Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the first week of January 20X4, Tom Fasbee called you to his office and asked if you would be willing to review HydroQual's

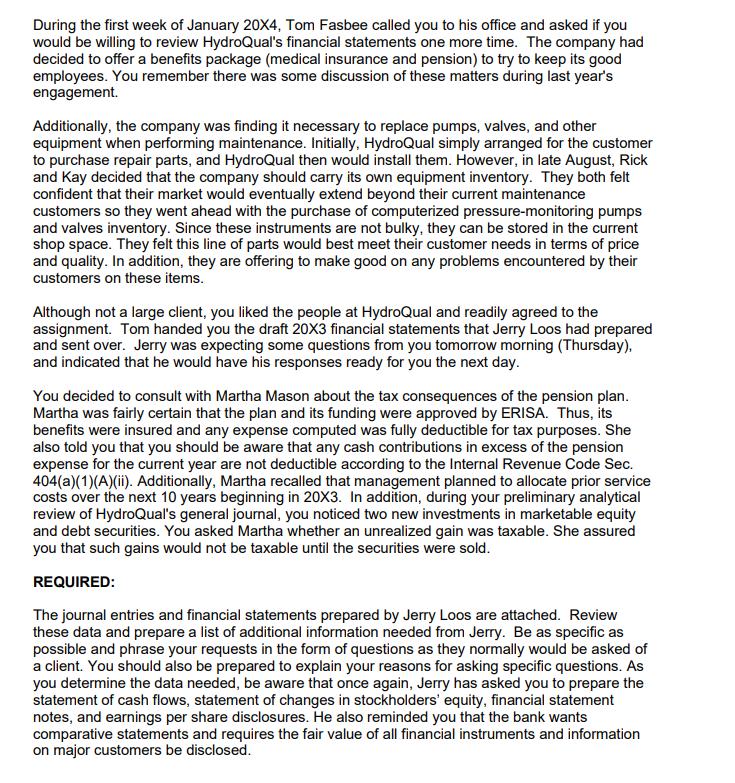

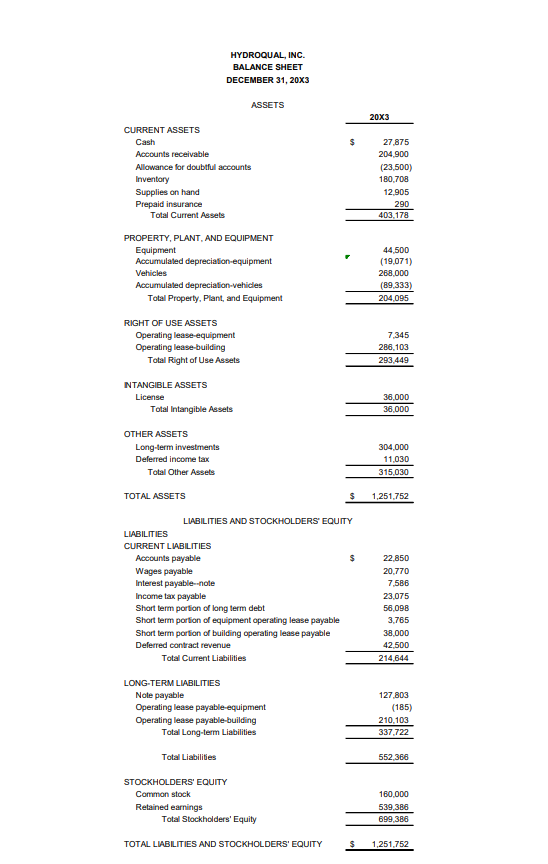

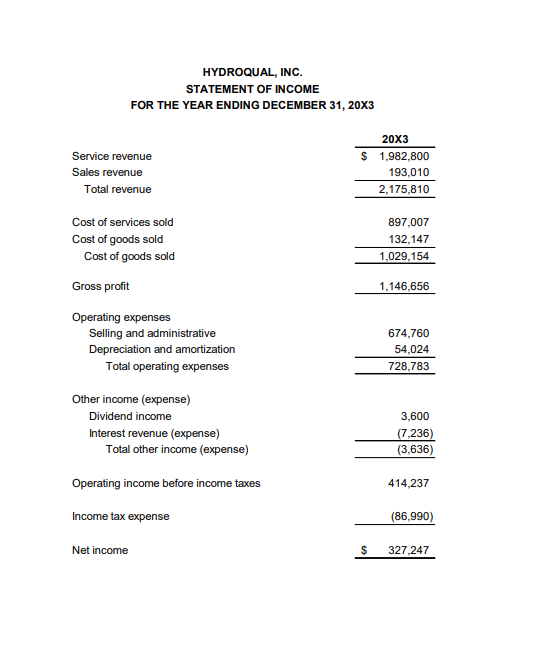

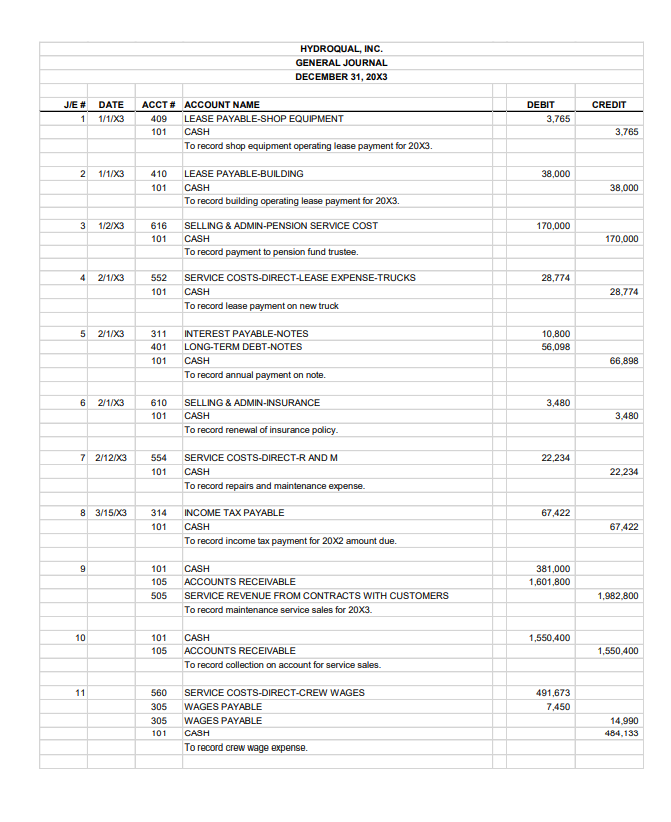

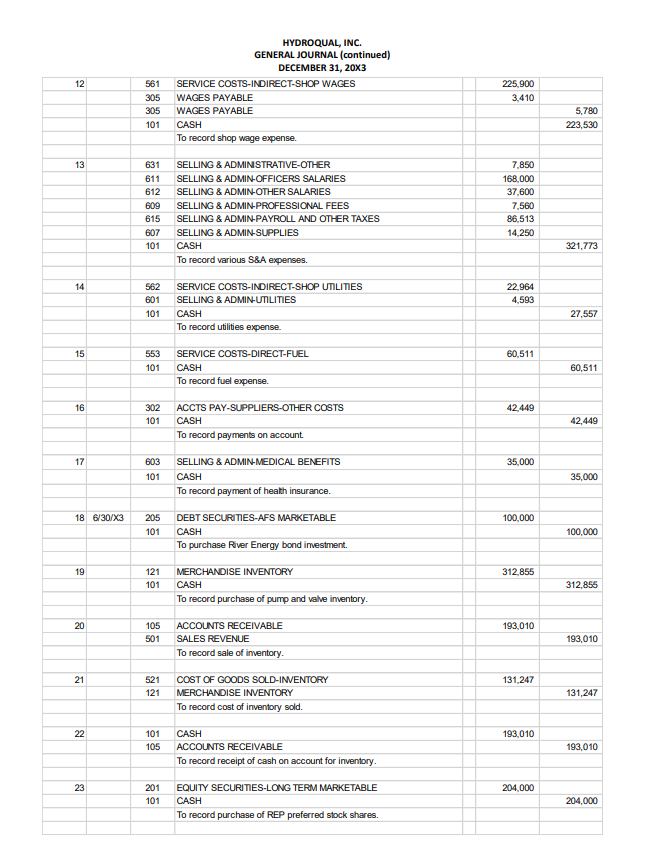

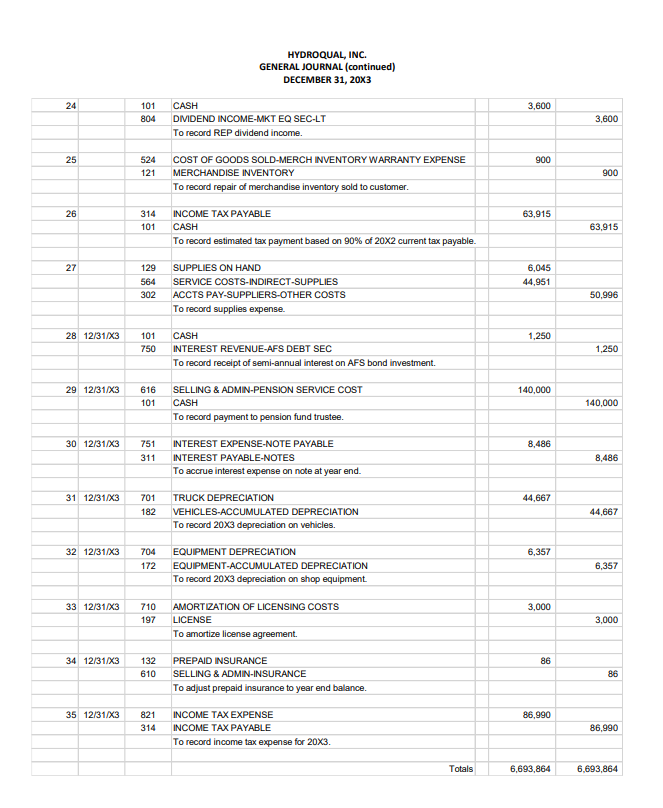

During the first week of January 20X4, Tom Fasbee called you to his office and asked if you would be willing to review HydroQual's financial statements one more time. The company had decided to offer a benefits package (medical insurance and pension) to try to keep its good employees. You remember there was some discussion of these matters during last year's engagement. Additionally, the company was finding it necessary to replace pumps, valves, and other equipment when performing maintenance. Initially, HydroQual simply arranged for the customer to purchase repair parts, and HydroQual then would install them. However, in late August, Rick and Kay decided that the company should carry its own equipment inventory. They both felt confident that their market would eventually extend beyond their current maintenance customers so they went ahead with the purchase of computerized pressure-monitoring pumps and valves inventory. Since these instruments are not bulky, they can be stored in the current shop space. They felt this line of parts would best meet their customer needs in terms of price and quality. In addition, they are offering to make good on any problems encountered by their customers on these items. Although not a large client, you liked the people at HydroQual and readily agreed to the assignment. Tom handed you the draft 20X3 financial statements that Jerry Loos had prepared and sent over. Jerry was expecting some questions from you tomorrow morning (Thursday), and indicated that he would have his responses ready for you the next day. You decided to consult with Martha Mason about the tax consequences of the pension plan. Martha was fairly certain that the plan and its funding were approved by ERISA. Thus, its benefits were insured and any expense computed was fully deductible for tax purposes. She also told you that you should be aware that any cash contributions in excess of the pension expense for the current year are not deductible according to the Internal Revenue Code Sec. 404(a)(1)(A)(ii). Additionally, Martha recalled that management planned to allocate prior service costs over the next 10 years beginning in 20X3. In addition, during your preliminary analytical review of HydroQual's general journal, you noticed two new investments in marketable equity and debt securities. You asked Martha whether an unrealized gain was taxable. She assured you that such gains would not be taxable until the securities were sold. REQUIRED: The journal entries and financial statements prepared by Jerry Loos are attached. Review these data and prepare a list of additional information needed from Jerry. Be as specific as possible and phrase your requests in the form of questions as they normally would be asked of a client. You should also be prepared to explain your reasons for asking specific questions. As you determine the data needed, be aware that once again, Jerry has asked you to prepare the statement of cash flows, statement of changes in stockholders' equity, financial statement notes, and earnings per share disclosures. He also reminded you that the bank wants comparative statements and requires the fair value of all financial instruments and information on major customers be disclosed. CURRENT ASSETS HYDROQUAL, INC. BALANCE SHEET DECEMBER 31, 20x3 Cash Accounts receivable Allowance for doubtful accounts Inventory Supplies on hand ASSETS 20X3 $ 27,875 204,900 (23,500) 180,708 12,905 Prepaid insurance 290 Total Current Assets 403,178 PROPERTY, PLANT, AND EQUIPMENT Equipment 44,500 Accumulated depreciation-equipment (19,071) Vehicles 268,000 Accumulated depreciation-vehicles (89,333) Total Property, Plant, and Equipment 204,095 RIGHT OF USE ASSETS Operating lease-equipment Operating lease-building Total Right of Use Assets 7,345 286,103 293,449 INTANGIBLE ASSETS License 36,000 Total Intangible Assets 36,000 OTHER ASSETS Long-term investments Deferred income tax Total Other Assets TOTAL ASSETS 304,000 11,030 315,030 1,251,752 LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES CURRENT LIABILITIES Accounts payable $ 22,850 Wages payable 20,770 Interest payable--note 7,586 Income tax payable 23,075 Short term portion of long term debt 56,098 Short term portion of equipment operating lease payable 3,765 Short term portion of building operating lease payable 38,000 Deferred contract revenue 42,500 Total Current Liabilities 214,644 LONG-TERM LIABILITIES Note payable 127,803 Operating lease payable-equipment (185) Operating lease payable-building 210,103 Total Long-term Liabilities 337,722 Total Liabilities 552,366 STOCKHOLDERS' EQUITY Common stock Retained earnings Total Stockholders' Equity 160,000 539,386 699,386 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 1,251,752 HYDROQUAL, INC. STATEMENT OF INCOME FOR THE YEAR ENDING DECEMBER 31, 20X3 Service revenue Sales revenue Total revenue 20X3 $ 1,982,800 193,010 2,175,810 Cost of services sold 897,007 Cost of goods sold 132,147 Cost of goods sold 1,029,154 Gross profit 1,146,656 Operating expenses Selling and administrative 674,760 Depreciation and amortization Total operating expenses Other income (expense) 54,024 728,783 Dividend income Interest revenue (expense) Total other income (expense) Operating income before income taxes Income tax expense Net income 3,600 (7,236) (3,636) 414,237 (86,990) $ 327,247 HYDROQUAL, INC. GENERAL JOURNAL DECEMBER 31, 20X3 J/E # DATE ACCT # ACCOUNT NAME 1 1/1/X3 409 LEASE PAYABLE-SHOP EQUIPMENT DEBIT CREDIT 3,765 101 CASH 3,765 To record shop equipment operating lease payment for 20X3. 2 1/1/X3 410 LEASE PAYABLE-BUILDING 38,000 101 CASH 38,000 To record building operating lease payment for 20X3. 3 1/2/X3 616 SELLING & ADMIN-PENSION SERVICE COST 170,000 101 CASH 170,000 To record payment to pension fund trustee. 4 2/1/X3 552 SERVICE COSTS-DIRECT-LEASE EXPENSE-TRUCKS 28,774 101 CASH 28,774 To record lease payment on new truck 5 2/1/X3 311 INTEREST PAYABLE-NOTES 401 101 10,800 56,098 66,898 6 2/1/X3 610 101 LONG-TERM DEBT-NOTES CASH To record annual payment on note. SELLING & ADMIN-INSURANCE CASH To record renewal of insurance policy. 3,480 3,480 7 2/12/X3 554 101 SERVICE COSTS-DIRECT-R AND M CASH 22,234 22,234 To record repairs and maintenance expense. 8 3/15/X3 314 INCOME TAX PAYABLE 67,422 101 CASH 67,422 To record income tax payment for 20X2 amount due. 9 101 CASH 381,000 105 ACCOUNTS RECEIVABLE 1,601,800 505 SERVICE REVENUE FROM CONTRACTS WITH CUSTOMERS To record maintenance service sales for 20X3. 1,982,800 10 101 CASH 105 ACCOUNTS RECEIVABLE 1,550,400 1,550,400 To record collection on account for service sales. 11 560 305 SERVICE COSTS-DIRECT-CREW WAGES WAGES PAYABLE 305 101 WAGES PAYABLE CASH To record crew wage expense. 491,673 7,450 14,990 484,133 HYDROQUAL, INC. GENERAL JOURNAL (continued) DECEMBER 31, 20x3 12 561 SERVICE COSTS-INDIRECT-SHOP WAGES 305 WAGES PAYABLE 305 WAGES PAYABLE 101 CASH To record shop wage expense. 225,900 3,410 5,780 223,530 13 631 SELLING & ADMINISTRATIVE-OTHER 7,850 611 SELLING & ADMIN-OFFICERS SALARIES 168,000 612 SELLING & ADMIN-OTHER SALARIES 37,600 609 SELLING & ADMIN-PROFESSIONAL FEES 7,560 615 SELLING & ADMIN-PAYROLL AND OTHER TAXES 86,513 607 SELLING & ADMIN-SUPPLIES 14,250 101 CASH 321,773 To record various S&A expenses. 14 562 SERVICE COSTS-INDIRECT-SHOP UTILITIES 22,964 601 SELLING & ADMIN-UTILITIES 4,593 101 CASH 27,557 To record utilities expense. 15 553 SERVICE COSTS-DIRECT-FUEL 101 CASH 60,511 60,511 To record fuel expense. 16 302 ACCTS PAY-SUPPLIERS-OTHER COSTS 42,449 101 CASH 42,449 To record payments on account. 17 603 SELLING & ADMIN-MEDICAL BENEFITS 35,000 101 CASH 35,000 To record payment of health insurance. 18 6/30/X3 205 101 DEBT SECURITIES-AFS MARKETABLE CASH 100,000 100,000 To purchase River Energy bond investment. 19 121 MERCHANDISE INVENTORY 312,855 101 CASH 312,855 To record purchase of pump and valve inventory. 20 105 ACCOUNTS RECEIVABLE 193,010 501 SALES REVENUE 193,010 To record sale of inventory. 21 521 COST OF GOODS SOLD-INVENTORY 121 MERCHANDISE INVENTORY 131,247 131,247 To record cost of inventory sold. 22 101 CASH 105 ACCOUNTS RECEIVABLE 193,010 193,010 To record receipt of cash on account for inventory. 23 201 101 EQUITY SECURITIES-LONG TERM MARKETABLE CASH 204,000 204,000 To record purchase of REP preferred stock shares. HYDROQUAL, INC. GENERAL JOURNAL (continued) DECEMBER 31, 20x3 24 101 CASH 804 DIVIDEND INCOME-MKT EQ SEC-LT 3,600 3,600 To record REP dividend income. 25 524 121 COST OF GOODS SOLD-MERCH INVENTORY WARRANTY EXPENSE MERCHANDISE INVENTORY 900 900 To record repair of merchandise inventory sold to customer. 26 314 INCOME TAX PAYABLE 63,915 101 CASH 63,915 To record estimated tax payment based on 90% of 20X2 current tax payable. 27 129 SUPPLIES ON HAND 564 SERVICE COSTS-INDIRECT-SUPPLIES 6,045 44,951 302 ACCTS PAY-SUPPLIERS-OTHER COSTS 50,996 To record supplies expense. 28 12/31/X3 101 CASH 750 INTEREST REVENUE-AFS DEBT SEC 1,250 1,250 To record receipt of semi-annual interest on AFS bond investment. 29 12/31/X3 616 SELLING & ADMIN-PENSION SERVICE COST 140,000 101 CASH 140,000 To record payment to pension fund trustee. 30 12/31/X3 751 INTEREST EXPENSE-NOTE PAYABLE 8,486 311 INTEREST PAYABLE-NOTES 8,486 To accrue interest expense on note at year end. 31 12/31/X3 701 TRUCK DEPRECIATION 44,667 182 VEHICLES-ACCUMULATED DEPRECIATION 44,667 To record 20X3 depreciation on vehicles. 32 12/31/X3 704 EQUIPMENT DEPRECIATION 172 EQUIPMENT-ACCUMULATED DEPRECIATION 6,357 6,357 To record 203 depreciation on shop equipment. 33 12/31/X3 710 197 AMORTIZATION OF LICENSING COSTS 3,000 LICENSE 3,000 To amortize license agreement. 34 12/31/X3 132 PREPAID INSURANCE 610 SELLING & ADMIN-INSURANCE To adjust prepaid insurance to year end balance. 86 86 35 12/31/X3 821 INCOME TAX EXPENSE 314 INCOME TAX PAYABLE 86,990 86,990 To record income tax expense for 20X3. Totals 6,693,864 6,693,864

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started