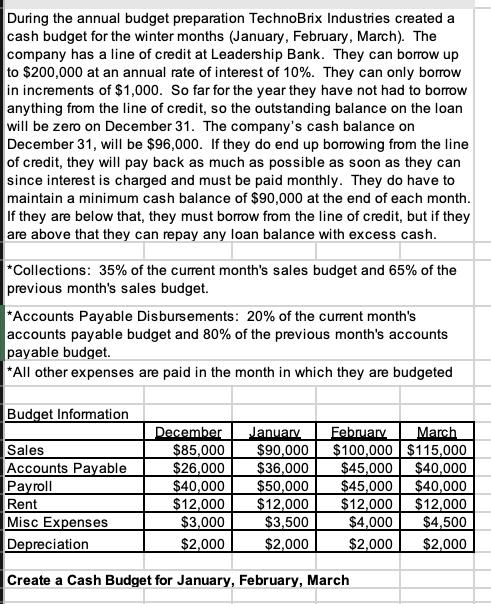

During the annual budget preparation TechnoBrix Industries created a cash budget for the winter months (January, February, March). The company has a line of credit at Leadership Bank. They can borrow up to $200,000 at an annual rate of interest of 10%. They can only borrow in increments of $1,000. So far for the year they have not had to borrow anything from the line of credit, so the outstanding balance on the loan will be zero on December 31. The company's cash balance on December 31, will be $96,000. If they do end up borrowing from the line of credit, they will pay back as much as possible as soon as they can since interest is charged and must be paid monthly. They do have to maintain a minimum cash balance of $90,000 at the end of each month. If they are below that, they must borrow from the line of credit, but if they are above that they can repay any loan balance with excess cash. *Collections: 35% of the current month's sales budget and 65% of the previous month's sales budget. *Accounts Payable Disbursements: 20% of the current month's accounts payable budget and 80% of the previous month's accounts payable budget. *All other expenses are paid in the month in which they are budgeted Budget Information December January February March Sales $85,000 $90,000 $100,000 $115,000 Accounts Payable $26,000 $36,000 $45,000 $40,000 Payroll $40,000 $50,000 $45,000 $40,000 Rent $12,000 $12,000 $12,000 $12,000 Misc Expenses $3,000 $3,500 $4,000 $4,500 Depreciation $2,000 $2,000 $2,000 $2,000 Create a Cash Budget for January, February, March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started