Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, Janet Jones realizes capital gains from her investment portfolio, with total taxable capital gains of $7,200. However, she realizes allowable capital

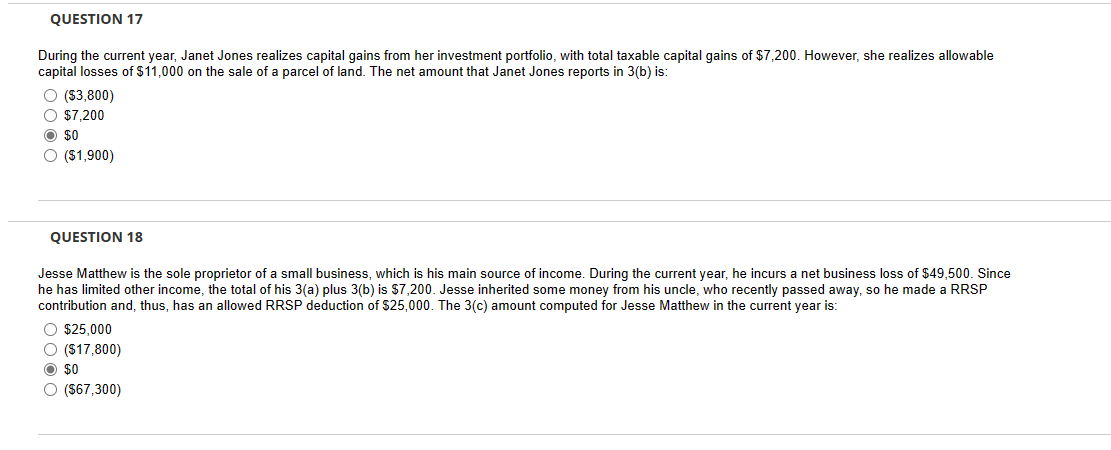

During the current year, Janet Jones realizes capital gains from her investment portfolio, with total taxable capital gains of $7,200. However, she realizes allowable capital losses of $11,000 on the sale of a parcel of land. The net amount that Janet Jones reports in 3(b) is: ($3,800) $7,200 $0 ($1,900) QUESTION 18 Jesse Matthew is the sole proprietor of a small business, which is his main source of income. During the current year, he incurs a net business loss of $49,500. Since he has limited other income, the total of his 3(a) plus 3(b) is $7,200. Jesse inherited some money from his uncle, who recently passed away, so he made a RRSP contribution and, thus, has an allowed RRSP deduction of $25,000. The 3(c) amount computed for Jesse Matthew in the current year is: $25,000($17,800)$0($67,300)

During the current year, Janet Jones realizes capital gains from her investment portfolio, with total taxable capital gains of $7,200. However, she realizes allowable capital losses of $11,000 on the sale of a parcel of land. The net amount that Janet Jones reports in 3(b) is: ($3,800) $7,200 $0 ($1,900) QUESTION 18 Jesse Matthew is the sole proprietor of a small business, which is his main source of income. During the current year, he incurs a net business loss of $49,500. Since he has limited other income, the total of his 3(a) plus 3(b) is $7,200. Jesse inherited some money from his uncle, who recently passed away, so he made a RRSP contribution and, thus, has an allowed RRSP deduction of $25,000. The 3(c) amount computed for Jesse Matthew in the current year is: $25,000($17,800)$0($67,300) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started