Question

During the current year, Jack and Mary Bronson paid the following taxes: Taxes on residence (for period January 1 to September 30 of the

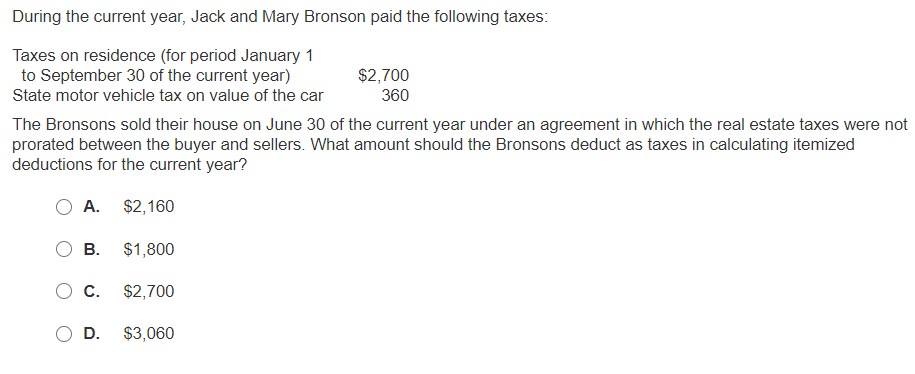

During the current year, Jack and Mary Bronson paid the following taxes: Taxes on residence (for period January 1 to September 30 of the current year) $2,700 360 State motor vehicle tax on value of the car The Bronsons sold their house on June 30 of the current year under an agreement in which the real estate taxes were not prorated between the buyer and sellers. What amount should the Bronsons deduct as taxes in calculating itemized deductions for the current year? A. $2,160 B. $1,800 C. $2,700 D. $3,060

Step by Step Solution

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ie 2160 Tax upto september 27...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App