Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, Ben worked 1,500 hours as a tax consultant and 500 hours as a real estate agent. His one other employee (his

During the current year, Ben worked 1,500 hours as a tax consultant and 500 hours as a real estate agent. His one other employee (his wife) worked 350 hours in the real estate business. Ben eamed $60,000 as a tax consultant, and together the couple lost $18,000 in the real estate business.

How should Ben treat the loss on his federal income tax return?

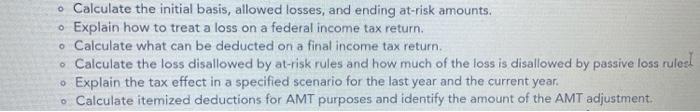

Instructions:

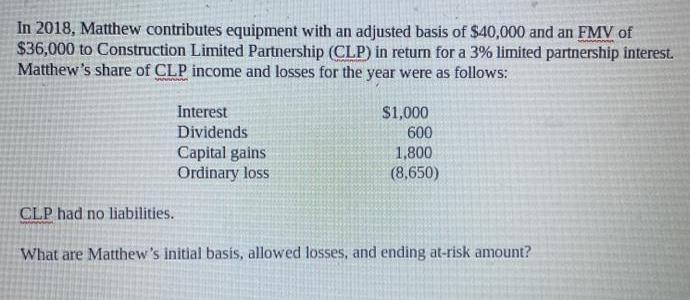

In 2018, Matthew contributes equipment with an adjusted basis of $40,000 and an FMV of $36,000 to Construction Limited Partnership (CLP) in return for a 3% limited partnership interest. Matthew's share of CLP income and losses for the year were as follows: Interest Dividends Capital gains Ordinary loss $1,000 600 1,800 (8,650) CLP had no liabilities. What are Matthew's initial basis, allowed losses, and ending at-risk amount?

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Matthews Initial Basis Matthews initial basis in the limited partnership interest is determined by the adjusted basis of the contributed equipment In this case the adjusted basis is 40000 Therefore Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started