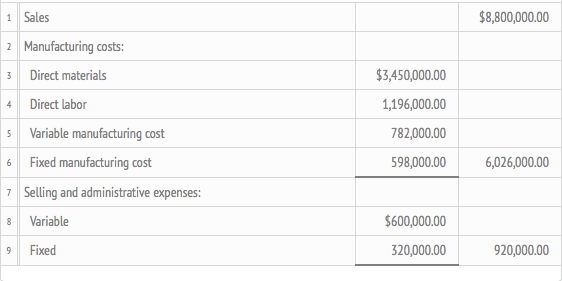

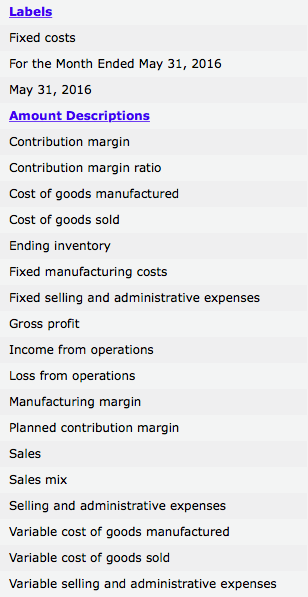

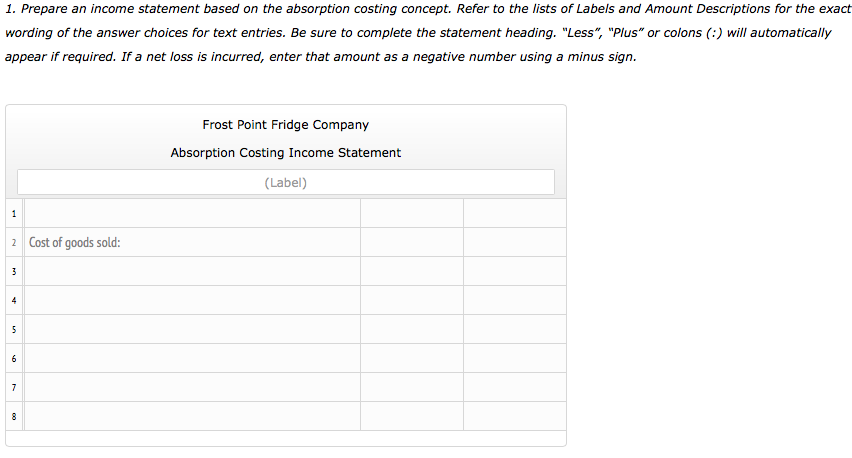

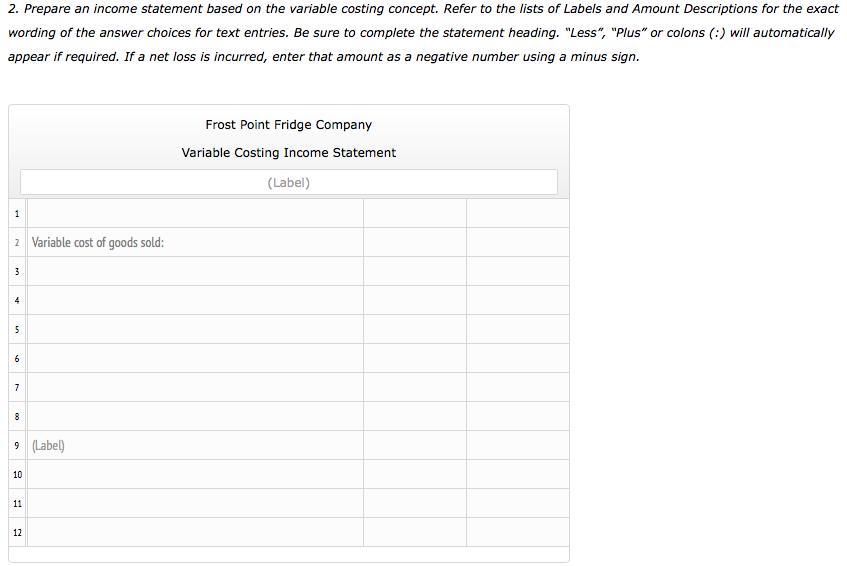

| | * Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. Less, Plus or colons (:) will automatically appear if required. If a net loss is incurred, enter that amount as a negative number using a minus sign.

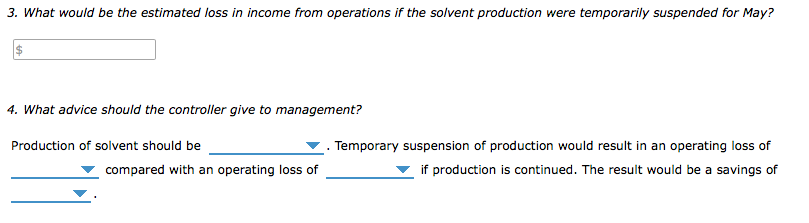

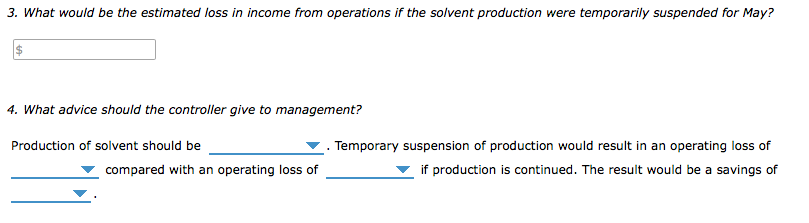

The demand for solvent, one of numerous products manufactured by Mac n Cheese Industries Inc., has dropped sharply because of recent competition from a similar product. The companys chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on June 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed. The controller has been asked by the president of the company for advice on whether to continue production during May or to suspend the manufacture of solvent until June 1. The controller has assembled the following pertinent data:

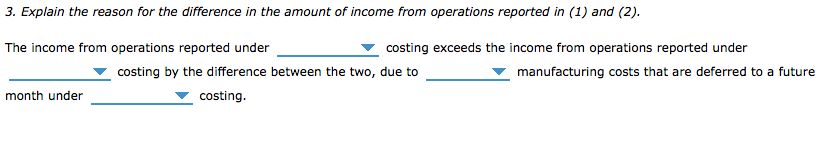

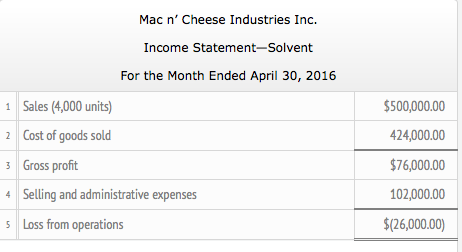

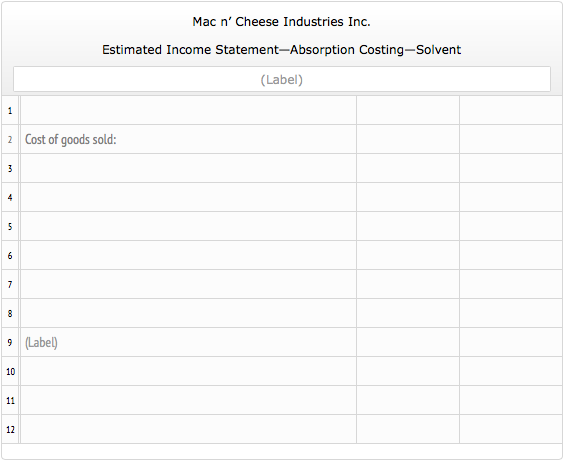

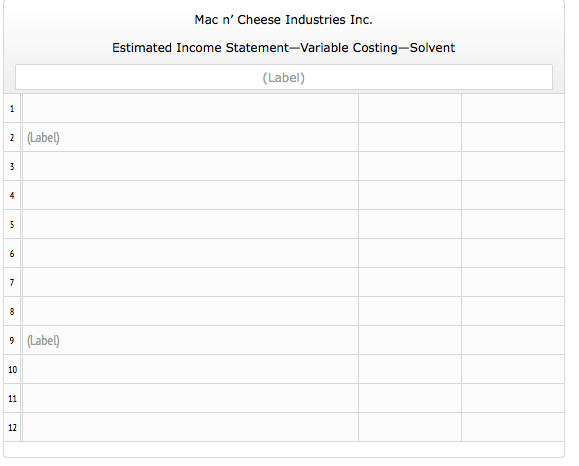

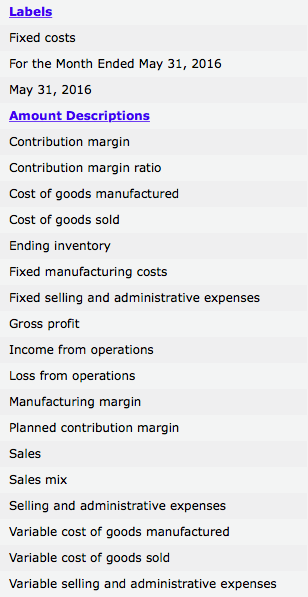

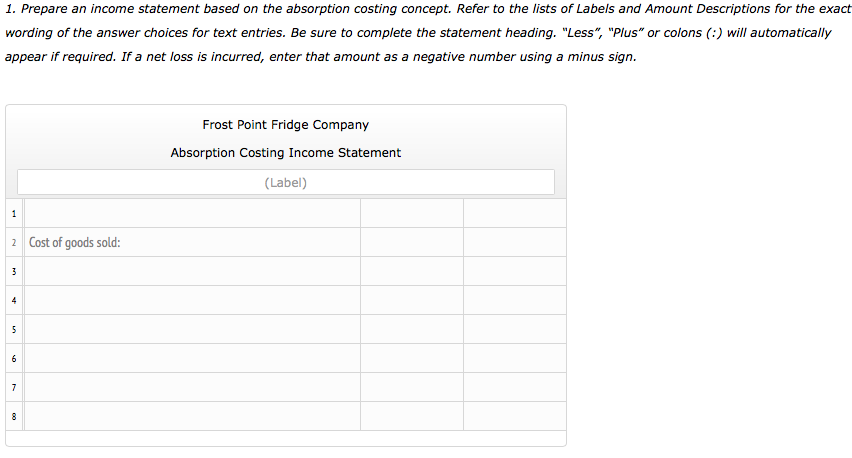

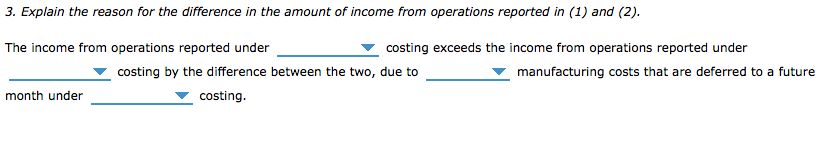

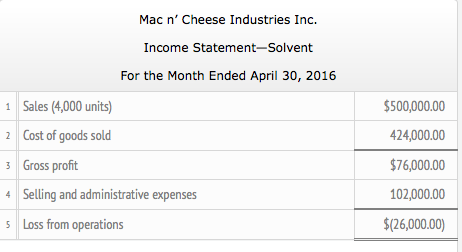

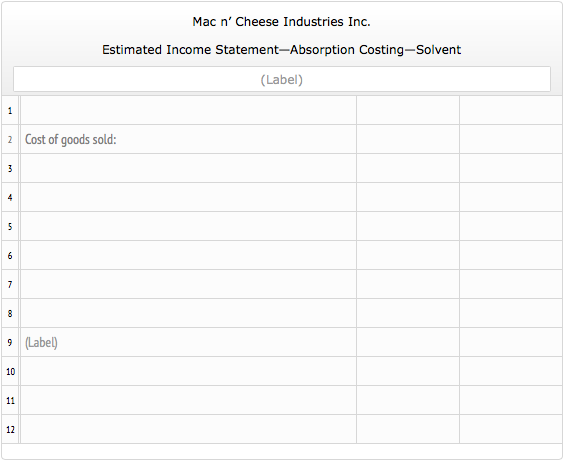

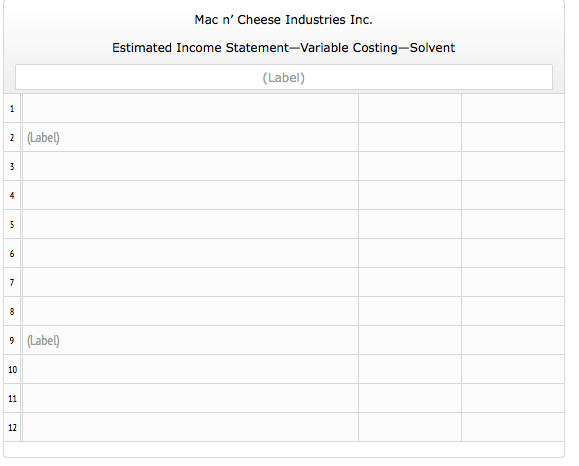

The production costs and selling and administrative expenses, based on production of 4,000 units in April, are as follows: | Direct materials | $45 per unit | | Direct labor | 20 per unit | | Variable manufacturing cost | 16 per unit | | Variable selling and administrative expenses | 15 per unit | | Fixed manufacturing cost | $100,000 for April | | Fixed selling and administrative expenses | 42,000 for April | Sales for May are expected to drop about 20% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of May is expected to be inconsequential. | | Required: | | 1. | Prepare an estimated income statement in absorption costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.* | | 2. | Prepare an estimated income statement in variable costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.* | | 3. | What would be the estimated loss in income from operations if the solvent production were temporarily suspended for May? | | 4. | What advice should the controller give to management? | | * Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. | Labels | | | Fixed costs | | | For the Month Ending May 31, 2016 | | | May 31, 2016 | | | Selling and administrative expenses | | | Variable cost of goods sold | | | Amount Descriptions | | | Contribution margin | | | Contribution margin ratio | | | Cost of goods sold | | | Direct labor | | | Direct materials | | | Fixed manufacturing cost | | | Fixed selling and administrative expenses | | | Gross profit | | | Income from operations | | | Loss from operations | | | Manufacturing margin | | | Planned contribution margin | | | Sales | | | Sales mix | | | Variable manufacturing cost | | | Variable selling and administrative expenses 1. Prepare an estimated income statement in absorption costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign.  2. Prepare an estimated income statement in variable costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign.

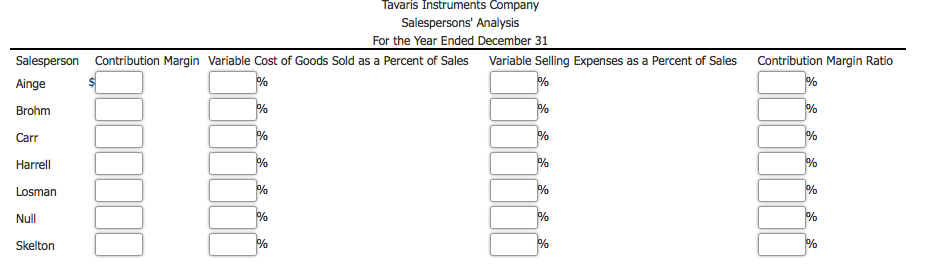

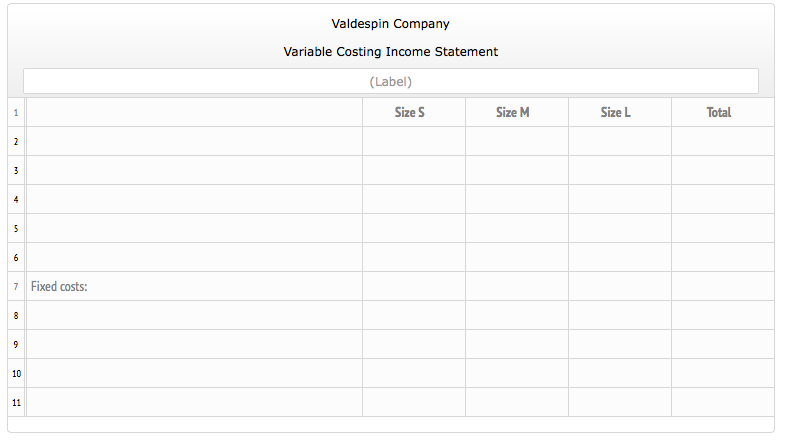

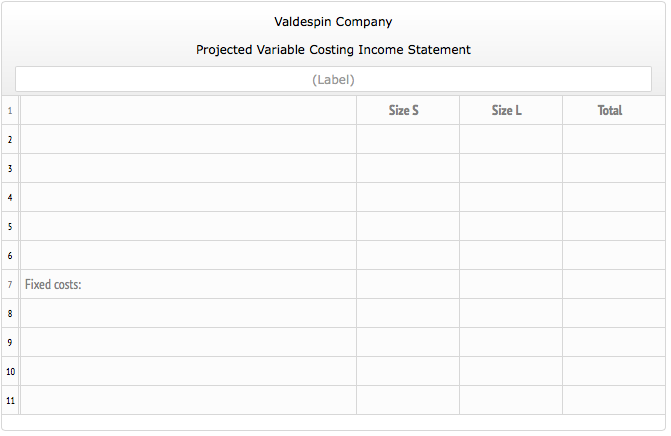

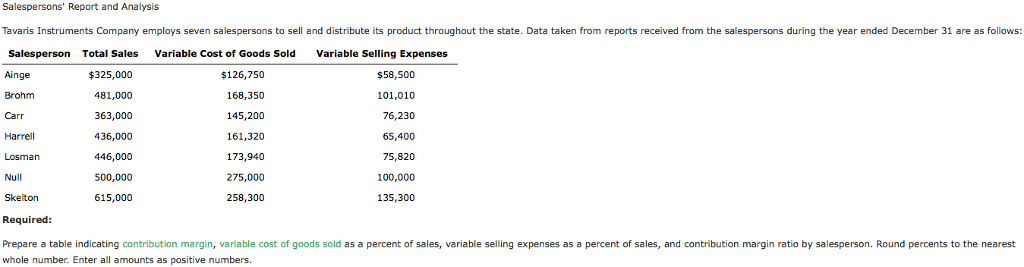

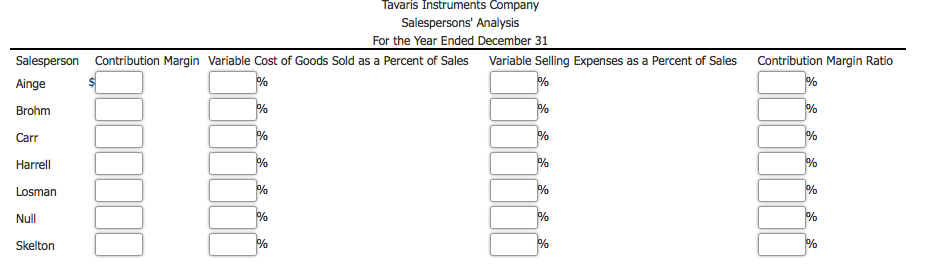

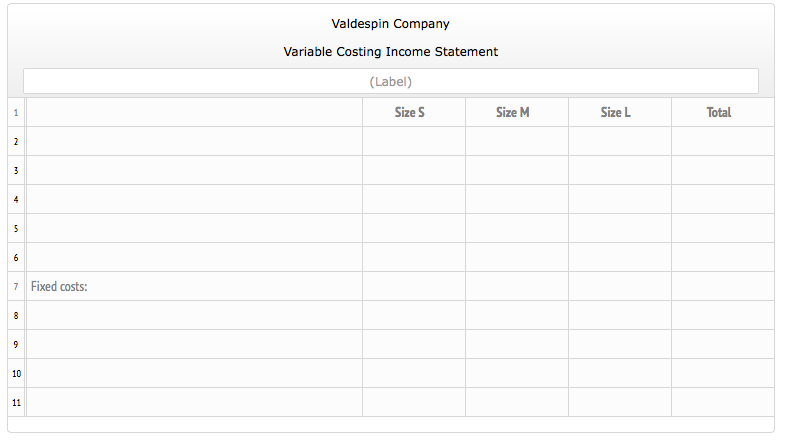

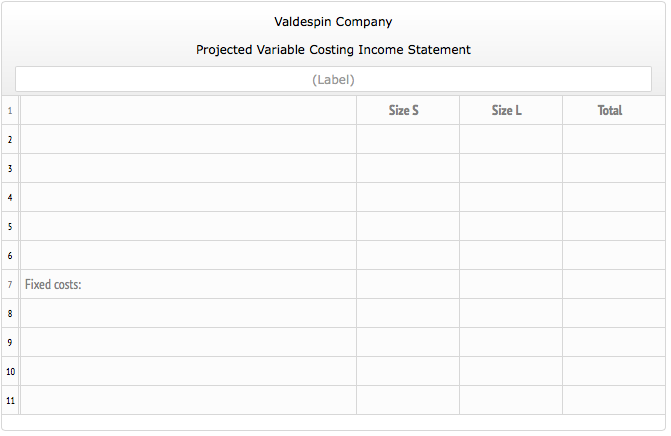

Valdespin Company manufactures three sizes of camping tentssmall (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used. If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $46,080 and $32,240 respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $34,560 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M. The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 2016, is as follows:

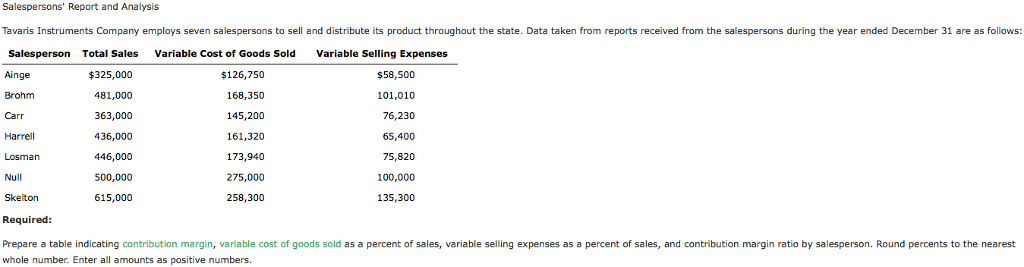

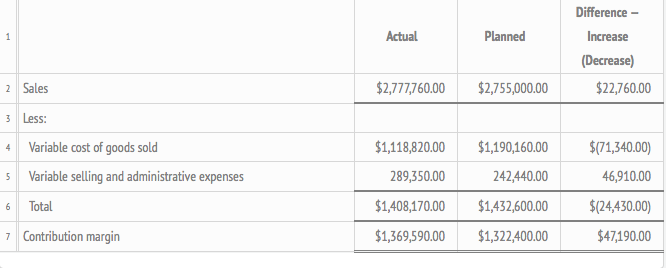

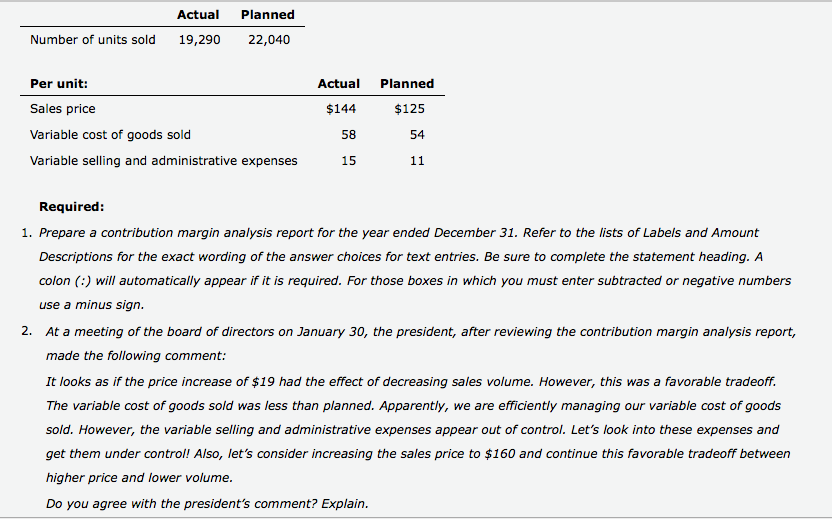

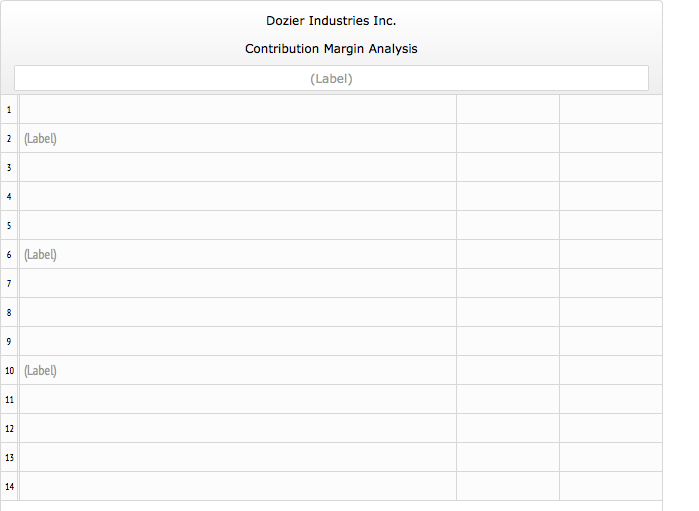

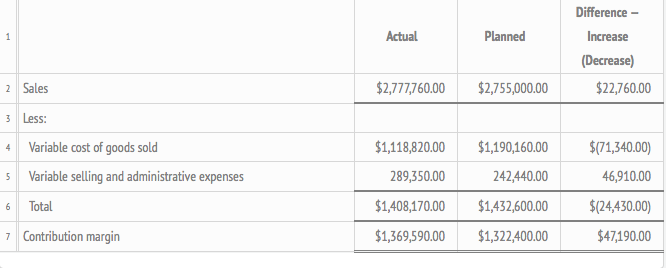

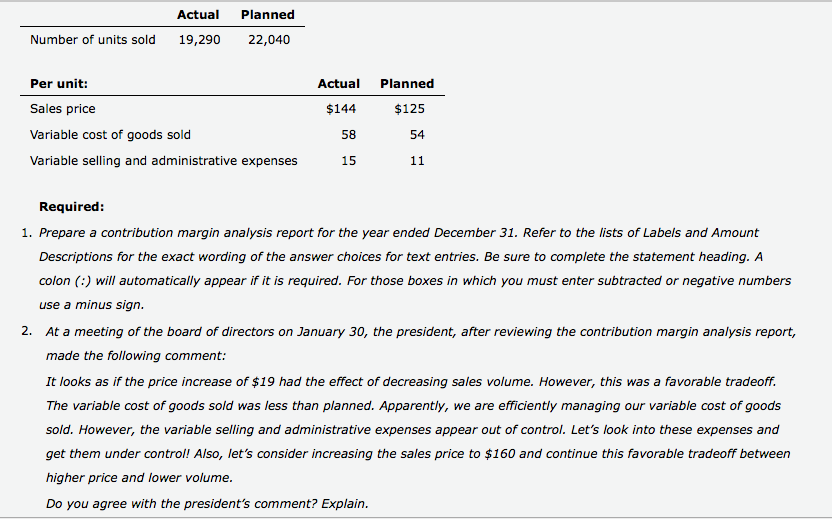

| | Required: | | 1. | Prepare an income statement for the past year in the variable costing format. Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the Total column, to determine income from operations.* | | 2. | Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted. | | 3. | Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the Total column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses.* | | 4. | By how much would total annual income increase above its present level if Proposal 3 is accepted? | | * Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. Enter all amounts as positive numbers. | Labels | | | For the Year Ended June 30, 2016 | | | For the Year Ended June 30, 2017 | | | June 30, 2016 | | | June 30, 2017 | | | Amount Descriptions | | | Contribution margin | | | Cost of goods sold | | | Fixed manufacturing costs | | | Fixed operating expenses | | | Gross profit | | | Income from operations | | | Manufacturing margin | | | Sales | | | Total fixed costs | | | Variable cost of goods sold | | | Variable operating expenses 1. Prepare an income statement for the past year in the variable costing format. Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the Total column, to determine income from operations. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. Enter all amounts as positive numbers.  2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted. $___________ 3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the Total column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. Enter all amounts as positive numbers.  4. By how much would total annual income increase above its present level if Proposal 3 is accepted? $__________ Dozier Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $47,190 from the planned level of $1,322,400. The president of Dozier Industries Inc. has expressed some concern about such a small increase and has requested a follow-up report. The following data have been gathered from the accounting records for the year ended December 31:

| | | | | Labels | | | Effect of changes in sales | | | Effect of changes in variable selling and administrative expenses | | | Effect of changes in variable cost of goods sold | | | For the Year Ended December 31 | | | Amount Descriptions | | | Actual contribution margin | | | Contribution margin ratio | | | Gross profit | | | Planned contribution margin | | | Sales mix | | | Sales quantity factor | | | Total effect of changes in sales | | | Total effect of changes in variable selling and administrative expenses | | | Total effect of changes in variable cost of goods sold | | | Unit cost factor | | | Unit price factor | | | Variable cost quantity factor 1. Prepare a contribution margin analysis report for the year ended December 31. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign.  2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment: It looks as if the price increase of $19 had the effect of decreasing sales volume. However, this was a favorable tradeoff. The variable cost of goods sold was less than planned. Apparently, we are efficiently managing our variable cost of goods sold. However, the variable selling and administrative expenses appear out of control. Lets look into these expenses and get them under control! Also, lets consider increasing the sales price to $160 and continue this favorable tradeoff between higher price and lower volume. Do you agree with the presidents comment? Explain. ()Agree with the president because the total effect of change in sales is greater than the total effect of changes in variable cost of goods sold, making an additional price raise attractive for more profits. ()Agree with the president because the majority of the decrease in the variable cost of goods sold was due to the sales price factor, as well as an increase in the variable selling and administrative expenses as a percentage of sales, making an additional price raise attractive for more profits. ()Disagree with the president because the majority of the decrease in the variable cost of goods sold was due to the variable cost quantity factor and the increased variable selling and administrative expenses are probably a result of additional selling efforts needed to be competitive at higher prices. ()Disagree with the president because the contribution margin as a percentage of sales is greater for the planned sales level than the actual sales level, making his concern about variable selling and administrative expenses unwarranted. ()Agree with the president because the unit cost factor for the variable selling and administrative cost is greater than the unit cost factor for the variable cost of goods sold, making an investigation necessary. | | | |