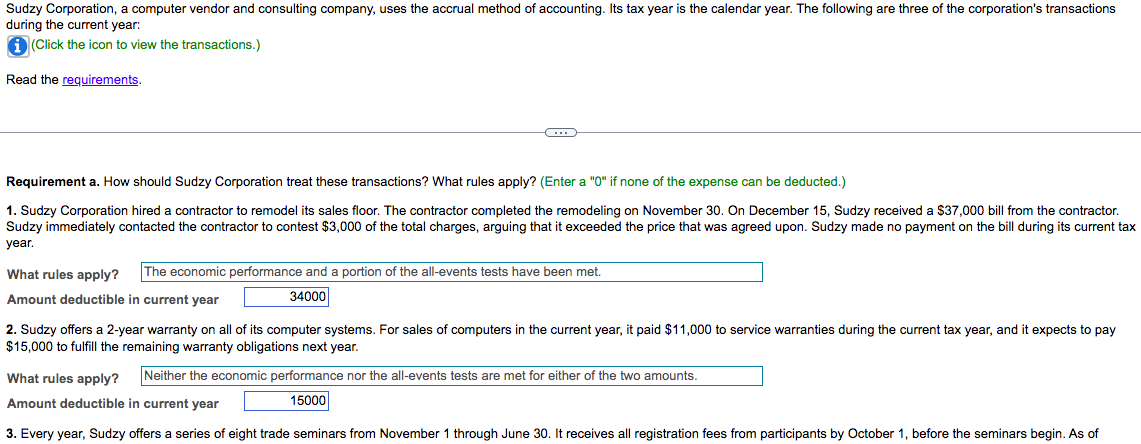

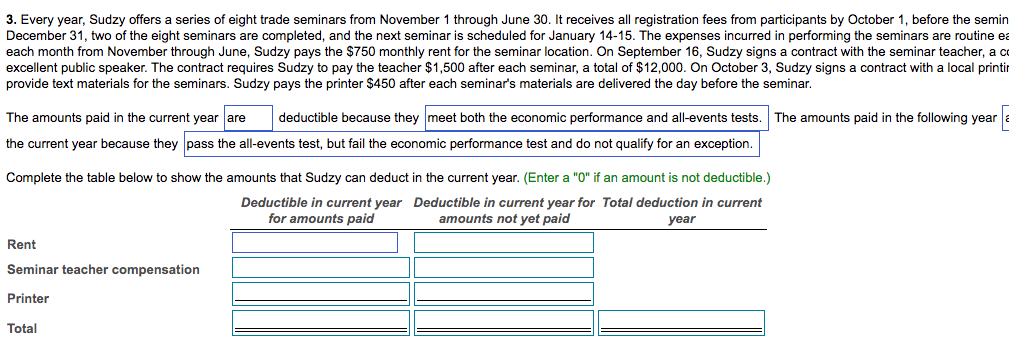

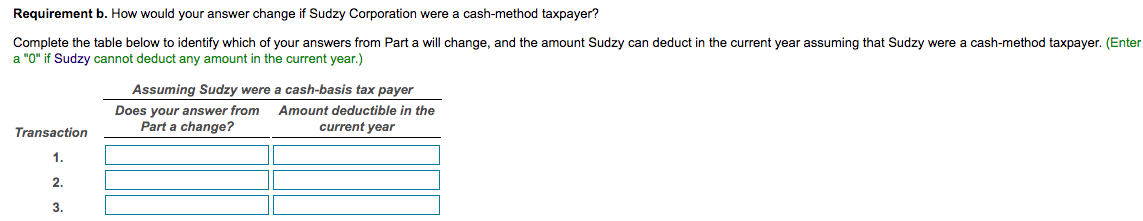

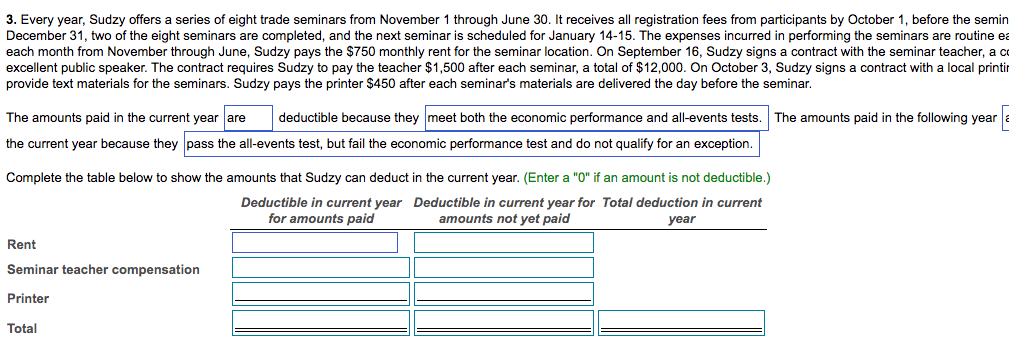

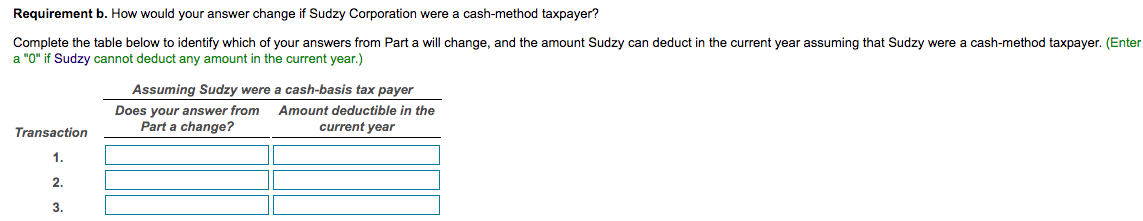

during the current year: (Click the icon to view the transactions.) Read the requirements. Requirement a. How should Sudzy Corporation treat these transactions? What rules apply? (Enter a "0" if none of the expense can be deducted.) year. What rules apply? The economic performance and a portion of the all-events tests have been met. Amount deductible in current year $15,000 to fulfill the remaining warranty obligations next year. What rules apply? Neither the economic performance nor the all-events tests are met for either of the two amounts. Amount deductible in current year 3. Every year, Sudzy offers a series of eight trade seminars from November 1 through June 30 . It receives all registration fees from participants by October 1 , before the semir December 31 , two of the eight seminars are completed, and the next seminar is scheduled for January 14-15. The expenses incurred in performing the seminars are routine e each month from November through June, Sudzy pays the $750 monthly rent for the seminar location. On September 16 , Sudzy signs a contract with the seminar teacher, a c excellent public speaker. The contract requires Sudzy to pay the teacher $1,500 after each seminar, a total of $12,000. On October 3 , Sudzy signs a contract with a local printi provide text materials for the seminars. Sudzy pays the printer $450 after each seminar's materials are delivered the day before the seminar. The amounts paid in the current year deductible because they the current year because they pass the all-events test, but fail the economic performance test and do not qualify for an exception. Requirement b. How would your answer change if Sudzy Corporation were a cash-method taxpayer? a "0" if Sudzy cannot deduct any amount in the current year.) during the current year: (Click the icon to view the transactions.) Read the requirements. Requirement a. How should Sudzy Corporation treat these transactions? What rules apply? (Enter a "0" if none of the expense can be deducted.) year. What rules apply? The economic performance and a portion of the all-events tests have been met. Amount deductible in current year $15,000 to fulfill the remaining warranty obligations next year. What rules apply? Neither the economic performance nor the all-events tests are met for either of the two amounts. Amount deductible in current year 3. Every year, Sudzy offers a series of eight trade seminars from November 1 through June 30 . It receives all registration fees from participants by October 1 , before the semir December 31 , two of the eight seminars are completed, and the next seminar is scheduled for January 14-15. The expenses incurred in performing the seminars are routine e each month from November through June, Sudzy pays the $750 monthly rent for the seminar location. On September 16 , Sudzy signs a contract with the seminar teacher, a c excellent public speaker. The contract requires Sudzy to pay the teacher $1,500 after each seminar, a total of $12,000. On October 3 , Sudzy signs a contract with a local printi provide text materials for the seminars. Sudzy pays the printer $450 after each seminar's materials are delivered the day before the seminar. The amounts paid in the current year deductible because they the current year because they pass the all-events test, but fail the economic performance test and do not qualify for an exception. Requirement b. How would your answer change if Sudzy Corporation were a cash-method taxpayer? a "0" if Sudzy cannot deduct any amount in the current year.)