During the current financial year, Angela relocated from Melbourne to Perth and as such sold a number of her assets prior to moving. Details

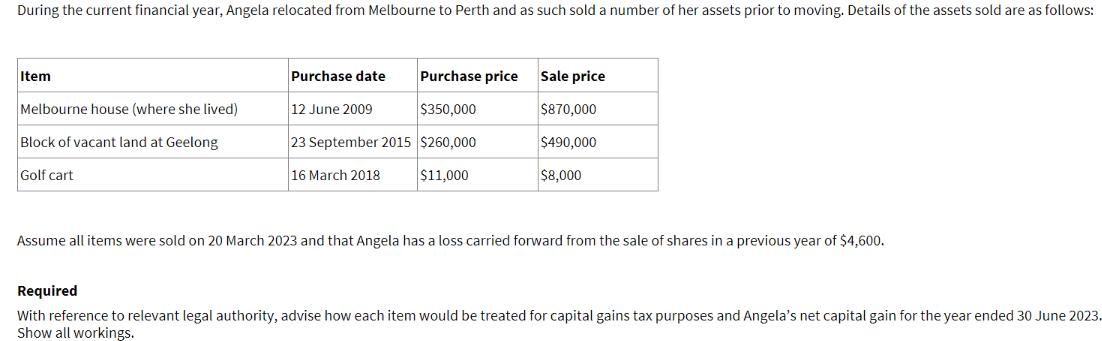

During the current financial year, Angela relocated from Melbourne to Perth and as such sold a number of her assets prior to moving. Details of the assets sold are as follows: Item Melbourne house (where she lived) Block of vacant land at Geelong Golf cart Purchase price $350,000 23 September 2015 $260,000 16 March 2018 $11,000 Purchase date 12 June 2009 Sale price $870,000 $490,000 $8,000 Assume all items were sold on 20 March 2023 and that Angela has a loss carried forward from the sale of shares in a previous year of $4,600. Required With reference to relevant legal authority, advise how each item would be treated for capital gains tax purposes and Angela's net capital gain for the year ended 30 June 2023. Show all workings.

Step by Step Solution

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Angelas capital gains tax CGT for the financial year ending 30 June 2023 we need to det...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started