Answered step by step

Verified Expert Solution

Question

1 Approved Answer

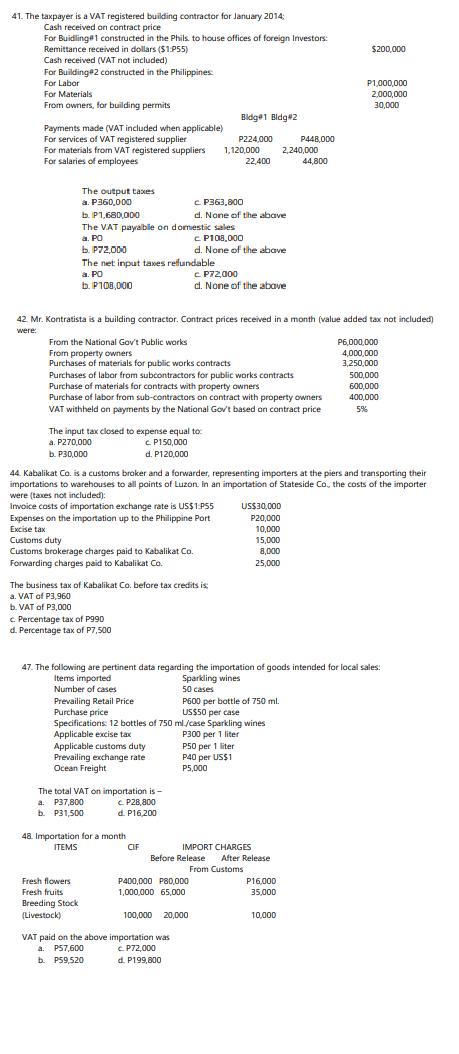

41. The taxpayer is a VAT registered building contractor for January 2014; Cash received on contract price For Buidling#1 constructed in the Phils. to

41. The taxpayer is a VAT registered building contractor for January 2014; Cash received on contract price For Buidling#1 constructed in the Phils. to house offices of foreign Investors: Remittance received in dollars ($1:P55) Cash received (VAT not included) For Building 2 constructed in the Philippines: For Labor For Materials From owners, for building permits Payments made (VAT included when applicable) For services of VAT registered supplier. For materials from VAT registered suppliers For salaries of employees The output taxes a. P360,000 b. P1,680,000 a. PO b. P72,000 The net input taxes refundable a. PO b. P108,000 The VAT payable on domestic sales c. P108,000 d. None of the above From the National Gov't Public works From property owners Purchases of materials for public works contracts The input tax closed to expense equal to: a. P270,000 c. P150,000 b. P30,000 d. P120,000 c. Percentage tax of P990 d. Percentage tax of P7,500 The business tax of Kabalikat Co. before tax credits is: a. VAT of P3,960 b. VAT of P3,000 Items imported Number of cases Prevailing Retail Price Purchase price. 42. Mr. Kontratista is a building contractor. Contract prices received in a month (value added tax not included) were: Purchases of labor from subcontractors for public works contracts Purchase of materials for contracts with property owners Purchase of labor from sub-contractors on contract with property owners. VAT withheld on payments by the National Gov't based on contract price Applicable excise tax Applicable customs duty Prevailing exchange rate Ocean Freight Fresh flowers Fresh fruits Breeding Stock (Livestock) The total VAT on importation is- c. P28,800 d. P16,200 a. P37,800 b. P31,500 48. Importation for a month ITEMS Bldg 1 Bldg #2 1,120,000 c P363,800 d. None of the above P224,000 CIF 44. Kabalikat Co. is a customs broker and a forwarder, representing importers at the piers and transporting their importations to warehouses to all points of Luzon. In an importation of Stateside Co., the costs of the importer were (taxes not included): Invoice costs of importation exchange rate is US$1.P55 Expenses on the importation up to the Philippine Port Excise tax Customs duty Customs brokerage charges paid to Kabalikat Co. Forwarding charges paid to Kabalikat Co. c. P72,000 d. None of the above 22,400 VAT paid on the above importation was a. P57,600 b. P59,520 Specifications: 12 bottles of 750 ml/case Sparkling wines P300 per 1 liter P400,000 P80,000 1.000.000 65,000 100,000 20,000 c. P72,000 d. P199,800 47. The following are pertinent data regarding the importation of goods intended for local sales: Sparkling wines 50 cases P50 per 1 liter P40 per US$1 P5,000 US$30,000 P20,000 IMPORT CHARGES Before Release P600 per bottle of 750 ml. US$50 per case 10,000 15,000 8,000 25,000 2,240,000 From Customs P448,000 After Release 44,800 P16,000 35,000 10,000 $200,000 P1,000,000 2,000,000 30,000 6,000,000 4,000,000 3,250,000 500,000 600,000 400,000 5%

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer 41 Taxpayer is a VAT registered building contractor for January 2014 Cash received on contract price For Buidling1 constructed in the Phils to house offices of foreign Investors Remittance rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started