Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, the City of Plattsburgh recorded the following transactions related to its property taxes: Levied property taxes of $6,730,000, of which 2

During the current year, the City of Plattsburgh recorded the following transactions related to its property taxes:

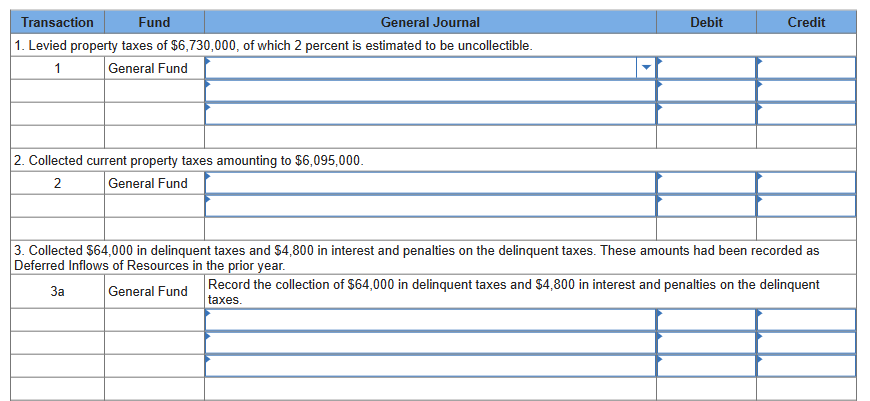

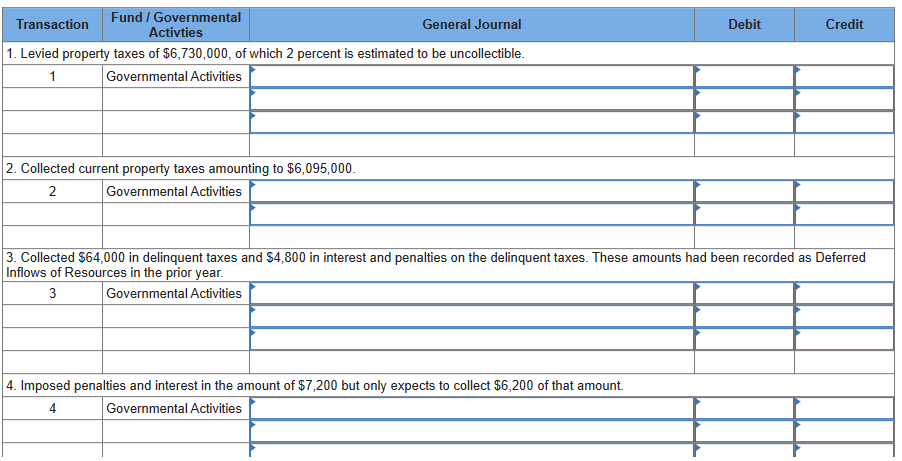

- Levied property taxes of $6,730,000, of which 2 percent is estimated to be uncollectible.

- Collected current property taxes amounting to $6,095,000.

- Collected $64,000 in delinquent taxes and $4,800 in interest and penalties on the delinquent taxes. These amounts had been recorded as Deferred Inflows of Resources in the prior year.

- Imposed penalties and interest in the amount of $7,200 but only expects to collect $6,200 of that amount.

- Reclassified uncollected taxes and interest and penalties as delinquent. These amounts are not expected to be collected within the first 60 days of the following fiscal year.

Required

- Prepare journal entries to record the property tax transactions in the General Fund.

- Prepare journal entries to record the property tax transactions in the governmental activities journal.

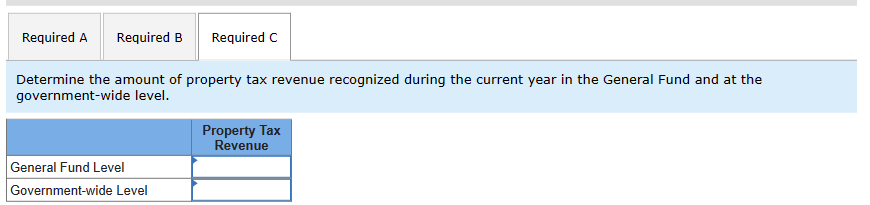

- Determine the amount of property tax revenue recognized during the current year in the General Fund and at the government-wide level.

Options in drop down box:

- Allowance for Uncollectible Current Taxes

- Allowance for Uncollectible Delinquent Taxes

- Allowance for Uncollectible Interest and Penalties

- Appropriations

- Budgetary Fund Balance

- Cash

- Deferred Inflows of ResourcesUnavailable Revenues

- Due from State Government

- Due to Federal Government

- Due to State Government

- Encumbrances

- Encumbrances Outstanding

- Estimated Revenues

- Expenditures

- ExpensesGeneral Government

- ExpensesPublic Safety

- Fund BalanceNonspendableInterfund Loans Receivable

- Fund BalanceNonspendableInventory of Supplies

- Fund BalanceUnassigned

- General RevenuesInterest and Penalities on Delinquent Taxes

- General RevenuesMiscellaneous

- General RevenuesProperty taxes

- Interest and Penalties Receivable on Taxes

- Interfund Loans PayableCurrent

- Interfund Loans PayableNoncurrent

- Interfund Loans ReceivableCurrent

- Interfund Loans ReceivableNoncurrent

- Inventory of Supplies

- Other Financing Sources

- Other Financing Uses

- Program RevenuesGeneral Government

- Program RevenuesPublic Safety

- Revenues

- Tax Anticipation Notes Payable

- Taxes ReceivableCurrent

- Taxes ReceivableDelinquent

- Vouchers Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started