Answered step by step

Verified Expert Solution

Question

1 Approved Answer

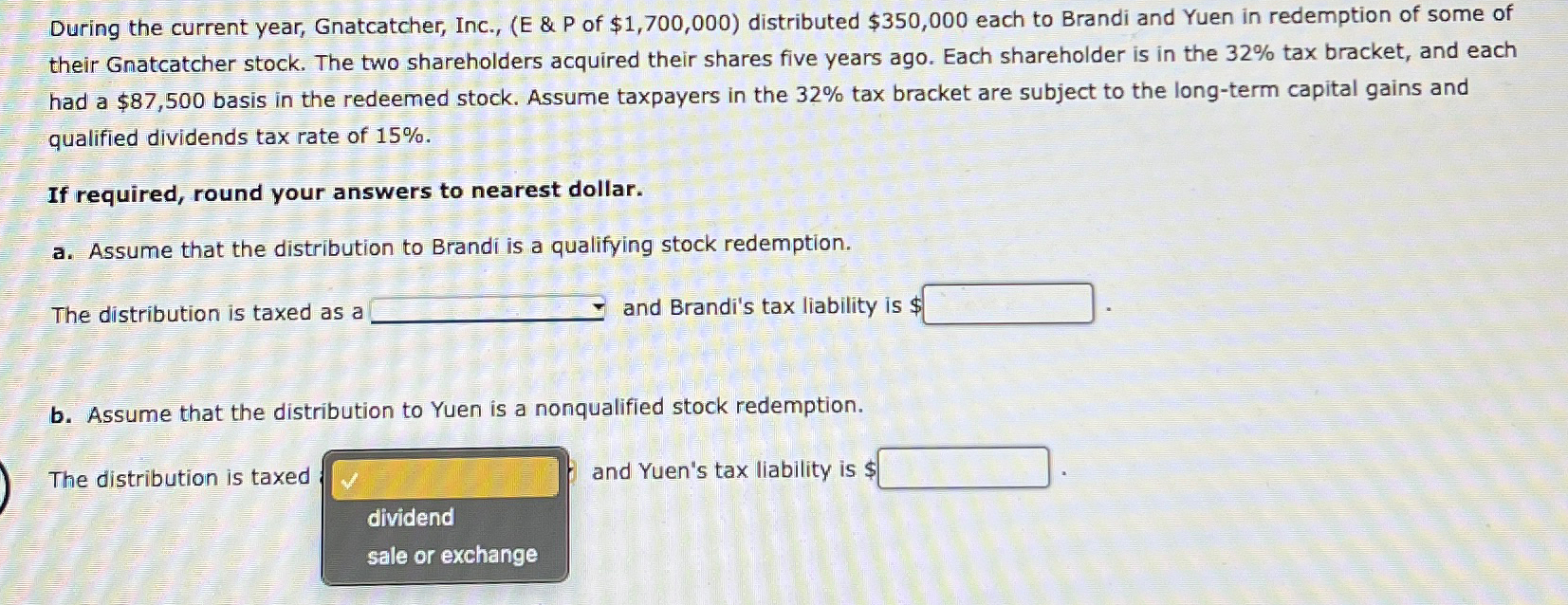

During the current year, Gnatcatcher, Inc., ( E & P of $ 1 , 7 0 0 , 0 0 0 ) distributed $ 3

During the current year, Gnatcatcher, Inc., E & P of $ distributed $ each to Brandi and Yuen in redemption of some of their Gnatcatcher stock. The two shareholders acquired their shares five years ago. Each shareholder is in the tax bracket, and each had a $ basis in the redeemed stock. Assume taxpayers in the tax bracket are subject to the longterm capital gains and qualified dividends tax rate of

If required, round your answers to nearest dollar.

a Assume that the distribution to Brandi is a qualifying stock redemption.

The distribution is taxed as a and Brandi's tax liability is $

b Assume that the distribution to Yuen is a nonqualified stock redemption.

The distribution is taxed : and Yuen's tax liability is $

dividend

sale or exchange

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started