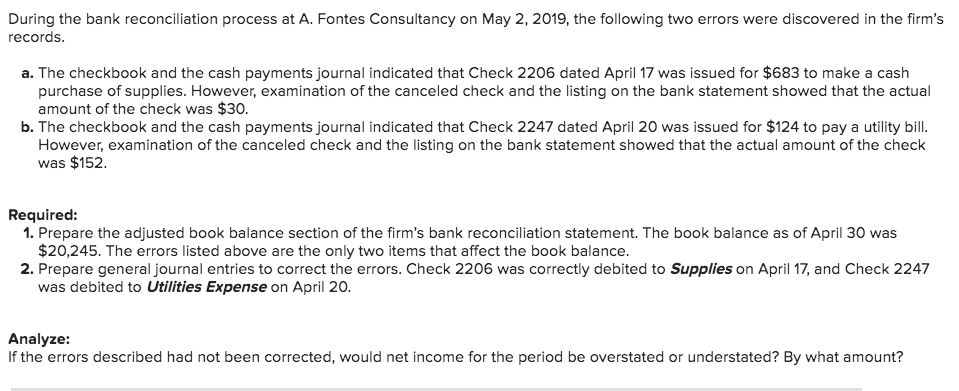

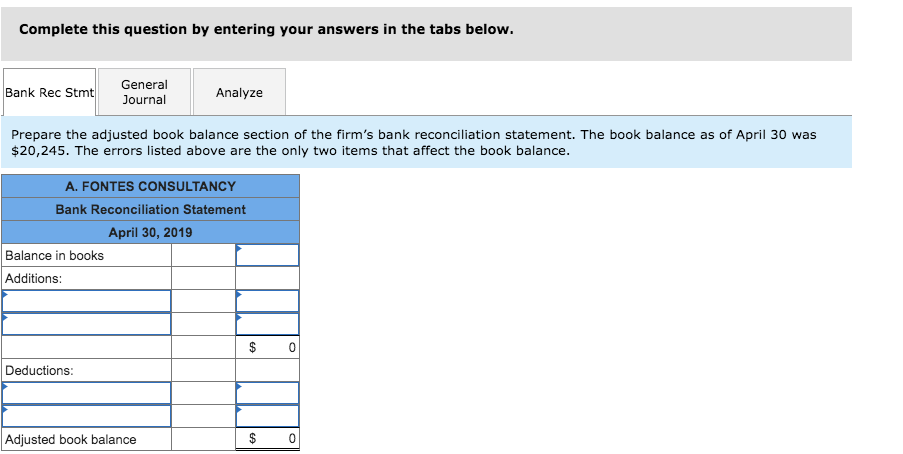

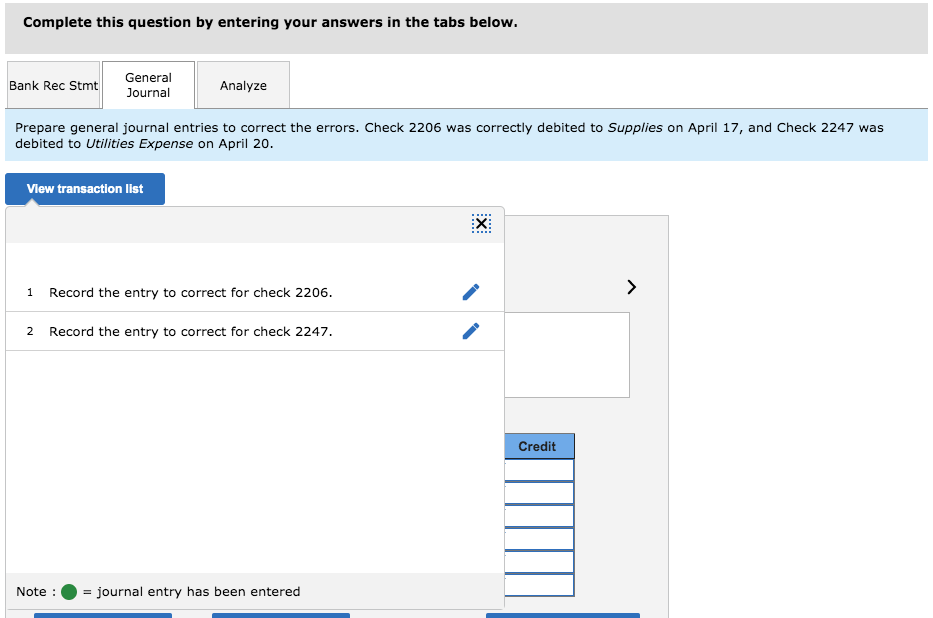

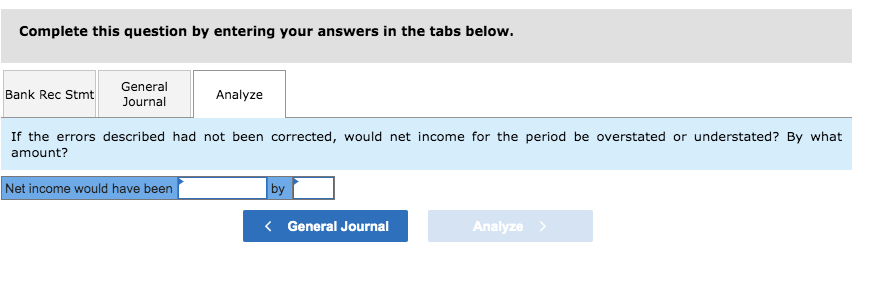

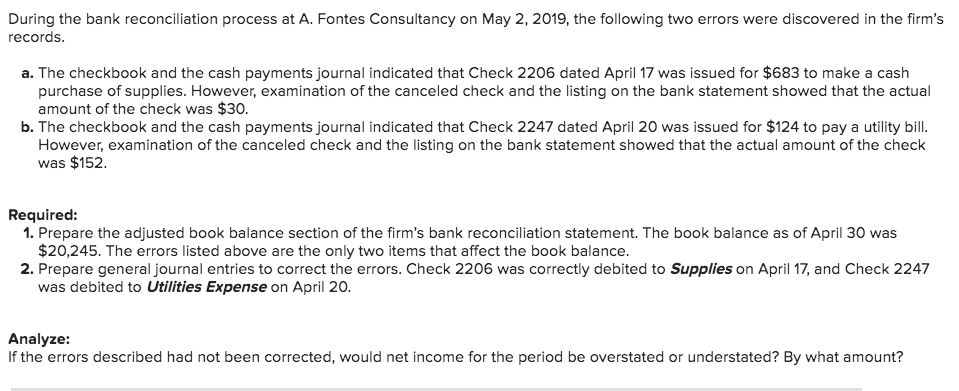

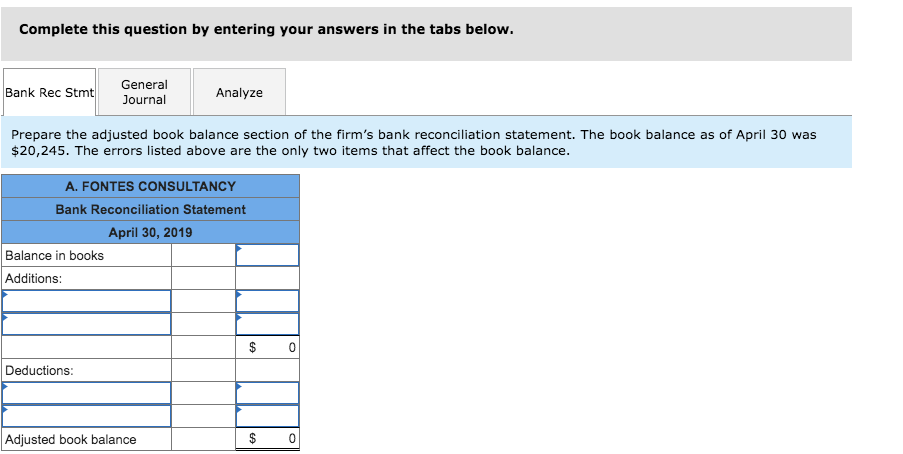

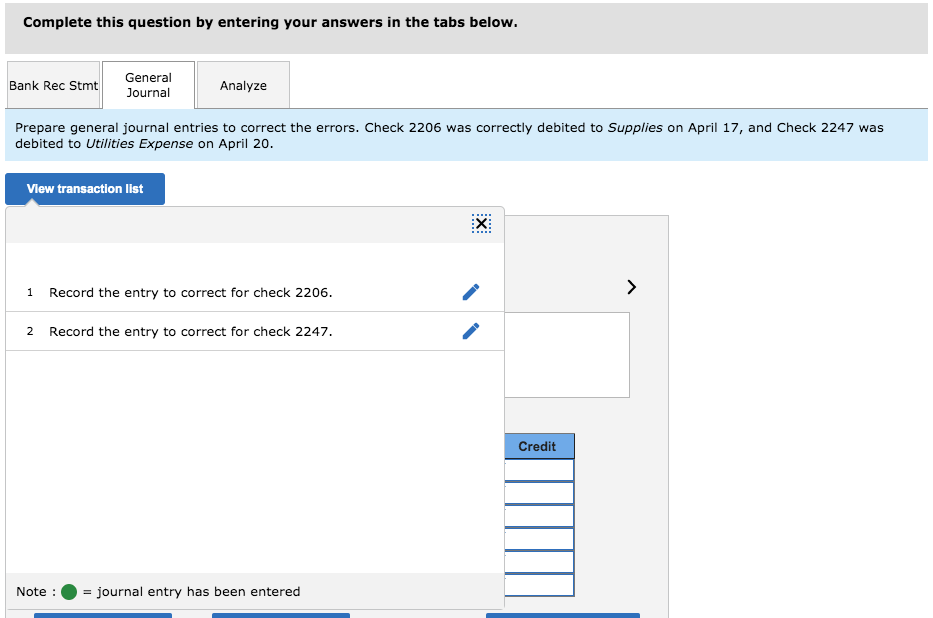

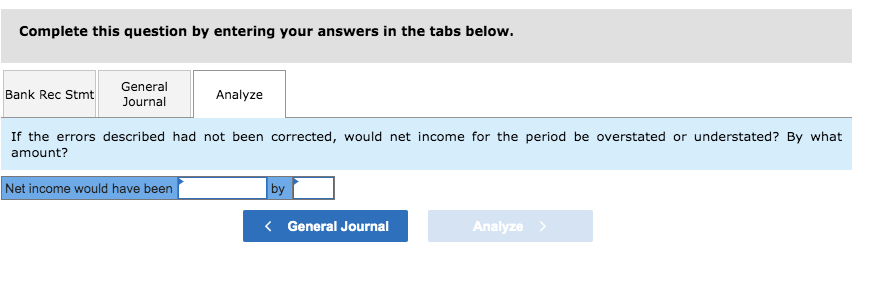

During the bank reconciliation process at A. Fontes Consultancy on May 2, 2019, the following two errors were discovered in the firm's records. a. The checkbook and the cash payments journal indicated that Check 2206 dated April 17 was issued for $683 to make a cash purchase of supplies. However, examination of the canceled check and the listing on the bank statement showed that the actual amount of the check was $30. b. The checkbook and the cash payments journal indicated that Check 2247 dated April 20 was issued for $124 to pay a utility bill. However, examination of the canceled check and the listing on the bank statement showed that the actual amount of the check was $152. Required: 1. Prepare the adjusted book balance section of the firm's bank reconciliation statement. The book balance as of April 30 was $20,245. The errors listed above are the only two items that affect the book balance. 2. Prepare general journal entries to correct the errors. Check 2206 was correctly debited to Supplies on April 17, and Check 2247 was debited to Utilities Expense on April 20. Analyze: If the errors described had not been corrected, would net income for the period be overstated or understated? By what amount? Complete this question by entering your answers in the tabs below. Bank Rec Stmt General Journal Analyze Prepare the adjusted book balance section of the firm's bank reconciliation statement. The book balance as of April 30 was $20,245. The errors listed above are the only two items that affect the book balance. A. FONTES CONSULTANCY Bank Reconciliation Statement April 30, 2019 Balance in books Additions: $ 0 Deductions: Adjusted book balance $ 0 Complete this question by entering your answers in the tabs below. Bank Rec Stmt General Journal Analyze Prepare general journal entries to correct the errors. Check 2206 was correctly debited to Supplies on April 17, and Check 2247 was debited to Utilities Expense on April 20. View transaction list X: 1 Record the entry to correct for check 2206. > 2 Record the entry to correct for check 2247. Credit Note : = journal entry has been entered Complete this question by entering your answers in the tabs below. Bank Rec Stmt General Journal Analyze If the errors described had not been corrected, would net income for the period be overstated or understated? By what amount? Net income would have been by