Question

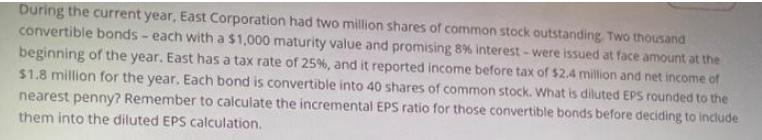

During the current year, East Corporation had two million shares of common stock outstanding, Two thousand convertible bonds - each with a $1,000 maturity

During the current year, East Corporation had two million shares of common stock outstanding, Two thousand convertible bonds - each with a $1,000 maturity value and promising 8% interest - were issued at face amount at the beginning of the year. East has a tax rate of 25%, and it reported income before tax of $2.4 million and net income of $1.8 million for the year. Each bond is convertible into 40 shares of common stock. What is diluted EPS rounded to the nearest penny? Remember to calculate the incremental EPS ratio for those convertible bonds before deciding to include them into the diluted EPS calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the diluted earnings per share EPS and determine whether the convertible bonds should b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App