Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, Mark sells a tract of land for $550,000. The property was received as a gift from Marva on March 10,

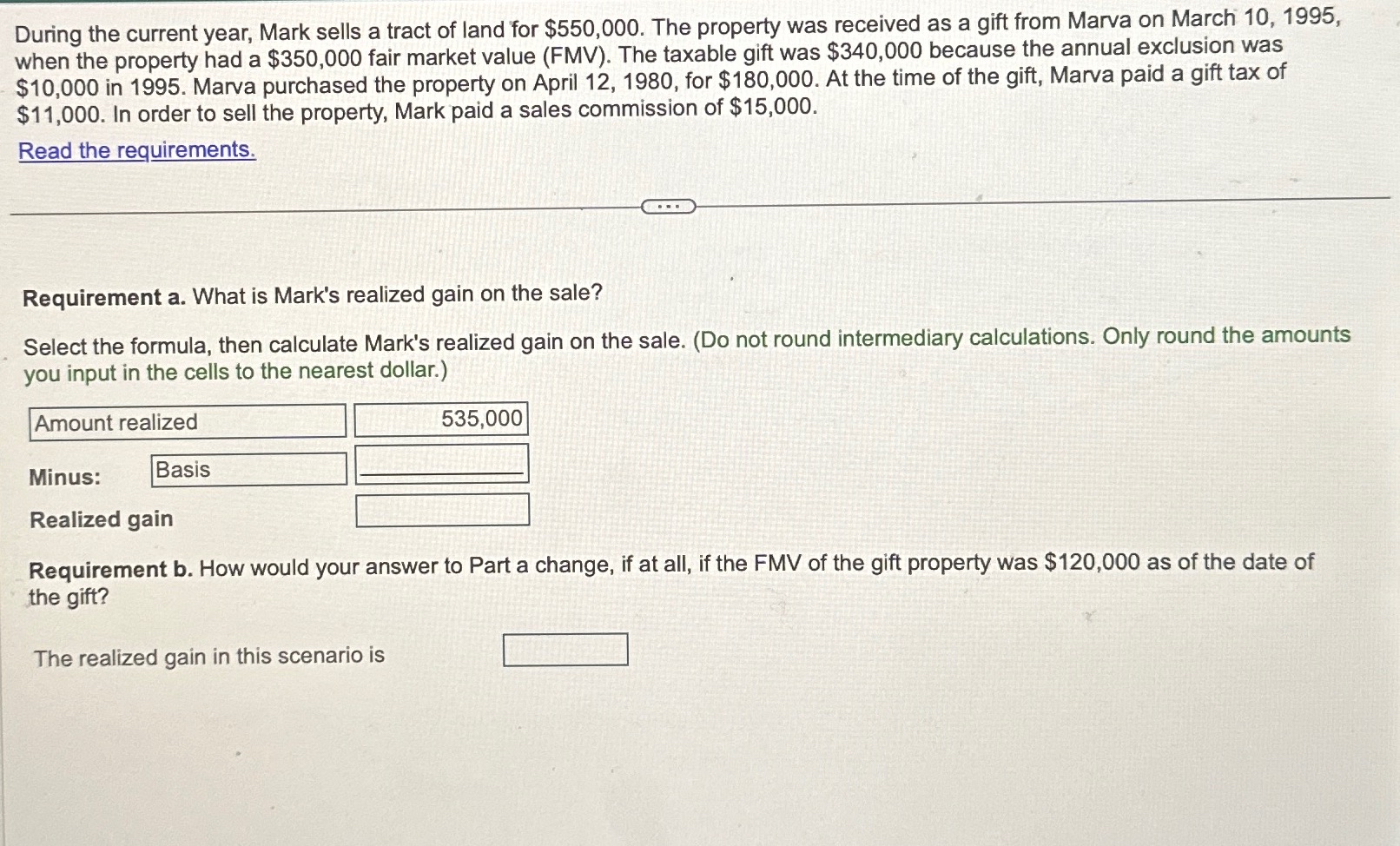

During the current year, Mark sells a tract of land for $550,000. The property was received as a gift from Marva on March 10, 1995, when the property had a $350,000 fair market value (FMV). The taxable gift was $340,000 because the annual exclusion was $10,000 in 1995. Marva purchased the property on April 12, 1980, for $180,000. At the time of the gift, Marva paid a gift tax of $11,000. In order to sell the property, Mark paid a sales commission of $15,000. Read the requirements. Requirement a. What is Mark's realized gain on the sale? Select the formula, then calculate Mark's realized gain on the sale. (Do not round intermediary calculations. Only round the amounts you input in the cells to the nearest dollar.) Amount realized Minus: Basis Realized gain 535,000 Requirement b. How would your answer to Part a change, if at all, if the FMV of the gift property was $120,000 as of the date of the gift? The realized gain in this scenario is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement a To calculate Marks realized gain on the sale we need to de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6643108431cd0_952622.pdf

180 KBs PDF File

6643108431cd0_952622.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started