Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, Jessica, Ed and Terri form the JET ( JET ) Corporation. Jessica contributes land having a $ 4 5 , 0

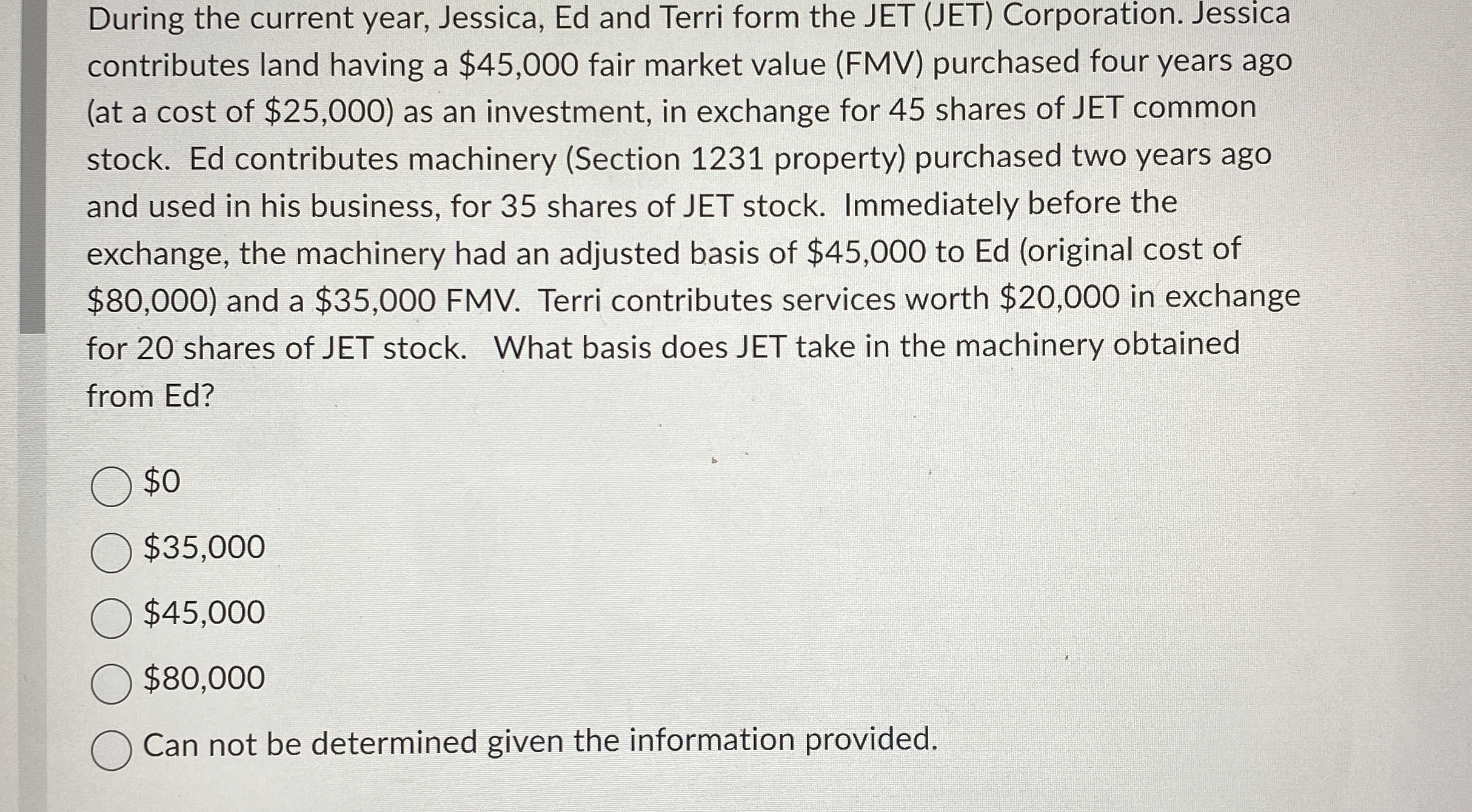

During the current year, Jessica, Ed and Terri form the JET JET Corporation. Jessica contributes land having a $ fair market value FMV purchased four years ago at a cost of $ as an investment, in exchange for shares of JET common stock. Ed contributes machinery Section property purchased two years ago and used in his business, for shares of JET stock. Immediately before the exchange, the machinery had an adjusted basis of $ to Ed original cost of $ and a $ FMV Terri contributes services worth $ in exchange for shares of JET stock. What basis does JET take in the machinery obtained from Ed

$

$

$

$

Can not be determined given the information provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started