Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the fiscal year ended December 31, 2017, Garden Comfort will be required to make quarterly income tax installment payments of $35,000 Outstanding income

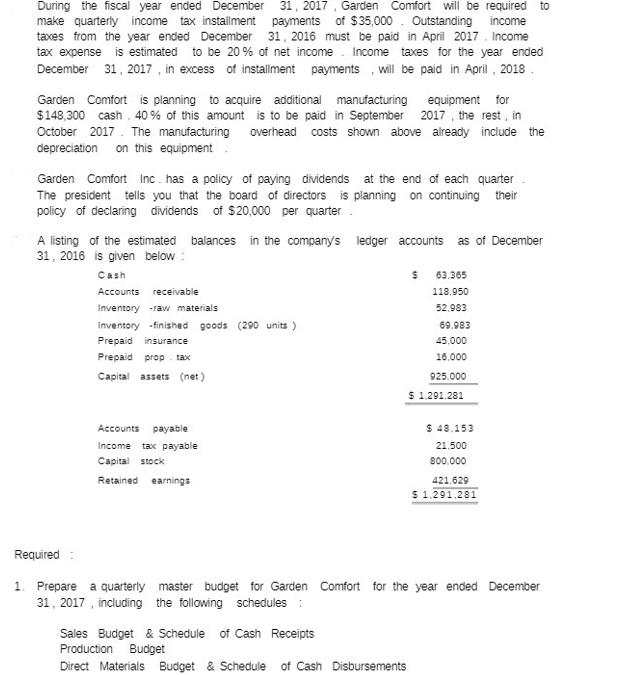

During the fiscal year ended December 31, 2017, Garden Comfort will be required to make quarterly income tax installment payments of $35,000 Outstanding income taxes from the year ended December 31, 2016 must be paid in April 2017. Income tax expense is estimated to be 20% of net income Income taxes for the year ended December 31, 2017, in excess of installment payments will be paid in April, 2018 Garden Comfort is planning to acquire additional manufacturing equipment for $148,300 cash. 40% of this amount is to be paid in September 2017, the rest, in October 2017. The manufacturing overhead costs shown above already include the depreciation on this equipment. Garden Comfort Inc. has a policy of paying dividends at the end of each quarter The president tells you that the board of directors is planning on continuing their policy of declaring dividends of $20,000 per quarter. A listing of the estimated balances in the company's ledger accounts as of December 31, 2016 is given below: Required: Cash Accounts receivable Inventory raw materials Inventory -finished goods (290 units) Prepaid insurance Prepaid prop tax Capital assets (net) Accounts payable Income tax payable Capital stock Retained earnings $ Sales Budget & Schedule of Cash Receipts Production Budget Direct Materials Budget & Schedule of Cash Disbursements 63.365 118,950 52,983 69.983 45.000 16.000 925.000 $ 1.291.281 $ 48.153 21.500 800.000 421,629 $ 1.291.281 1. Prepare a quarterly master budget for Garden Comfort for the year ended December 31, 2017, including the following schedules

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the quarterly master budget for Garden Comfort for the year ended December 31 2017 we need to create the following schedules 1 Sales Budget ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started