Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the December 31, 2023 Financial Statement Audit, the company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred

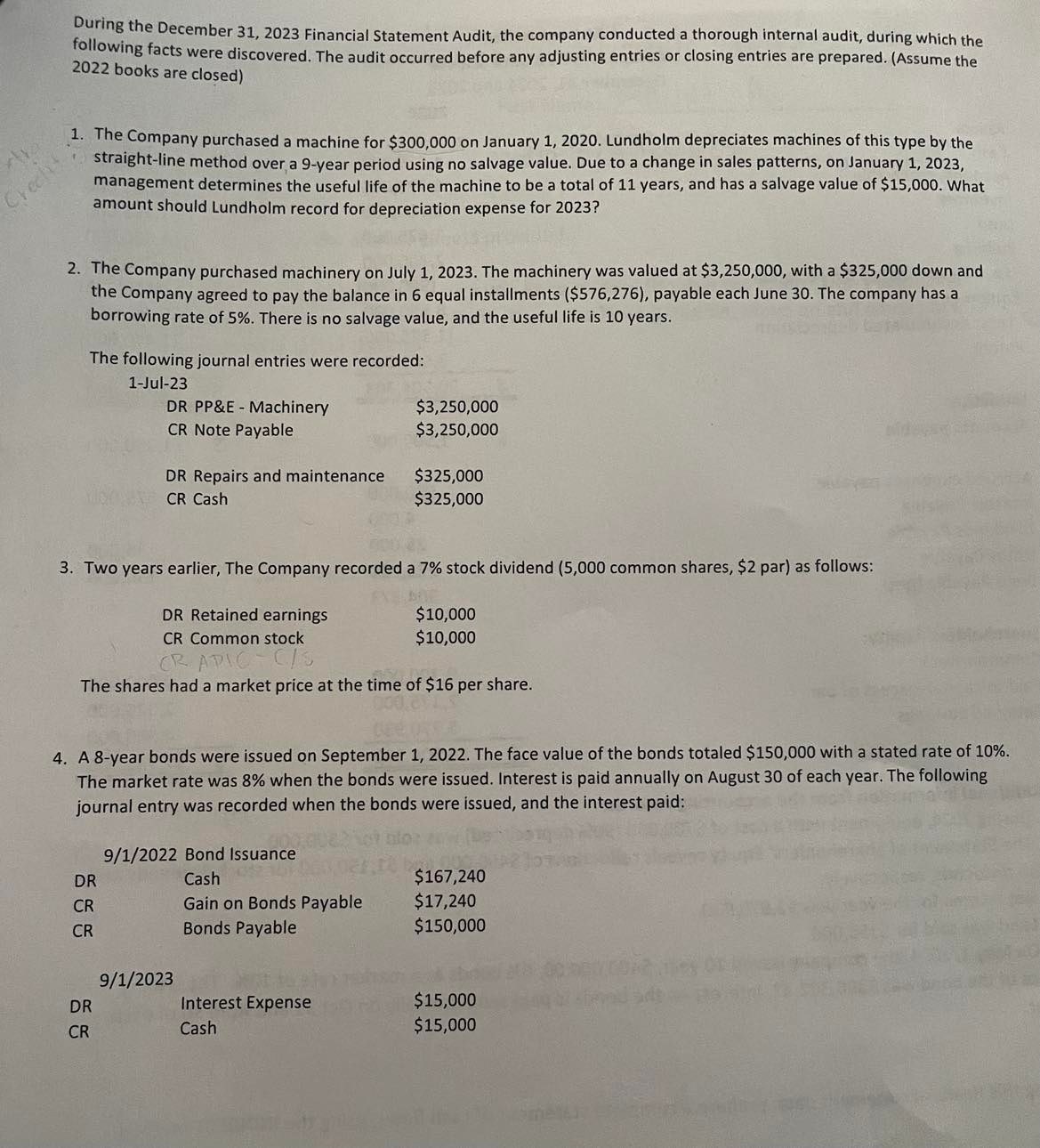

During the December 31, 2023 Financial Statement Audit, the company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred before any adjusting entries or closing entries are prepared. (Assume the 2022 books are closed) 1. The Company purchased a machine for $300,000 on January 1,2020 . Lundholm depreciates machines of this type by the straight-line method over a 9-year period using no salvage value. Due to a change in sales patterns, on January 1,2023 , management determines the useful life of the machine to be a total of 11 years, and has a salvage value of $15,000. What amount should Lundholm record for depreciation expense for 2023? 2. The Company purchased machinery on July 1,2023 . The machinery was valued at $3,250,000, with a $325,000 down and the Company agreed to pay the balance in 6 equal installments ($576,276), payable each June 30 . The company has a borrowing rate of 5%. There is no salvage value, and the useful life is 10 years. The following journal entries were recorded: 1. 3. Two years earlier, The Company recorded a 7% stock dividend (5,000 common shares, $2 par) as follows: The shares had a market price at the time of $16 per share. 4. A 8-year bonds were issued on September 1,2022 . The face value of the bonds totaled $150,000 with a stated rate of 10%. The market rate was 8% when the bonds were issued. Interest is paid annually on August 30 of each year. The following journal entry was recorded when the bonds were issued, and the interest paid: During the December 31, 2023 Financial Statement Audit, the company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred before any adjusting entries or closing entries are prepared. (Assume the 2022 books are closed) 1. The Company purchased a machine for $300,000 on January 1,2020 . Lundholm depreciates machines of this type by the straight-line method over a 9-year period using no salvage value. Due to a change in sales patterns, on January 1,2023 , management determines the useful life of the machine to be a total of 11 years, and has a salvage value of $15,000. What amount should Lundholm record for depreciation expense for 2023? 2. The Company purchased machinery on July 1,2023 . The machinery was valued at $3,250,000, with a $325,000 down and the Company agreed to pay the balance in 6 equal installments ($576,276), payable each June 30 . The company has a borrowing rate of 5%. There is no salvage value, and the useful life is 10 years. The following journal entries were recorded: 1. 3. Two years earlier, The Company recorded a 7% stock dividend (5,000 common shares, $2 par) as follows: The shares had a market price at the time of $16 per share. 4. A 8-year bonds were issued on September 1,2022 . The face value of the bonds totaled $150,000 with a stated rate of 10%. The market rate was 8% when the bonds were issued. Interest is paid annually on August 30 of each year. The following journal entry was recorded when the bonds were issued, and the interest paid

During the December 31, 2023 Financial Statement Audit, the company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred before any adjusting entries or closing entries are prepared. (Assume the 2022 books are closed) 1. The Company purchased a machine for $300,000 on January 1,2020 . Lundholm depreciates machines of this type by the straight-line method over a 9-year period using no salvage value. Due to a change in sales patterns, on January 1,2023 , management determines the useful life of the machine to be a total of 11 years, and has a salvage value of $15,000. What amount should Lundholm record for depreciation expense for 2023? 2. The Company purchased machinery on July 1,2023 . The machinery was valued at $3,250,000, with a $325,000 down and the Company agreed to pay the balance in 6 equal installments ($576,276), payable each June 30 . The company has a borrowing rate of 5%. There is no salvage value, and the useful life is 10 years. The following journal entries were recorded: 1. 3. Two years earlier, The Company recorded a 7% stock dividend (5,000 common shares, $2 par) as follows: The shares had a market price at the time of $16 per share. 4. A 8-year bonds were issued on September 1,2022 . The face value of the bonds totaled $150,000 with a stated rate of 10%. The market rate was 8% when the bonds were issued. Interest is paid annually on August 30 of each year. The following journal entry was recorded when the bonds were issued, and the interest paid: During the December 31, 2023 Financial Statement Audit, the company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred before any adjusting entries or closing entries are prepared. (Assume the 2022 books are closed) 1. The Company purchased a machine for $300,000 on January 1,2020 . Lundholm depreciates machines of this type by the straight-line method over a 9-year period using no salvage value. Due to a change in sales patterns, on January 1,2023 , management determines the useful life of the machine to be a total of 11 years, and has a salvage value of $15,000. What amount should Lundholm record for depreciation expense for 2023? 2. The Company purchased machinery on July 1,2023 . The machinery was valued at $3,250,000, with a $325,000 down and the Company agreed to pay the balance in 6 equal installments ($576,276), payable each June 30 . The company has a borrowing rate of 5%. There is no salvage value, and the useful life is 10 years. The following journal entries were recorded: 1. 3. Two years earlier, The Company recorded a 7% stock dividend (5,000 common shares, $2 par) as follows: The shares had a market price at the time of $16 per share. 4. A 8-year bonds were issued on September 1,2022 . The face value of the bonds totaled $150,000 with a stated rate of 10%. The market rate was 8% when the bonds were issued. Interest is paid annually on August 30 of each year. The following journal entry was recorded when the bonds were issued, and the interest paid Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started