Answered step by step

Verified Expert Solution

Question

1 Approved Answer

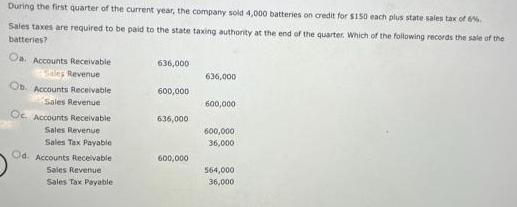

During the first quarter of the current year, the company sold 4,000 batteries on credit for $150 each plus state sales tax of 6.

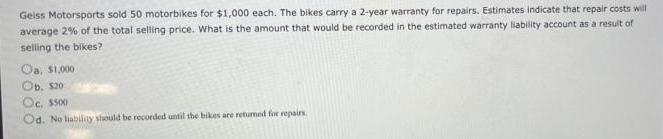

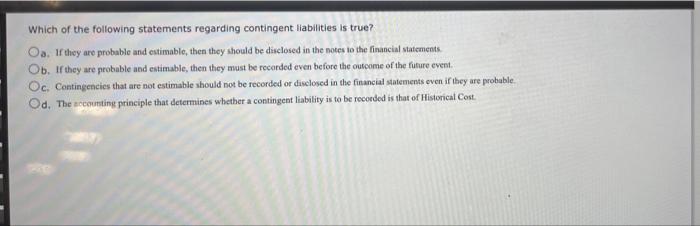

During the first quarter of the current year, the company sold 4,000 batteries on credit for $150 each plus state sales tax of 6. Sales taxes are required to be paid to the state taxing authority at the end of the quarter. Which of the following records the sale of the batteries? Oa. Accounts Receivable 636,000 ales Revenue 636,000 Ob. Accounts Receivable 600,000 Sales Revenue 600,000 Oe Accounts Receivable 636,000 Sales Revenue 600,000 Sales Tax Payable 36,000 Od. Accounts Receivable 600,000 Sales Revenue 564,000 Sales Tax Payable 36,000 Geiss Motorsports sold 50 motorbikes for $1,000 each. The bikes carry a 2-year warranty for repairs. Estimates indicate that repair costs will average 2% of the total seling price. What is the amount that would be recorded in the estimated warranty liability account as a result of selling the bikes? Oa, S1,000 Ob, s20 Oc. SS00 Od. No liabilay should be recorded until the bikes are retumed for repairs Which of the following statements regarding contingent liabilities is true? Oa. If they are probable and estimable, then they should be disclosed in the notes to the financial statements. Ob. If they are probable and estimable, then they must be recorded even before the outcome of the future event. Oc. Contingencies that are not estimable should not be recorded or disclosed in the financial statements even if they are probable Od, The accoumting principle that determines whether a contingent liability is to be recorded is that of Historical Cost.

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Answer to the first question is as follows Answer is Option C Account Receivables ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started